DIA: Bigger Losses Ahead? – SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA)

[ad_1]

In 2018, the SPDR Dow Jones Industrials ETF (DIA) fell sufferer to the market’s promoting strain and the fund posted a few of its worst performances in a decade. DIA continues to be exhibiting losses of just about 6% during the last 12 months, and lots of buyers have proven reluctance earlier than adopting a contrarian stance to purchase the fund at its lows. But the macro setting stays supportive, as Federal Reserve rate of interest coverage is accommodative (by historic requirements) and U.S. unemployment ranges maintain close to 50-year lows. Sales figures this vacation season displayed a few of the best performances in six years and this maintains the outlook for steady shopper spending ranges in 2019. Moreover, sturdy earnings expectations for most of the key holdings in SPDR Dow Jones Industrials ETF counsel excessive chances for a rally within the fund throughout the early components of 2019. As a end result, additional declines look unlikely and DIA may very well be a “strong buy” at these weakened worth valuations.

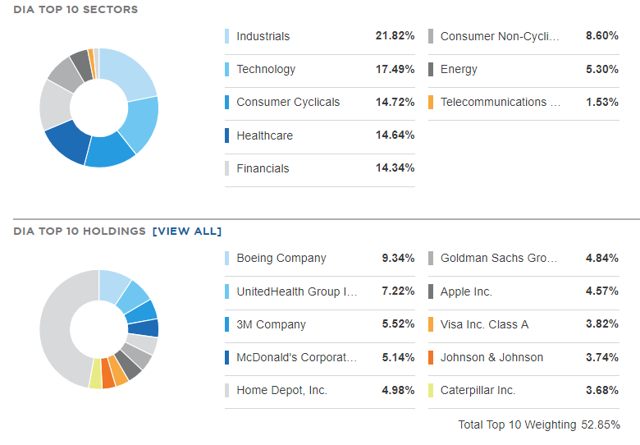

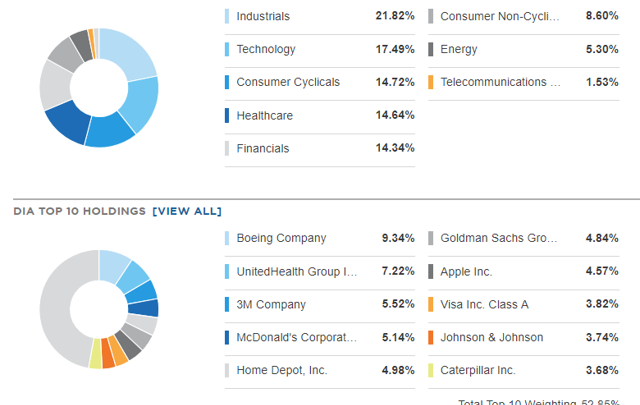

(Source: ETF.com)

While it’s true that the most important allocations throughout the SPDR Dow Jones Industrials ETF are dedicated to the economic sector, the fund’s excessive stage of diversification usually comes as a shock to most buyers. The second-largest sector allocation is definitely present in expertise (a 17.49%), and that is adopted by shopper cyclicals (at 14.72%). The healthcare and monetary sectors spherical out the highest 5 positions at 14.64% and 14.62%, respectively. So, as we are able to see, there’s a broad stage of diversification within the fund, which could not be obvious to these with out publicity.

(Source: ETFdb.com)

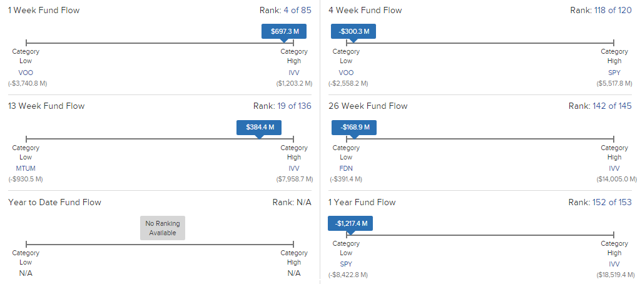

Most of this bearish exercise could be visualized via the outflow figures which have been related to the ETF. Over the final 12 months, DIA has been negatively impacted by outflows of $1,271.4 million. This places DIA close to the lows for its class. But the bearish exercise has not confirmed to be constant via more moderen buying and selling durations. Outflows nonetheless prevail during the last 26 weeks (at $168.9 million) however the bulls have prevailed throughout final 13 weeks (with inflows of $384.4 million).

But the market exercise proven in the newest figures is probably most exceptional. Over the final month, DIA has been negatively impacted by outflows of $300.3 million, placing the fund close to its class lows for the interval. However, main reversals are evident during the last week, as inflows of $697.3 million have been directed towards DIA. Ultimately, this means that buyers have been impressed to start shopping for in on the lows and that sentiment is perhaps handing over favor of these holding lengthy positions as we start buying and selling in 2019.

(Source: Author)

The largest particular person stock holding within the fund is Boeing (BA), which has misplaced 17.46% because it hit prior highs on October third. But this exercise fails to offer buyers the broader image, as BA truly managed to supply features of 9.09% during the last 12 months. This upside occurred regardless of the widespread losses which had been seen all through the market in 2018, and this bullish outlook continues to be pushed by the corporate’s spectacular earnings performances. During the third-quarter, Boeing smashed analyst estimates with adjusted earnings of $3.58 per share (versus expectations of $3.47 per share). Revenues had been much more spectacular at $25.15 billion, and this beat analyst estimates by greater than $1 billion.

This units the corporate on a transparent path to surpass market expectations once more when the corporate releases quarterly earnings for the fiscal fourth-quarter on 01/30/2019. Boeing is anticipated to point out earnings of $4.51 per share, which might mark an annualized decline of 6.04% (if realized). But the corporate has crushed the market’s earnings expectations in three of the final 4 quarters, and the sturdy performances in Q3 counsel that Boeing won’t have a lot problem overcoming the weaker estimates that are presently seen within the consensus surveys.

(Source: Author)

Much stronger earnings performances are presently anticipated for Goldman Sachs Group (GS), which makes up 3.84% of the SPDR Dow Jones Industrials ETF. The stock has suffered losses of 29.09% of its worth since hitting prior highs on August 27th. As the most important monetary sector holding in DIA, it’s important that Goldman Sachs is ready to match analyst expectations in its fourth-quarter earnings launch.

If latest traits are any indication, there are strong causes to consider that this would be the case. During the third-quarter, Goldman produced earnings of $6.28 per share (versus expectations of $5.38 per share). This offers us one other instance of extremely supportive earnings traits inside a key DIA holding. Goldman’s third-quarter earnings determine signifies annualized progress of 27.09%. Revenue for the quarter got here in at $8.65 billion, which was additionally firmly above the analyst estimates of $8.4 billion. Strong performances had been seen in Goldman’s funding banking division and this development might assist the financial institution beat analyst expectations for the fourth-quarter.

(Source: Author)

Another title to observe is Home Depot, Inc. (HD), which makes up 4.98% of the SPDR Dow Jones Industrials ETF. The stock has misplaced 19.38% for the reason that stock hit prior highs final September. But these declines to not appear to match the market’s forecasts for earnings for the fourth-quarter. Home Depot is scheduled to launch its quarterly report for the interval on 02/19/2019. Consensus estimates counsel Home Depot will present earnings of $2.17 per share, which might mark an annualized acquire of 28.40% (if realized). It could be stated that these elevated forecasts is perhaps tough for the corporate to match, however Home Depot has managed to beat analyst estimates in every of the final 4 quarters. If this seems to be the case within the firm’s subsequent quarterly launch, it might not be shocking to see buyers turn out to be extra bullish on the stock whereas it continues to commerce close to its latest lows.

Ultimately, the sturdy earnings outlook for most of the key holdings in SPDR Dow Jones Industrials ETF suggests excessive chances for a rally within the early components of 2019. Of course, we might want to see these firms match the market’s elevated expectations as soon as earnings season. But with the intense declines we’ve already witnessed during the last three months, we are able to nonetheless see validity within the argument that continued draw back seems unlikely. Rising volatility ranges might act as a counter argument to this constructive outlook for DIA. But a lot of the proof is pointing within the bullish path, and this means strength in shopping for alternatives for DIA as we start 2019.

Thank you for studying.

Now, it is time to make your voice heard. Reader interplay is a very powerful a part of the funding studying course of! Comments are extremely inspired. We look ahead to studying your viewpoints on DIA.

Disclosure: I’m/we’re lengthy BA, HD. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]