Diana Shipping Eyes Genco: Could A Small-Cap Drybulk Marriage Be Next?

Genco Shipping & Trading (NYSE:GNK) just got a knock on the door—and not just any knock, but one carrying a $20.60 per share cash offer from Diana Shipping (NYSE:DSX). The unsolicited bid, announced November 24, 2025, represents a 15% premium over Genco’s prior close and sent the stock surging more than 7% in early trading. Diana, already holding a 14.8% stake in Genco, now wants the rest—and fast. The Greek shipper said it would finance the acquisition through a new facility and hinted at selective asset sales post-deal to fine-tune the combined fleet. The timing is interesting. Drybulk markets have shown real signs of life in the second half of 2025, especially on the Capesize front, where both companies have significant exposure. With freight rates strong and Genco nearing the end of a heavy drydock year, Diana seems to be buying into strength—but also long-term potential. Let us dig into why this deal might make sense.

Complementary Fleets & Balanced Exposure Across Bulk Segments

At the heart of Diana Shipping’s interest in Genco is the strategic fit of their fleets. Genco operates a blend of 17 Capesize and 26 Ultramax/Supramax vessels, balancing high-beta exposure to volatile but lucrative long-haul iron ore routes with steadier, smaller-ship trades. This 40/60 ownership split (by vessel count) leans slightly Capesize when viewed through the lens of net revenue and asset value. Diana, which also owns a sizable fleet of drybulk ships, sees an opportunity here to consolidate and optimize.

Combining the two fleets would immediately boost operational scale, giving the merged entity increased leverage over voyage charters, maintenance contracts, and even bunker fuel procurement. It also gives Diana access to Genco’s newer, fuel-efficient Capesize vessels—four of which were acquired since late 2023—as well as a diversified minor bulk footprint that could help cushion any Capesize market downturns. Fleet synergy in shipping isn’t just about owning more ships; it’s about owning the right ships, trading in the right lanes. In that respect, Genco’s fleet profile, with its exposure to Brazil-China iron ore and South American grain flows, is a natural complement to Diana’s existing assets.

Moreover, Genco has already completed 90% of its drydocking program for 2025, which means its ships are largely back in the water during a seasonally strong Q4. That increases their near-term earnings power—a fact that wouldn’t be lost on any acquirer. Combining two relatively young and commercially active fleets could give the combined entity scale without the baggage of excessive capital expenditures or scrappage concerns.

Built-In Operating Leverage With Industry-Low Breakevens

Genco’s value strategy since 2021 has been built on three pillars: dividends, deleveraging, and growth. That framework has not only generated 25 consecutive quarterly dividends but also positioned the company with one of the lowest breakeven rates in the sector—just $10,000 per day. In Q4, its time charter equivalent (TCE) rates were already tracking above $20,000/day, creating a wide margin for operating cash flow.

This kind of built-in leverage is rare, especially in the drybulk world where many players still carry heavy debt loads or legacy inefficiencies. For Diana, acquiring a small-cap like Genco means plugging into a cost structure that is already optimized for volatility. There’s no need to restructure or overhaul operations—Genco’s balance sheet is clean, its dividend policy is transparent, and its fleet is already earning well above cash breakeven.

Even better, Genco’s financial leverage is low, with net loan-to-value sitting at just 12% and an undrawn revolver of $430 million. That leaves plenty of headroom for Diana to consolidate without taking on outsized risk. From an M&A standpoint, it’s a rare combo: high operating leverage without the financial burden, and upside without the need for massive reworking. In short, Genco is “deal-ready.”

Synergies In Corporate Governance & Shareholder Transparency

One underappreciated angle here is governance—yes, in shipping. Genco has made a point of highlighting its clean governance structure, including zero related-party transactions, a rarity in an industry often criticized for insider dealings and opaque financial practices. Its board is independent and diverse, and its shareholder communications have been consistent, detailed, and frequent.

For Diana, which has traditionally followed a more traditional shipping governance playbook, acquiring Genco could mean importing some of that institutional credibility. It’s not just about ESG checkboxes—it’s about long-term capital access. Genco’s investor-friendly reputation could help Diana tap new pools of capital, particularly from institutional investors or ESG-conscious funds that might otherwise avoid smaller shipping names.

There is also value in Genco’s approach to transparency. From earnings presentations to TCE disclosures, Genco operates with a level of visibility that could set a new bar for the combined entity. That matters when you’re trying to attract long-only investors in a market still viewed as cyclical and hard to model. Simply put, Genco isn’t just a bunch of ships—it’s a platform that institutional investors already trust.

Strategic Timing Amid Improving Industry Fundamentals

Diana’s timing could be more than opportunistic—it might be strategic. The drybulk shipping industry, after several sluggish quarters, is finally showing signs of firming up. Brazilian iron ore exports hit record highs in Q3 2025, Supramax and Capesize indices are climbing, and China is back in the market for U.S. soybeans after a diplomatic reset. Genco’s Q4 fleet-wide TCE is projected above $20,000 per day, with Capes fetching $27,000+—levels not seen consistently since 2022.

Meanwhile, Genco has just added another 2020-built Capesize vessel and now has 43 ships in operation, most of which are back from drydock. The company is firing on all cylinders just as industry tailwinds build. And with the global drybulk order book still at historical lows, particularly for Capesizes (just 9% of the fleet), the sector's supply side is in check.

For Diana, this is a potential chance to “buy beta” at a reasonable multiple. Genco’s trailing LTM TEV/EBITDA stands at 15.2x, with forward estimates at 6.4x—suggesting the worst might already be priced in. The stock is trading at a 15.84x forward P/E and 7.4% dividend yield, reflecting a small-cap premium but also healthy returns. If Diana believes in a multi-quarter drybulk upcycle, Genco becomes a highly leveraged way to play it—without having to build up organically.

Final Thoughts

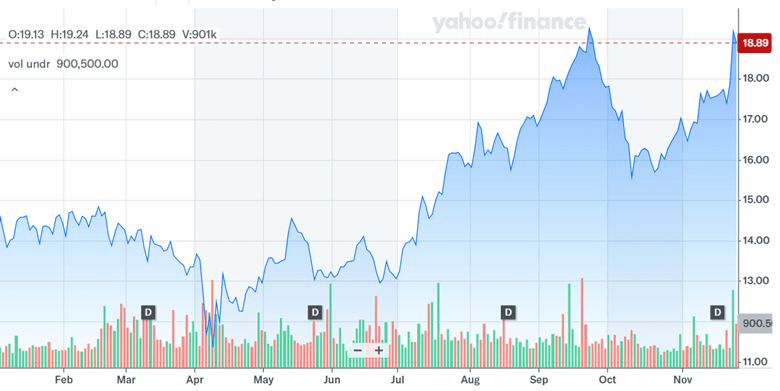

Source: Yahoo Finance

Genco’s stock price as well as its trading volumes have soared after the Diana Shipping deal. The company’s trailing LTM valuation multiples remain elevated—15.2x TEV/EBITDA and an eye-popping 227x TEV/EBIT. While forward multiples are more moderate, especially the 6.42x TEV/EBITDA, the current valuation suggests much of the rebound is already baked in. For Diana, the decision to pursue a full acquisition hinges on how much value it places on synergy versus standalone performance. Genco might make Diana bigger—but whether it makes it better will depend on execution, timing, and of course, drybulk freight rates.