DocGo’s Bold SteadyMD Acquisition Sends Shares Flying—What’s Next?

DocGo Inc. (NASDAQ:DCGO), a small-cap mobile health and medical transportation providerthat brings healthcare to your doorstep, just made a big move—and Wall Street loved it. The company announced that it’s buying SteadyMD, a virtual care platform that lets people see doctors online. Right after the news hit, DocGo’s stock shot up by more than 30%. The cool part? They are paying for the whole thing with cash they already had, and SteadyMD is expected to bring in $25 million in sales next year and actually turn a profit by 2026. The founders of SteadyMD are joining the DocGo team too, which should help everything run smoothly. This news came shortly after DocGo’s recent earnings update, where they shared some solid wins—like cutting costs, growing their business, and collecting more cash. DocGo also promised to update its full-year outlook in November. Let’s break down why this deal has people excited—and what we should keep an eye on moving forward.

Strengthening DocGo’s Strategic Footprint In Virtual Care

Let’s face it—healthcare is changing. More and more, people want care that comes to them—whether it’s at home or on their phone. That’s exactly why DocGo bought SteadyMD. It’s a big step toward growing their virtual care services and building stronger partnerships with health insurance companies. In the past, DocGo did a lot of short-term government work, like helping during the migrant crisis. But now, they’re focusing on long-term relationships—helping patients stay healthy at home, avoid hospital readmissions, and manage chronic conditions like diabetes and high blood pressure. With SteadyMD on board, DocGo now has access to over 1.2 million patients assigned by insurance companies (that’s up from 900,000 just a few months ago). The goal? Turn those patients into long-term virtual care users. SteadyMD’s tech makes it easy to schedule appointments and meet with doctors online. It’s a great match for DocGo’s existing home visit services, and together, they can offer care that’s convenient, flexible, and tech-friendly. Plus, DocGo has already been using smart AI tools to send reminders in seven different languages—SteadyMD’s platform fits right in with that strategy. This deal could also help DocGo expand into more states and work with even bigger health insurers. So, if you’re wondering how DocGo plans to keep growing, this is a major piece of the puzzle.

Financial Upside From Revenue Growth & Profitability

SteadyMD is expected to bring in $25 million in revenue next year—and best of all, they’re expected to be profitable by 2026. That’s great news for DocGo, especially since they’ve recently seen revenue drop after phasing out their migrant care programs. In the latest quarter, DocGo brought in $80.4 million in total sales—down from $164.9 million last year—but most of that drop came from the winding down of short-term government work. Their bread-and-butter business, medical transportation, stayed steady at $49.6 million, and their in-home care services brought in another $30.8 million. While the company still lost some money this quarter (about $6.1 million), they’re seeing improvement in the right areas. In-home care is getting more efficient, and margins are going up. Bringing SteadyMD into the mix could help get DocGo back to profitability, especially since they’re keeping costs in check and making smart use of their cash. Speaking of cash—they’ve got plenty of it. DocGo ended the quarter with nearly $129 million in the bank, no debt, and even used some of that cash to buy back shares of their own stock. Investors like to see that. DocGo’s leadership says they’ll update their full-year forecast in November, and people will definitely be watching to see how SteadyMD’s numbers fit into the bigger picture. If things go according to plan, this deal could be a big step toward getting the company back in the green.

Investor Confidence Reflected In Strong Market Response

Until recently, there were some concerns about DocGo being too reliant on one-time government contracts. Those deals brought in a lot of money but weren’t something the company could count on long-term. With the SteadyMD acquisition, DocGo is showing it’s ready to shift gears and focus on a more stable, growth-oriented business model. And the fact that they’re paying for the deal entirely with their own cash? That’s another win in the eyes of investors. Plus, DocGo has been trimming costs, investing in technology, and expanding its reach—all things that make it more attractive to people thinking about buying the stock. The SteadyMD team joining DocGo adds even more confidence that the transition will go smoothly. For a small-cap company like this one (which just means it’s not a giant on the stock market), every good move can make a big difference. Right now, DocGo’s stock is still priced pretty low compared to how much revenue it brings in, which could mean there’s more room to grow. Investors are hoping that this deal is just the beginning of a bigger comeback story.

Guidance Revision & Integration Execution As Key Watchpoints

Of course, no deal is without its challenges. While the excitement is real, DocGo still has to prove that it can bring SteadyMD into the fold without any hiccups. The company plans to share updated financial guidance in November, and that’s when we’ll learn more about how much this acquisition will boost their numbers. Right now, DocGo is growing its number of patients and signing on more big-name insurance partners—but scaling up can be tricky. They’ve been doing a great job cutting unnecessary costs and keeping expenses down, and it’s important they don’t lose that momentum as they bring on new people and systems. Combining teams, making sure everyone’s on the same page, and keeping quality high—it all takes careful planning. On top of that, SteadyMD’s promise to become profitable by 2026 depends on keeping expenses low and customers happy. If the company grows too fast or spends too much, that could delay things. Investors will also want to see how well DocGo retains its patients and whether SteadyMD’s tech blends well with DocGo’s tools. There’s a lot to watch in the next few months—but if DocGo manages this right, the long-term payoff could be worth it.

Final Thoughts

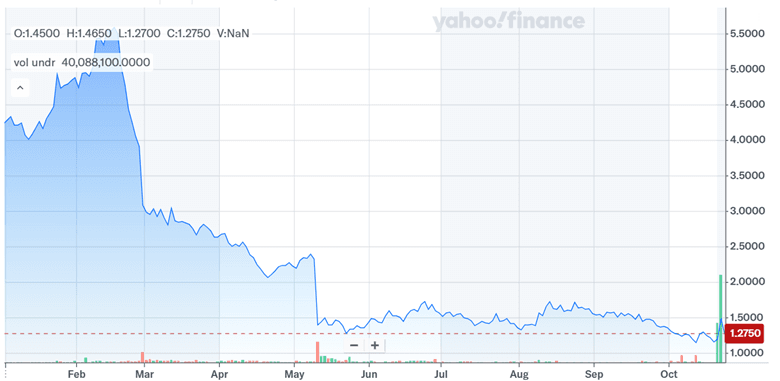

Source: Yahoo Finance

You don’t see a such a massive surge in volumes every day—so what’s got investors this fired up? We believe that DocGo’s decision to buy SteadyMD is a big step toward building a stronger, more modern healthcare business. It helps them move away from one-time contracts and toward a steady flow of virtual and in-home care services. Investors clearly liked the move. But it’s not all smooth sailing just yet. The company still needs to successfully combine the two businesses, keep costs in check, and hit its profit goals. Right now, DocGo’s stock is still trading at low levels, with a price-to-sales ratio of just 0.21x and a negative earnings multiple. That tells us investors are still cautious and waiting to see results. Whether this deal pays off will depend on how well DocGo delivers in the next few quarters. But for now, it’s a bold move—and one that’s got a lot of people paying attention.