Eramet: Rock-Solid Balance Sheet And Strong Rebound Potential For This Nickel-Manganese Miner – Eramet-SLN (OTCMKTS:ERMAF)

[ad_1]

Eramet S.A. – Primary ticker: ERA:PA – solely the Euronext-traded shares supply correct liquidity.

ADR: OTCPK:ERMAY, Grey Market: OTC:ERMAF.

Market capitalization @52€/share: €1,385M ($1,567M)

Our value goal: €115 ($130) for the Euronext Paris-traded shares

Investment Thesis

Eramet S.A. is a French mining and metallurgical firm, and one of many world’s largest producers of nickel and manganese. Despite stable monetary outcomes, Eramet’s share value has been lower in half since May, on account of:

- The potential impression of decelerating Chinese progress on carbon metal and stainless-steel; the primary markets for manganese and nickel respectively.

- An organization announcement final week that it was investigating high quality points in its Alloys division.

(Source: Yahoo Finance)

(Source: Yahoo Finance)

We consider that this value motion is overdone, and that it has led to important undervaluation (Eramet trades at an EV/EBITDA ratio of 3, a 50% low cost to friends), since:

- Demand stays supportive for manganese, the primary contributor to the corporate’s earnings.

- The high quality points within the Alloys division seem manageable.

- A recession would after all impression Eramet’s outcomes, however the firm now has a stable stability sheet that ought to allow it to climate the storm.

- Its lengthy-time period prospects are vivid with a number of progress tasks in nickel, manganese and lithium. Nickel specifically supplies important optionality.

Why is investor sentiment so poor in the intervening time? I believe two elements are at play:

- As certainly one of only a few European commodity producers, Eramet’s shares have felt the mixed impression of negativity round European equities, and commerce conflict fears.

- The solidity of the stability sheet has been, in our opinion, ignored by buyers who keep in mind the heavy debt burden of the corporate throughout the nickel trough of 2015, which noticed the shares plummet. Since then, Eramet has taken the appropriate steps to strengthen its stability sheet, as proven by a gearing of 23% and web debt of solely 0.5x EBITDA as of June 30, 2018.

If we lastly get some aid on the commerce entrance, the shares ought to rebound with €115 our value goal (120% upside potential), making use of an EV/EBITDA ratio of 5. As proven on the chart above, the stock was buying and selling at €150 only some months in the past. As all the time with miners, there’s draw back threat if commodity costs had been to fall additional. This doesn’t alter our lengthy-time period view of Eramet.

Overview Of Eramet’s Activities

A) Business segments

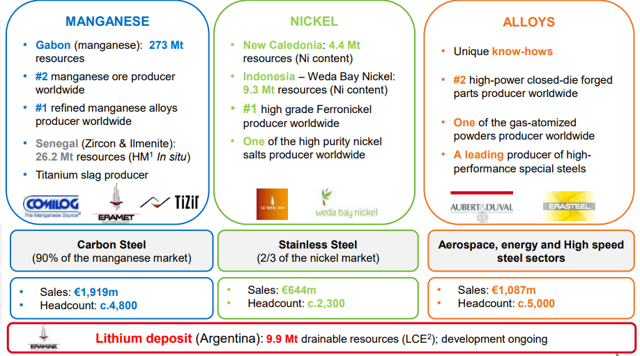

Eramet operates throughout 3 segments: Manganese, Nickel and Alloys. The firm additionally has a possible lithium challenge in Argentina, which remains to be at an early stage (extra on that within the Growth Projects part).

(Source: company presentation)

(Source: company presentation)

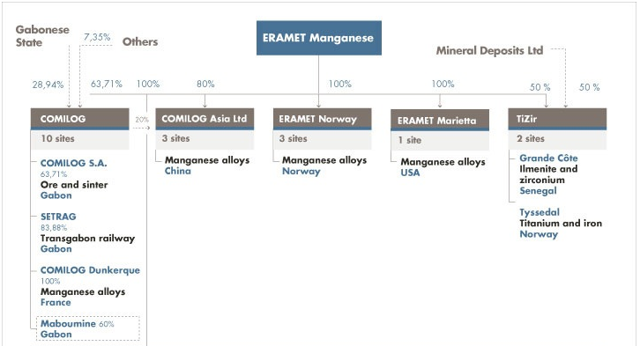

Manganese And Mineral Sands

Eramet is the world’s second largest manganese ore producer, after Australia’s South 32 (OTCPK:SOUHY, OTCPK:SHTLF). It mines excessive-grade 44% manganese ore in Gabon, by way of COMILOG, a three way partnership with the Gabonese State. According to COMILOG, the corporate’s Moanda deposit hosts 25% of the world’s reserves of excessive-grade manganese. Eramet extracted 4.1 million tons of manganese ore in 2017 and is on track to attain the identical volumes in 2018.

The manganese extracted from the Moanda mine is then:

- both offered to customers, primarily within the alloys and chemical substances fields;

- or processed into alloys within the firm’s crops in Norway and the U.S.

When it involves mineral sands, Eramet mines titanium-bearing minerals and zirconium in Senegal, and operates a titanium dioxide plant in Norway:

Since 2014, TiZir has operated a mineral sand deposit by steady dredging, by way of its subsidiary Grande Côte Opérations SA (GCO) in Senegal. The 2% of heavy minerals (titanium-bearing minerals – ilmenite, leucoxene and rutile- and zirconium) is then concentrated, separated and dried. The extracted ilmenite is distributed to the Tyssedal plant in Norway, the place it’s became titanium dioxide slag and excessive-purity forged iron.

(Source: firm’s website)

The organizational chart of the manganese and mineral sands actions is as follows:

(Source: firm’s website)

Note: Eramet has since elevated its stake in TiZir following its takeover bid for Mineral Deposits Limited’s 50% curiosity.

Nickel

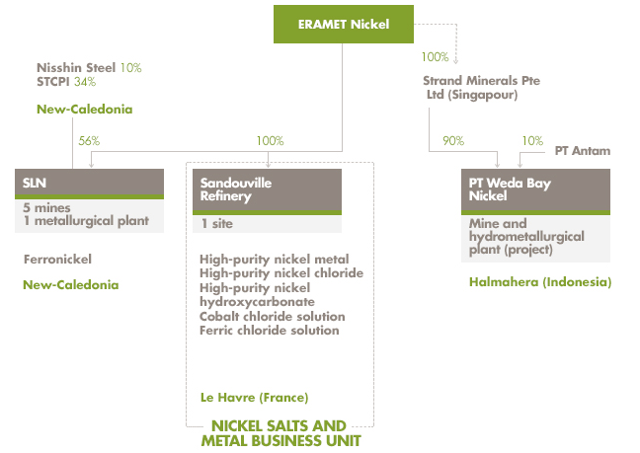

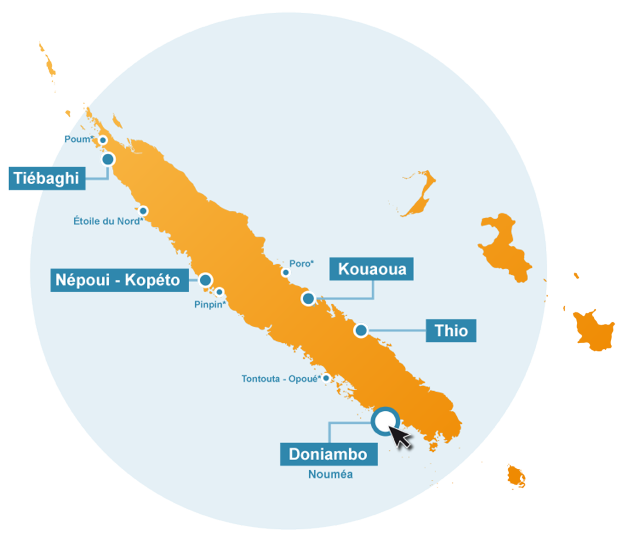

In nickel, Eramet is a prime 10 producer. It is the highest producer of ferronickel, and operates primarily on the French island of New Caledonia, in Oceania. The island holds about 11% of world nickel reserves.

Eramet extracts nickel ore from its mines in New Caledonia, and transforms it into ferronickel (FeNi) on the Doniambo plant on the island. Ferronickel is a Class II kind of nickel, suited for stainless-steel manufacturing however not for purposes that require excessive purity Class I nickel (used as an illustration in electrical car batteries). Eramet does produce some larger-high quality nickel metals and salts at its Sandouville plant in France.

The organizational chart of the nickel division is proven beneath. It consists of the Weda Bay challenge in Indonesia, that we are going to talk about within the Growth Projects part.

(Source: firm’s website)

Alloys

Eramet’s Alloys division consists of two entities, Aubert & Duval and Erasteel, that produce aluminum and titanium alloys, and excessive-efficiency metal. The phase’s operations are positioned in France, China, Sweden, the U.S. and the U.Ok.

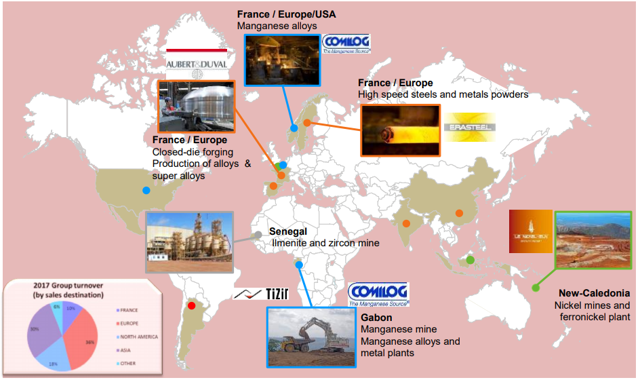

B) Site areas

The map beneath reveals the assorted operations of Eramet around the globe. We will analyze the nation threat related to a few of these areas within the Risks part of this report.

(Source: company presentation)

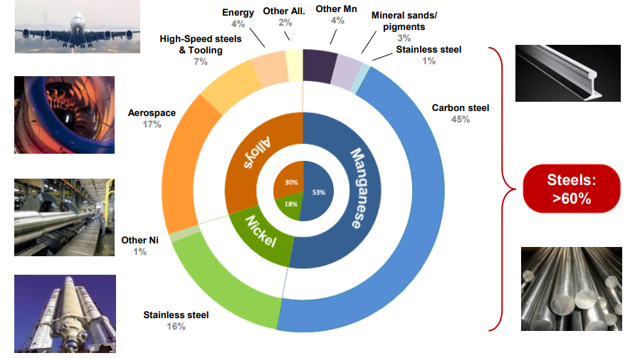

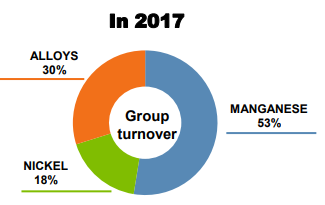

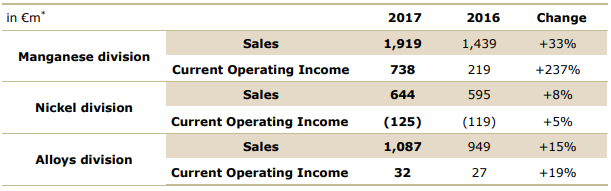

3) Weighting of every division

Before we dive into the financials of Eramet, allow us to make it clear that the corporate’s robust efficiency up to now two years has been attributable to the Manganese division. Nickel, alternatively, has struggled in a context of low costs and working difficulties. The weight of manganese is obvious within the gross sales breakdown, and much more so within the Current Operating Income desk:

(Source: company presentation)

(Source: company presentation)

(Source: firm’s 2017 outcomes press release)

Improving manganese costs in 2017 (a pattern that has continued into 2018, see beneath) underpinned the robust efficiency of that division. Nickel remained loss-making in a context of costs which are low by historic requirements. In addition, the manufacturing prices of nickel in New Caledonia have been a problem, in stark distinction to the associated fee-advantaged manganese manufacturing in Gabon.

Eramet’s Markets Are Supportive

Below is an summary of the corporate’s fundamental finish markets, dominated by carbon metal and stainless-steel:

(Source: company presentation)

The Alloys division’s prospects are supported by the tailwinds of a thriving aerospace business, a pattern that’s expected to persist for the foreseeable future. Let us take a better take a look at the manganese and nickel fundamentals.

Manganese

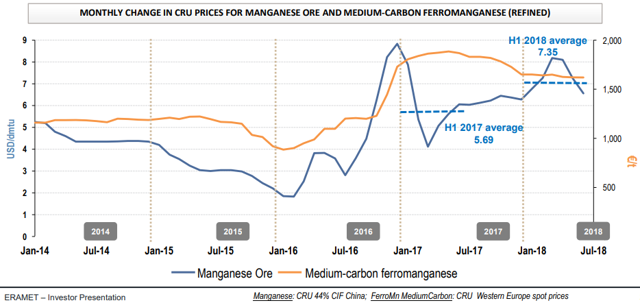

Manganese’s fundamental utility is carbon metal, of which China is the primary producer. According to Eramet’s Q3 sales report, carbon metal manufacturing elevated 4.6% throughout the first 9 months of 2018. As China’s home manufacturing of manganese ore declined over the previous few years, because of extra stringent environmental necessities, the nation’s imports of manganese ore have soared. This has resulted in an improved pricing setting for the reason that trough of 2016:

(Note: 44% ore CIF China is the benchmark for Eramet’s gross sales. Source: company presentation)

The demand facet has just lately discovered additional help from new rebar (reinforcing metal bar) requirements that got here into impact in China on November 1, requiring higher manganese content. Against this favorable backdrop, the worth of the 44% grade ore that Eramet produces was buying and selling at a nonetheless healthy $6.91 per dmtu (dry metric ton unit) CIF China as of December 7, in response to Fastmarkets MB’s data. This was, nevertheless, a 4% decline from the $7.20 recorded the previous week, as manganese is after all not proof against a slowing China.

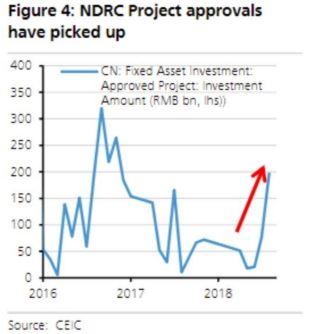

In truth, a recession in China would in all probability see costs tank. However, it is value noting that China has accepted many infrastructure tasks, at the side of its Belt & Road initiative. The nation’s leaders see such tasks as a technique to help progress:

(Source: CEIC)

Large infrastructure tasks may subsequently help the demand from China in relation to uncooked supplies for metal resembling manganese (and nickel for that matter). Longer time period, there shall be no lack of demand given the wants of different rising markets resembling India and South East Asia.

In addition, a brand new supply of demand has been rising quick lately: That of EV batteries. With a number of applied sciences utilizing manganese, together with the extensively-adopted NMC (nickel manganese cobalt) chemistry, the demand for top-grade manganese is getting a boost.

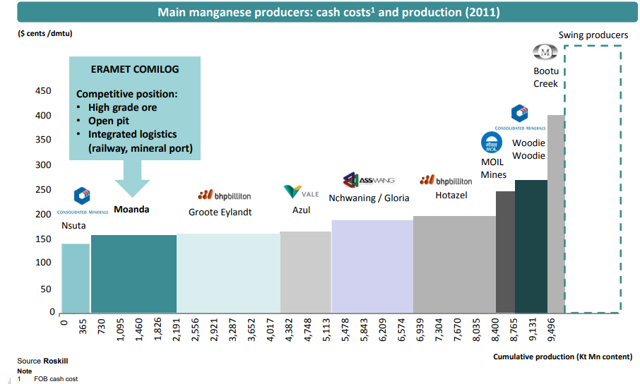

Finally, Eramet is a really low-price producer in relation to manganese. The Moanda mine of COMILOG (Eramet’s subsidiary in Gabon), is effectively-positioned on the worldwide price curve:

(Source: firm 2014 presentation)

(Source: firm 2014 presentation)

Nickel

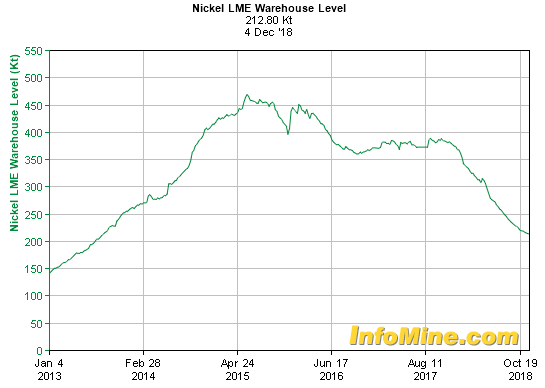

Nickel went by way of a extreme bear market in 2014 and 2015 because of new provide of nickel pig iron from the Philippines and Indonesia. This resulted in a pointy rise in inventories. Since 2017, nevertheless, the market has rebalanced, with an export ban in Indonesia and environmental restrictions within the Philippines easing the availability facet. Meanwhile, demand for stainless-steel from China and India has been sturdy. This explains the drop in inventories for the reason that prime in 2015:

(London Metal Exchange inventories. Source: InfoMine)

(London Metal Exchange inventories. Source: InfoMine)

The nickel value started collapsing in H2 2014 as inventories climbed and bottomed in early 2016. From August 2017, the worth staged a gradual restoration, helped by the robust demand and declining inventories, and reached $7/lb earlier this yr. Since the summer season, commerce jitters have had an impression, and nickel trades beneath $5/lb once more at present:

(Source: InfoMine)

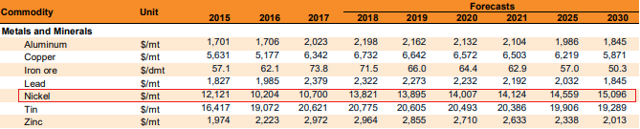

Looking past these brief-time period headwinds, nickel is commonly thought of to have probably the most promising outlook amongst base metals for the following decade:

(Source: World Bank’s Commodity Markets outlook, October 2018. Prices in $/mt)

(Source: World Bank’s Commodity Markets outlook, October 2018. Prices in $/mt)

Nickel is recurrently quoted as one of many future beneficiaries of the EV revolution. Unfortunately, Eramet’s present manufacturing in New Caledonia just isn’t suited to EV batteries that require Class I nickel. EV demand, although, would result in a reallocation to batteries of among the Class I nickel at present utilized in metal manufacturing. This ought to carry the Class II boat as effectively. And for a similar causes as manganese, lengthy-time period, infrastructure demand from rising markets shall be supportive.

For Eramet, the problem is to decrease its working prices in New Caledonia to have the ability to make revenue even at low nickel costs. Eramet’s money price in Q3 2018 was $5.75/lb, which makes the nickel operations uneconomic at present costs (once more, the cash is being made by the manganese division, see financials beneath).

But if the commerce conflict fears abate and the uptrend in nickel costs resumes, New Caledonia’s nickel will deliver quite a lot of optionality. Such is the reasoning, too, of Brazil’s Vale (VALE), the world’s largest nickel producer, who very just lately introduced its determination to invest $500M in its New Caledonian operations. Vale’s CEO, Fabio Schvarstman, expects EV adoption to carry all nickel boats:

”The determination to proceed on our personal was made as a result of (New Caledonia) might be an important a part of our technique to provide nickel particularly given the EV revolution” (supply: Reuters).

On prime of that, Eramet has a low-price nickel challenge in Weda Bay, Indonesia (see Growth Projects part), providing potential to additional capitalize on bettering fundamentals when the time is correct. This important upside potential has been, in our opinion, utterly ignored by the market.

Latest Results And FY 2018 Outlook

H1 outcomes

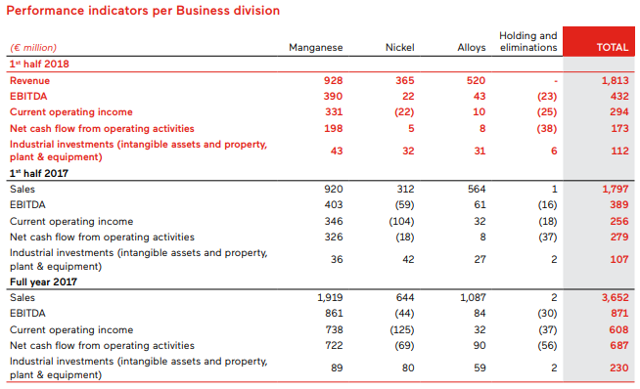

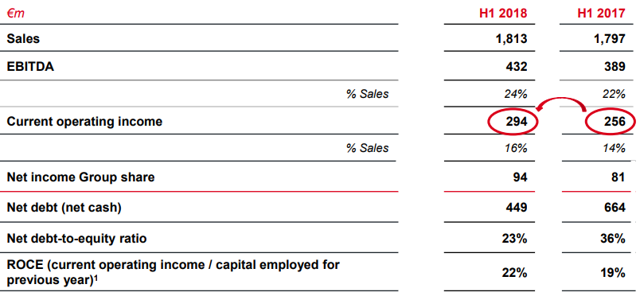

The monetary outcomes for the primary 6 months of 2018 are set out beneath:

(Source: firm’s H1 2018 report)

(Source: firm’s H1 2018 report)

The outcomes had been stable, however as soon as extra, present working earnings was pushed by the manganese division. Higher gross sales costs in nickel had been partially offset by foreign money and power price headwinds, that means that the nickel division could not break even, although there was a major enchancment from H1 2017:

(Source: firm’s H1 2018 report)

FY 2018 Outlook

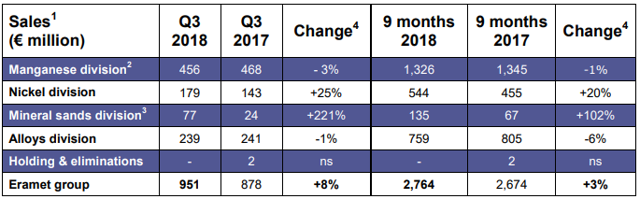

The Q3 Sales report (Eramet does not disclose full earnings on a quarterly foundation) was stable too. The manganese division’s turnover in Q3 was down barely (-3%) because of a detrimental quantity impact in response to the report.

(Source: Company’s Q3 Sales press launch. Note: In Mineral sands, TiZir was totally consolidated in Q3 2018, in comparison with 50% beforehand)

As a part of the discharge on October 25, Eramet gave its steering for the total yr:

The Group’s markets stay beneficial for mining actions, regardless of the dangers weighing on worldwide commerce relations. Assuming present metals and alloys’ costs are maintained, along with the Euro/US greenback alternate price and oil costs, the Group’s EBITDA forecast for the 2018 monetary yr must be on par with 2017.

(Source: Company’s Q3 Sales press release)

Since this was introduced in late October, nickel costs have softened in USD phrases, however the value of the 44%-content manganese ore has remained robust ($7.20 per dmtu as of December 7). Eramet may even have benefited in This autumn from a weakening euro. The weaker the euro, the higher for Eramet, as the corporate sells in USD and has most of its manufacturing prices in euros, or in currencies pegged to the euro. In addition, decrease oil costs since October are additionally a optimistic for the corporate.

In gentle of the above, we count on the corporate to satisfy or be near its steering (EBITDA on par with 2017), which might imply a 2018 EBITDA of about €900m. According to Reuters, the steering was additional confirmed on December 10 by an organization spokesman, within the wake of the press launch on Alloys mentioned beneath.

Alloys Division Quality Issues

On Monday, December 10, Eramet issued a press release revealing some high quality points inside its Alloys division:

As a part of an inner high quality course of assessment inside its Alloys division, carried out by the newly appointed administration, Eramet famous some non-conformances within the high quality administration system inside this division. Internal analyses carried out thus far haven’t revealed any impression of the foregoing on the protection of the merchandise in use. Customers concerned have been knowledgeable and additional analyses are being carried out in shut collaboration with them.

The threat of a fabric monetary impression was talked about:

The monetary penalties of this example can’t be precisely assessed thus far. They are nevertheless anticipated to be materials.

The shares offered off on the information, dropping 24%. According to Reuters, an organization spokesman later explained that by materials impression, the corporate meant a greater than €25M one-off hit to web consequence. The steering for working consequence was maintained. Investors must wait till the publication of the annual ends in February to know the total impression of the Alloys problem on web consequence.

Despite the corporate’s assertion that inner analyses carried out thus far haven’t revealed any security threat, the market might have feared that additional analyses may reveal such dangers. But on condition that the 24% drop erased greater than €400M of market capitalization, the worst case appears to have been priced in.

In truth, this response seems to be vastly exaggerated, and it’s seemingly that the present nervousness of the market performed an enormous half. The shares had been already low-cost earlier than the occasion, and so they bought even cheaper because of the overreaction.

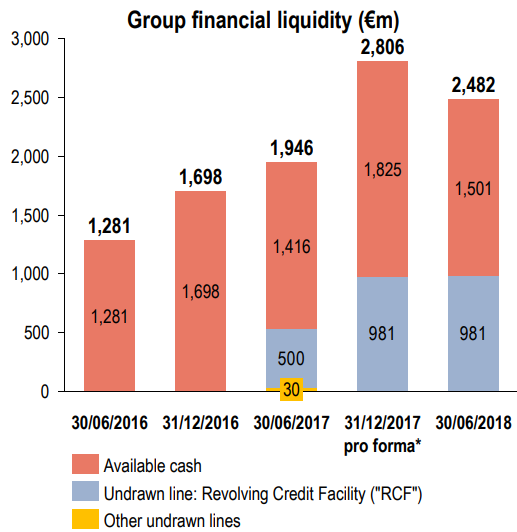

Robust Balance Sheet

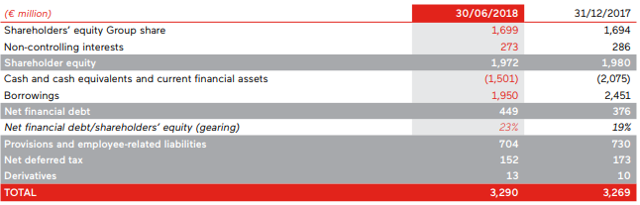

Readers might have seen from the H1 outcomes above that the H1 2018 EBITDA virtually matched the Net Debt as of June 30, 2018. In truth, Eramet has been capable of enormously strengthen its Balance Sheet over the previous 18 months.

As of June 30, 2018, the gearing was 23%. This was larger than on the finish of 2017 because of the firm reinstating a dividend, paid out in H1 2018. The €2.3 per share distribution represented €120m that specify the non permanent improve in web monetary debt:

(Source: Company’s H1 2018 report)

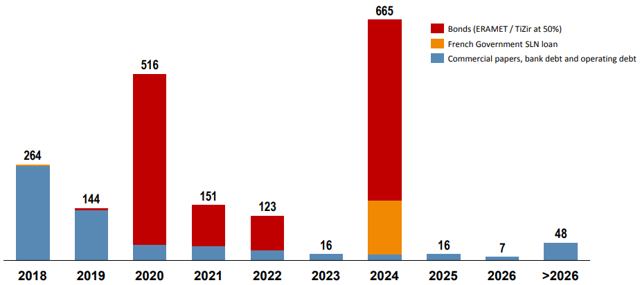

With a Net Debt / EBITDA ratio of about 0.5 for the total yr 2018, the stability sheet is on the protected facet. The debt compensation schedule should not trigger any specific issues both:

(Source: Investor presentation)

Current Valuation

Following the promote-off, Eramet is buying and selling at a really low-cost valuation in comparison with friends within the nickel and/or manganese house. With €900M in EBITDA anticipated for 2018, and an enterprise worth of €2.74bn (factoring in market capitalization of €1,385M, minority curiosity of €273M, web debt of €449M, and €704M in lengthy-time period provisions – as per the H1 2018 stability sheet above), Eramet at present trades at an EV/EBITDA ratio of 3.

(Author’s work primarily based on Seeking Alpha, Morningstar and firm statements)

Eramet is seen to commerce at a reduction of about 50% to most friends above. It’s value noting that Eramet has extra publicity to manganese than these friends, which in the intervening time is a optimistic given manganese ore’s resilience. And when one elements within the stable stability sheet, Eramet seems to be like a really inexpensive possibility for buyers trying to make the most of the weak point in mining shares.

Most names within the desk above are diversified miners with giant nickel and/or manganese operations. The final member, OM Holdings (presentation here), is a pure-play manganese firm, listed on the Australian stock alternate (with a market cap of about A$1bn/US$720m). Despite considerably extra leverage than Eramet (debt/fairness ratio of 1.32 in response to Morningstar), OM Holdings trades at 4.73 EV/EBITDA (Morningstar) and its share value has completed effectively in 2018 on the again of excessive manganese costs.

We think about that an EV/EBITDA ratio of 5 can be applicable for Eramet, particularly in gentle of the corporate’s progress prospects. A ratio of 5 would equate to a share value of €115, 120% upside from the present €52 (with EBITDA of €900M, making use of an EV/EBITDA ratio of 5 would worth EV at €4.5bn. Subtracting the €449M in web debt, €704M of different lengthy-time period liabilities, and €273M minority curiosity, fairness worth can be €3.07bn, 120% upside from the present market cap of €1.39bn).

Eramet In Previous Crises

2012-2015 commodity bear market

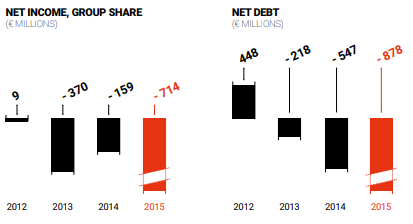

The commodity trough in 2012-2015 was a difficult interval for Eramet:

(Source: Company’s 2016 annual report. Note: in 2015, the €714 million web consequence included €668 million in asset impairments and tax receivables impairments)

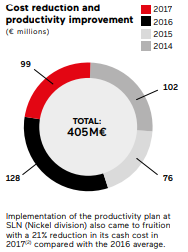

At the start of 2016, with the corporate exhibiting a debt burden of just about €900m and weak outcomes for 2015, the shares briefly traded beneath €20. This might be in lots of buyers’ minds and explains among the negativity. However, we expect the present scenario is totally different as Eramet now has a way more sturdy stability sheet. Unless a serious, protracted, disaster is across the nook, the corporate is significantly better outfitted this time round, given the stability sheet and the recurring price financial savings made by the corporate since then:

(Source: Company’s 2017 annual report)

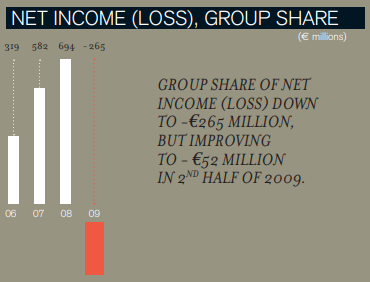

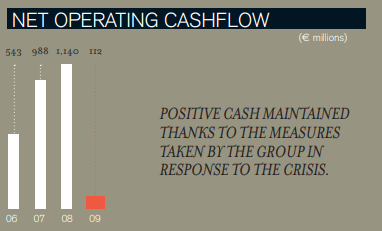

2009 recession

Going again to the 2009 disaster yr, earnings took a success however Eramet managed to stay money stream optimistic:

(Source: Company’s 2009 annual report)

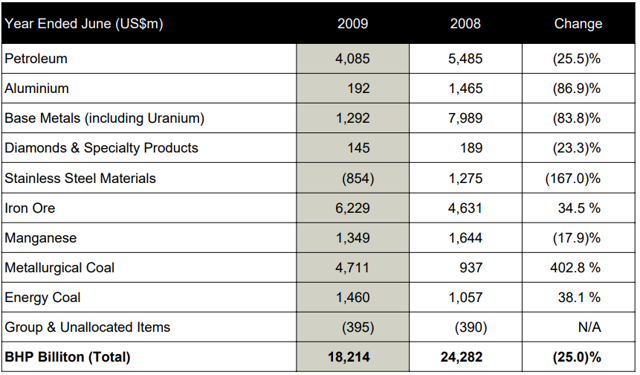

The largest manganese producer, BHP Billiton on the time (whose manganese division is now a part of South32), was additionally capable of face up to the downturn comparatively effectively. It reported solely a 17.9% discount within the manganese division’s EBIT, as manganese costs held up higher than different metals. The Stainless Steel Materials division, which incorporates nickel, was impacted by the suspension of the Ravensthorpe nickel operations in Australia:

(Source: BHP’s 2009 presentation)

(Source: BHP’s 2009 presentation)

Potential Worst-Case Scenario

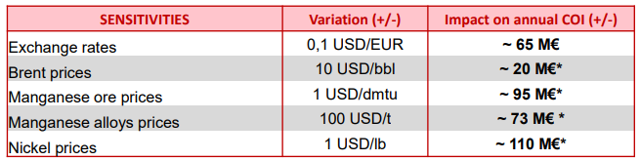

What would Eramet’s earnings appear like if a full-blown commerce conflict erupted, and a worldwide disaster materialized? This would clearly weigh on steel costs. To assess the potential impacts, we must always consult with the sensitivities supplied by the corporate:

*For an alternate price of 1.175 USD/€ / Source: Investor presentation

(Source: Corporate presentation)

Note: readers who wish to observe manganese 44% ore CIF China (and alloys) costs can consult with Fastmarket’s MB weekly updates (typically behind a paywall). With regard to nickel, infomine.com has daily updates.

Current working earnings (COI) is predicted to be round €600M in 2018 (as in 2017). In 2019, assuming nickel stays at its present $5/lb (roughly $1/lb decrease than its 2018 common) and that manganese goes all the way down to $6/dmtu (from the present $6.91/dmtu), working earnings can be within the area of €320M:

| 2018 Current Operating Income | €600M |

| – manganese ore value lower (from $7/dmtu to $6/dmtu ) | -95M |

| – manganese alloys value lower (from $1.600/mt to $1,500/mt) | -73M |

| – nickel value lower (from $6/lb to $5/lb) | -110M |

| 2019 Current Operating Income | 322M |

In a worst-case state of affairs, Manganese ore value may conceivably go all the way down to as little as 3 $/dmtu. Manganese alloys costs may lower by 500 $/mt (although there’s normally a lag of a number of months between the worth of ore and that of alloys). Meanwhile, nickel costs may drop again to 4 $/lb from their common of about 6 $/lb in 2018. COI would look very totally different certainly beneath the above depressed situations:

| 2018 Current Operating Income | €600M |

| – manganese ore value lower (from $7/dmtu to $3/dmtu ) | -380M |

| – manganese alloys value lower (from $1,600/mt to $1,100/mt) | -365M |

| – nickel value lower (from $6/lb to $4/lb ) | -220M |

| Worst-case Current Operating Income | -365M |

Other elements to think about embody:

– Brent costs, in such a disaster state of affairs, will surely be weak, which may mitigate the impression barely, and the euro can be unlikely to be robust (the greenback and yen are likely to carry out higher when tensions rise).

– A doable antagonistic quantity impact, although this must be mitigated by China’s infrastructure efforts.

Of course, market sentiment round miners can be horrible beneath such situations. It’s totally doable that Eramet’s share value would once more commerce within the €20s throughout the trough, as occurred in early 2016.

However, we do not assume such situations, in the event that they materialized, may persist for a really very long time. Most nickel producers have money prices a lot larger than $4/lb, and depressed costs will surely result in capability curtailments. In the case of Eramet, we may see among the much less worthwhile mines in New Caledonia being idled if the downturn was extended. Regarding manganese, the market’s construction has modified since China’s environmental restrictions decreased native manufacturing, so it is onerous to see costs remaining low for a chronic interval.

Cash-wise, Eramet would in all probability be capable of free some money from decreased working capital wants in such a state of affairs, and the corporate has important undrawn credit score strains at its disposal:

(Source: Investor presentation)

(Source: Investor presentation)

Growth Prospects

An enticing characteristic of Eramet, in our opinion, is its pipeline of progress tasks.

Manganese

Eramet has been considering an enlargement to its manganese operations in Gabon. COMILOG, the corporate’s native JV with the Gabonese State, would improve manufacturing by 30% by transitioning to a brand new mining plateau from 2020 onwards. A last funding determination shall be made within the first half of 2019.

Nickel

In nickel, the precedence is to stabilize the New Caledonian operations. But Eramet has additionally been assessing the potential of Indonesia, the place it has a big challenge in a three way partnership with China’s Tsingshan, the No. 1 international stainless-steel producer (the JV’s construction is ERAMET 43% / Tsingshan 57%).

The challenge contemplates nickel pig iron manufacturing from a big nickel oxidized deposit on Halmahera island. The JV’s manufacturing goal stands at 30 kt/yr in nickel content material (13 kt in nickel/a yr for ERAMET), in response to the newest investor presentation.

Lithium

Lithium has been overwhelmed up in current months, but it surely stays a key steel of the electrical car story. Eramet is able to capitalize with a doubtlessly giant challenge in Argentina. The challenge would have a capability of 20 kt of lithium carbonate per yr, and targets a 2021 start of manufacturing. As with COMILOG’s manganese enlargement, the ultimate funding determination on the lithium challenge is predicted to happen in H1 2019.

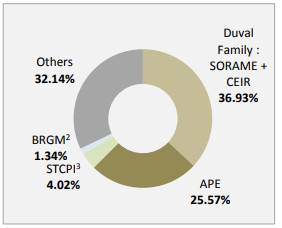

Stable shareholders

Before we transfer on to the Risks part, let’s check out Eramet’s shareholders, which embody a number of authorities entities:

(Source: Investor presentation)

- APE (Agence des Participations de l’Etat) owns 25.57%. It is principally the French sovereign fund.

- STCPI (Société Territoriale Calédonienne de Participation Industrielle) is an entity owned by the New Caledonian provinces (a French abroad territory), and holds a 4.02% stake.

- BRGM (Bureau de Recherches Géologiques et Minières, the French Geological Survey Office) is one other French authorities entity, which holds a 1.34% stake.

This 31% (in whole) authorities possession brings just a few advantages to Eramet:

- The firm is just too large to fail for New Caledonia, the place it’s the largest non-public employer: The native subsidiary (Société Le Nickel “SLN”) employs 1,900 workers. As a consequence, Eramet will get help when wanted. For occasion, a mortgage was awarded by the French State in 2015 throughout the nickel downturn.

- The presence of the French State brings some consolation when coping with international governments in Africa (Gabon) and elsewhere.

Risks

Commodity costs/power/alternate price

As with all producers, commodity costs (primarily manganese and nickel) are an enormous issue. Such costs are closely depending on financial exercise, particularly in China.

In phrases of key inputs, Eramet’s power prices are primarily based on Brent costs.

Finally, as beforehand talked about, the euro/USD alternate price impacts Eramet, with a lot of the manufacturing happening in New Caledonia and in Gabon, whose currencies (the Franc Pacifique and the Franc CFA respectively), are pegged to the euro. Meanwhile, gross sales are USD-denominated. Therefore, Eramet advantages from a weaker euro relative to the USD.

As a reminder, the sensitivity of Eramet’s present working consequence (COI) to those 3 elements is ready out beneath:

*For an alternate price of 1.175 USD/€ / Source: Investor presentation

Jurisdiction threat

New Caledonia

New Caledonia just isn’t the simplest of locations to function. The indigenous Kanak inhabitants has lengthy campaigned in favor of independence from France. As deliberate throughout a battle in 1988, an independence referendum was held on 4 November 2018. A 56.4% majority voted to stay a part of France, considerably nearer than anticipated however nonetheless sufficient to supply stability for the foreseeable future.

It’s common for Eramet to be focused by professional-independence activists. This results in enterprise interruptions at among the firm’s websites on the East coast of the island, the place Kanaks are a majority. The conveyor belt of the Kouaoua mine, specifically, has been tormented by several incidents in 2018. This is one thing the corporate has learnt to stay with, but it surely’s a drag on Eramet’s efforts to decrease working prices.

(Source: Société Le Nickel)

Gabon

The manganese division has been the primary supply of revenue for Eramet. Gabon will stay a key territory for the corporate, much more so with the enlargement at present being contemplated.

Gabon, a former French colony, has been a quite steady nation and an in depth ally of France – which maintains a everlasting navy base there – since independence. Other multinational corporations, resembling Total (TOT) by way of its subsidiary Total Gabon (OTC:ELFGF), have operated efficiently within the nation for many years. Considering the French authorities’s giant stake in Eramet, and the Gabonese authorities’s profitable cooperation with the corporate within the COMILOG JV, it is unlikely that Eramet can be a goal of useful resource nationalism as occurred to some miners in different African international locations. It can’t be dominated out utterly, nevertheless, if rulers much less “francophile” than the Bongo household got here to energy sooner or later.

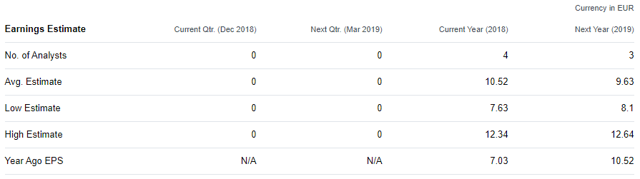

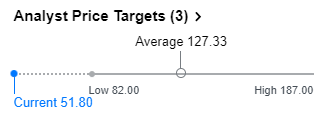

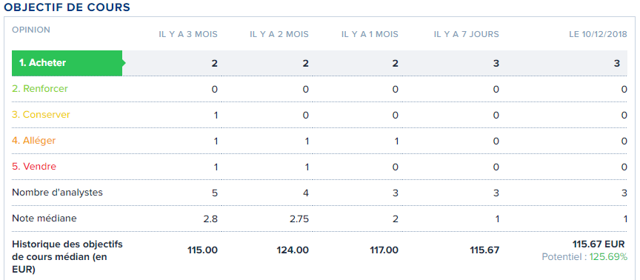

Analysts’ Targets

Analysts see important upside potential within the share value following the promote-off. EPS estimates and analyst value targets are set out beneath. Note: The value targets above had been issued earlier than the current announcement of high quality points throughout the Alloys division.

(Source: Yahoo Finance)

The common value goal as calculated by Yahoo is €127. Societe Generale’s (OTCPK:SCGLY) Boursorama.com web site, for its half, reveals a mean value goal of €116 (as of Dec 10, 2018):

(Source: Boursorama.com)

(Source: Boursorama.com)

Takeaway

Eramet, like its friends, just isn’t with out dangers and can be examined in a downturn, as an illustration if the commerce conflict with China escalated and resulted in a recession. In that case, the share value will surely fall additional. However, at an EV/EBITDA ratio of 3, the stock at present trades at a major low cost to different giant miners, which we expect is unwarranted.

The market does not appear to pay attention to the corporate’s stability sheet, which is far more sturdy than throughout the earlier commodity trough. Eramet affords a horny mixture of main manganese operations, a wealthy pipeline of progress tasks, and leverage to a restoration in nickel costs.

Importantly, Eramet’s stable monetary efficiency up to now 2 years was recorded regardless of the difficulties of the nickel division. If, as we do, one believes that the basics of nickel are supportive, Eramet brings large optionality due to its giant nickel operations, to not point out the potential for lithium manufacturing.

Disclosure: I’m/we’re lengthy ERA:PA. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Additional disclosure: The opinions and views expressed on this article are for info functions solely and shouldn’t be used or construed as a suggestion to promote, a solicitation of a suggestion to purchase, or a suggestion to purchase, promote or maintain any safety, funding technique or market sector.

[ad_2]