Exodus Just Bought Grateful—Here’s How It Could Disrupt Stablecoin Payments

Exodus Movement (NASDAQ:EXOD), a small-cap crypto wallet and financial technology company, has just made a splash with its newly announced acquisition of Uruguay-based Grateful—a young startup specializing in stablecoin payments for merchants. Even though the acquisition itself isn’t huge financially, it’s a meaningful signal of where Exodus wants to go next. Announced on November 10, 2025, the move shows the company is thinking beyond just holding or swapping crypto. It is aiming to build tools that let people actually use digital money in everyday life. And with the Grateful app launching in Argentina and Uruguay as soon as next month, the timing couldn’t be more interesting. Let us take a closer look at the deal and find out how this acquisition gives Exodus an early foothold in terms of developing an all‑in‑one financial app.

Embedded Merchant Payment Capabilities & Cross-Border Reach

The most direct synergy from Exodus acquiring Grateful is the addition of a stablecoin-native merchant checkout infrastructure. This means Exodus can now offer merchants an alternative to high-fee credit card processing systems, positioning itself as a cost-effective solution for cross-border and domestic commerce. In regions like Argentina and Uruguay, where inflation and currency volatility are rampant, stablecoins have already become a household name. By embedding Grateful’s checkout tech into its own platform, Exodus can immediately tap into these pain points and offer local merchants a cheaper, faster way to settle transactions in U.S. dollar-equivalent stablecoins. But the upside isn’t limited to Latin America. As stablecoin usage continues to rise globally, Exodus now owns both the consumer-facing wallet and the merchant-facing rails—a rare combination that sets the foundation for a vertically integrated payment ecosystem. Moreover, Grateful's merchant network gives Exodus an immediate testing ground for future products such as yield generation, loyalty programs, or credit offerings linked to stablecoin balances. With 1.8 million funded users and an increasingly global footprint, Exodus could begin rolling out these services in select markets with stablecoin demand already in place. While the monetization of merchant checkout is not an immediate focus—management has emphasized a utility-first approach—it opens the door for future fee-based models once user adoption scales. Grateful’s presence in high-inflation regions becomes a sandbox for product experimentation, giving Exodus a cost-efficient and operationally flexible entry into emerging-market financial services.

Consumer Yield Potential Through Stablecoin Deposits

Beyond merchant functionality, one of the most compelling growth opportunities lies in stablecoin-based consumer yield products. CEO JP Richardson highlighted that the real monetization potential will stem not from merchant transaction fees but from users holding stablecoins inside the Exodus wallet. In a world where bank interest rates remain inconsistent and financial inclusion remains elusive, Exodus sees a chance to become the default wallet for users seeking not just to store but to grow their digital dollars. The addition of Grateful enables Exodus to drive adoption in regions where saving in stablecoins is already a de facto strategy to hedge against inflation. If Exodus can offer even modest returns through lending protocols, staking, or other blockchain-native instruments, it can build recurring, high-margin revenue streams while giving users a reason to remain on-platform. More importantly, Exodus’ self-custodial model ensures that users retain full control of their assets, something that aligns with growing privacy and decentralization preferences. From a revenue perspective, stablecoin deposits could support yield-spread income models, partner revenue-sharing agreements, or fee-based products akin to checking accounts. This approach also lowers Exodus’ reliance on its core XO Swap aggregator business, which has historically been tied to volatile crypto trading volumes. In Q3 2025, non-exchange revenue reached over 10% of the total, a milestone Exodus hasn't seen in years. The company is effectively diversifying its stack with more predictable income streams, and Grateful accelerates this trajectory by providing the infrastructure for retail stablecoin usage in day-to-day financial activities.

Expansion Into Payments With Flexible Regulatory Architecture

Grateful also brings strategic regulatory flexibility to Exodus’ roadmap. As a small-cap crypto company aiming to scale internationally, one of the core challenges is tailoring products to specific jurisdictions while staying compliant. Grateful’s architecture and local experience in Uruguay and Argentina offer Exodus a modular entry point into regions with varying regulatory and monetary environments. This plays into a broader strategy highlighted by CFO James Gernetzke, who emphasized Grateful’s ability to “implement and refine aspects of [Exodus’] software for mass consumption” and to support “targeted rollouts and feature testing.” In simpler terms, Exodus now has a field lab in Latin America to experiment with feature sets, pricing models, and user flows before expanding to larger, more tightly regulated markets like the EU or the U.S. Additionally, by starting with merchant-focused tools, Exodus avoids some of the regulatory burdens that come with issuing stablecoins or offering investment products. The company has also clarified that it plans to integrate with existing debit and credit card rails—offering users the ability to use their stablecoins without needing to educate them about blockchain or custody. This hybrid model increases user appeal without getting bogged down in compliance issues that typically stall crypto adoption. As stablecoins become more mainstream globally and discussions around central bank digital currencies (CBDCs) continue to heat up, Exodus’ combination of wallet + checkout + yield gives it a flexible blueprint to meet both local demand and future regulatory expectations.

Broader Strategic Play Toward Tokenization & Financial Superapp

At the highest level, the Grateful acquisition signals that Exodus is not just thinking about crypto utility—it’s aiming to become a full-spectrum financial application. On the same call announcing the deal, the company reiterated its plans to tokenize common stock on multiple blockchains (currently Solana and Algorand) and to issue dividends in Bitcoin. These are not standalone gimmicks—they are early components of a future where your investment, savings, and spending activities all happen on a single app. Grateful’s addition gives Exodus another building block toward this vision, particularly as it builds the bridge between on-chain and real-world financial activity. Imagine a scenario where a user receives Bitcoin dividends from their EXOD holdings, stores stablecoins in the wallet for yield, and then spends those same assets via debit card—all without ever leaving the Exodus ecosystem. While these use cases are still in development, Grateful’s stablecoin payment app makes that future slightly more tangible. Furthermore, as tokenization gains traction in the U.S. and abroad, having a wallet that already supports tokenized stocks (and that can transact with stablecoins in real-world commerce) puts Exodus ahead of most crypto-native platforms. As CEO Richardson noted, today’s consumers want banking, investing, and spending to happen in a single tap, and Exodus is positioning itself to be that one-stop solution. The more verticals it owns, the more control it has over the user experience and revenue capture. Grateful may be a small acquisition, but it plays a critical role in Exodus’ broader ambition to become a digital finance “superapp.”

Final Thoughts

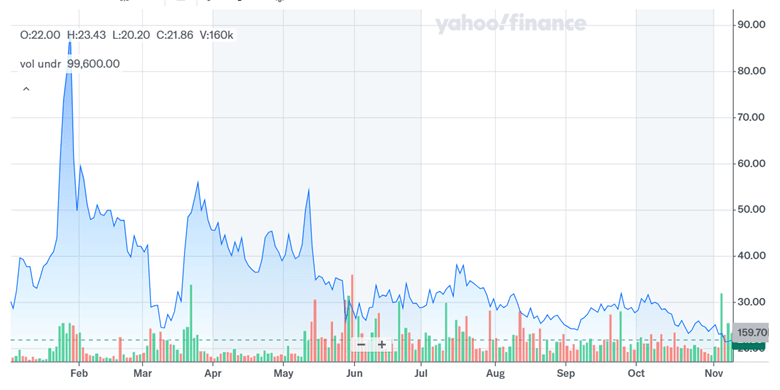

Source: Yahoo Finance

The acquisition of Grateful may not have had a significant impact on Exodus’ stock price but it could open new doors. However, those new doors could also be fraught with real challenges. Growing in Latin America or any new region takes time, consistent execution, and careful navigation of local rules. And since Exodus has long depended on crypto market activity, the company has to be thoughtful about how it balances new ideas with what its current users still expect. On the financial front, Exodus trades at 4.56x LTM EV/Revenue and 28.57x LTM EV/EBITDA—levels that show investors are already assuming solid growth for a small-cap company. That leaves limited room for mistakes as the strategy unfolds. In the end, Grateful may turn out to be a small deal with big potential, but its real impact will depend on how well Exodus blends these new tools into its broader vision without stretching itself too thin.