Gibraltar’s $1.34 Billion Play To Dominate Roofing Could Be A Game-Changer!

If you have been keeping an eye on the home improvement or small-cap stock space, here’s something worth your attention. Gibraltar Industries (NASDAQ:ROCK) just made a bold move—they are planning to buy OmniMax International for a hefty $1.34 billion in cash. Gibraltar is looking to strengthen its position in the residential building products market, especially roofing and rainwater systems. This deal is set to double their building products revenue and give them access to new parts of the U.S. market where they didn’t have much presence before. They are not doing this alone either—they have lined up some serious financing and expect the deal to close in the first half of 2026. Even better, they say this move will help boost profits right away and bring in $35 million in savings over a few years. Let us dive deeper into how this deal and how could shake things up for Gibraltar.

Market Reach & Product Breadth Expansion

One of the most immediate benefits Gibraltar could derive from acquiring OmniMax lies in the expansion of its addressable market and regional presence. OmniMax operates in approximately 20 local markets where Gibraltar currently has little or no exposure, including high-potential regions like the Northeast and the Southwestern U.S.—markets Gibraltar has historically underserved. With OmniMax’s established relationships in those areas and its strong product lineup in rainwear management and roofing accessories, Gibraltar gains not just market entry but also credibility and brand recognition. The acquisition would also allow Gibraltar to access a broader customer base through OmniMax’s strong presence in the home center retail channel, while complementing Gibraltar’s existing dominance in professional distribution. This synergy is more than geographical; it’s also about product breadth. OmniMax’s portfolio of legacy brands in rainwear management fills a gap in Gibraltar’s current offering, especially considering that approximately 40% of OmniMax’s revenue comes from this product category, which Gibraltar has largely exited. Combined, the two firms would serve a $9 billion market in trims, flashings, ventilation, metal roofing, and rainwear, allowing Gibraltar to bundle offerings more effectively and compete in more bids. This broader product and regional coverage is expected to support a more resilient revenue stream, especially in a fragmented roofing market characterized by localized building codes and contractor-specific requirements. The deal creates scale that could give Gibraltar a competitive edge in national distribution and contractor support.

Operational Synergies & Cost Optimization

Gibraltar’s management has been clear that the $35 million in targeted cost synergies are not just a hopeful estimate—they are backed by a concrete roadmap spanning logistics, supply chain, SG&A, and 80/20 operational savings. Approximately half of these synergies are expected to be captured within the first year post-closing, which would provide immediate margin enhancement. For a small-cap firm like Gibraltar, this level of efficiency gain is significant and would materially improve earnings quality and cash flow. The companies have compatible business models and manufacturing setups, making it easier to streamline overlapping functions, consolidate sourcing strategies, and optimize distribution networks. The 80/20 methodology, a cornerstone of Gibraltar’s lean operating model, is expected to be deployed rapidly within OmniMax to identify low-margin SKUs and unproductive processes. OmniMax, which already runs a lean transformation office, has done much of the heavy lifting in recent years by exiting underperforming product lines and acquiring high-margin businesses. Gibraltar plans to leverage this momentum rather than rebuild from scratch. Importantly, these synergies are expected to be driven through operational levers rather than risky headcount reductions, which helps reduce execution risk. The efficiency gains also support Gibraltar’s deleveraging plan, targeting a reduction in leverage from 3.7x at closing to 2.0–2.5x within 24 months. The debt structure—comprised of Term Loan A and B tranches and a revolver—is designed to facilitate early repayment and capitalize on the free cash flow improvements expected from these synergies.

Revenue Synergies & Cross-Selling Opportunities

While Gibraltar has intentionally excluded revenue synergies from its financial projections to keep guidance conservative, the potential upside from cross-selling is hard to ignore. With complementary customer bases and geographic footprints, Gibraltar and OmniMax can unlock new distribution channels and product placements almost immediately. For example, Gibraltar’s presence in metal roofing could help pull OmniMax’s rainwear and flashing products into new projects where OmniMax hasn’t had prior relationships. Likewise, OmniMax’s strong ties to national home centers and retail channels—where Gibraltar is less established—could open up new sales avenues for Gibraltar’s trims and ventilation products. The combined company would offer a “roof-to-gutter” solution that is attractive to both contractors and channel partners, especially as more players in the distribution ecosystem seek bundled solutions to streamline procurement. Additionally, more dots on the map mean a denser distribution network, enabling better service levels, faster delivery, and lower shipping costs—advantages that could be parlayed into market share gains. The overlap is complementary, not redundant, which minimizes channel conflict while maximizing touchpoints with end users. Product customization—key in a market with region-specific building codes—also becomes easier with combined design and engineering teams. These potential revenue synergies, while unquantified, represent a material upside to the base-case financial model and may help Gibraltar scale faster than it could through organic growth alone. For a small-cap company with a history of measured growth, this kind of synergy could represent a rare inflection point.

Tax Benefits & Enhanced Free Cash Flow

Another underappreciated synergy from the OmniMax acquisition is the significant tax benefit, which Gibraltar expects to yield approximately $100 million in present value. These tax attributes—primarily net operating losses—are not expected to flow through GAAP earnings, but they will provide real, tangible cash savings. Gibraltar anticipates realizing around $20 million of these benefits in the first year post-close, which would directly bolster free cash flow. These funds could be redirected toward debt repayment, additional bolt-on acquisitions, or even shareholder returns in the form of buybacks. When combined with the $49 million in free cash flow generated in Q3 2025 (16% of sales), Gibraltar is setting itself up to sustain a strong liquidity position despite the debt load from the acquisition. The deal structure—committed financing with favorable terms and flexibility for early repayment—ensures that the company can manage its balance sheet without compromising on growth initiatives. Gibraltar's debt-to-EBITDA ratio, projected at 3.7x at closing, may appear elevated for a small-cap, but the tax shield and free cash flow improvements provide a viable path back to its target range of 2.0–2.5x within two years. In addition, the acquisition could improve Gibraltar’s return on invested capital (ROIC) if the tax benefits are fully realized and reinvested wisely. For investors, this tax efficiency adds another layer of margin enhancement and de-risking, especially in an environment where interest expense and operating costs are closely scrutinized.

Final Thoughts

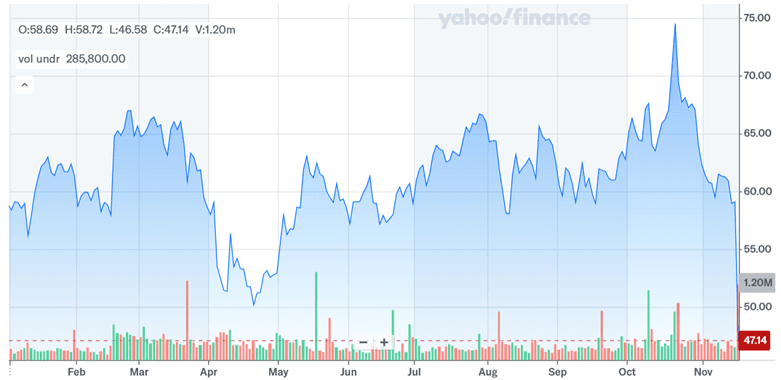

Source: Yahoo Finance

Gibraltar’s stock price has been crashing and the deal has done little to save its fate with the investors. The stock is trading at just under 7 times its earnings before interest and taxes—pretty reasonable for a small-cap in a growth mode. But is this a buy? Well, there is the challenge of combining two businesses smoothly, paying down new debt, and waiting for the housing market to pick up again. Whether this deal turns out to be a smart long-term move or a stretch too far will depend on how well Gibraltar follows through. For now, it’s a wait-and-watch situation with both opportunity and caution in the mix.