GROM Primed And Ready As Kids Return to the Classroom

The world has been in and out of some form of lock-down for well over a year now as each country does its best to slow the spread of COVID-19. Now, with vaccination numbers on the rise and real-world proof that the vaccines are working, the world is now beginning to think about returning to some sort of post pandemic normalcy.

When the pandemic first hit, investors were quick to identify stocks that were most likely to benefit from a remote workplace and consumers being stuck at home. Today, as countries begin to open back-up investors should be focusing on what exactly “opening back up” means, and which companies have positioned themselves to properly take advantage.

On August 2, 2021, the US Department of Education released their “Return to School Roadmap” designed to help students, schools, educators, and communities prepare as they make the transition from remote teaching, back to a full time in-person learning environment. This news also warrants special attention from investors, who should be connecting the dots that as schools allow students back into the classroom so too brings major opportunities for a select few high-flying growth companies to capitalize on this return to pre-pandemic life.

Company Overview

One such company that is poised perfectly to benefit from the Return to School movement, is Grom Social Enterprises (GROM), who is a dynamic social media platform company creating unique and original entertainment content for children under 13 years old. The company does this through their numerous subsidiaries including their flagship product Grom Social Inc, which delivers entertainment content (think movies, shows, videos and more) through web and mobile environments, allowing kids to interact with friends, play proprietary games all while teaching them how to be responsible users within the digital world. The company also oversees Grom Educational Services providing web-filtering services to schools and federal/municipal governments, and more excitingly recently owns and operates Top Draw Animation, an award-winning producer of high-quality animation services and programs for global entertainment providers.

Grom without a doubt has some encouraging momentum as the world begins to emerge from the pandemic, and it’s starting to show financially. In fact, the company’s revenue through the six months ending June 30, 2021 rose 7.4% with the most notable increase coming from Top Draw Animation’s 11.3% revenue growth. 2021 is proving to be a rebound year for this still very young social media company, and even with an incredibly strong performance year to date, Grom is showing they still have plenty of upside left to capitalize on.

Grom Announces New Acquisition of Family Content Creator Curiosity Ink Media LLC

Curiosity Ink Media is dedicated to creating captivating and original content designed for young audiences and families. Recently Grom announced the completion of the acquisition in which it acquired 80% of the equity and control of Curiosity Ink.

This acquisition will further boost Grom’s original content portfolio and will add brand new entertainment options such as children’s books, theatrical films, and TV series. As well, Brent Watts one of Curiosity’s key content creators will be joining the Grom team by staying in his current role of Chief Creative Officer of Curiosity.

The recently acquired Curiosity has already unveiled a wide array of future projects for the coming years including a collaboration with international toy company Cepia LLC to develop the popular children’s toy Cats vs. Pickles into a television series, while also creating an original animated holiday musical feature which will be presented on Santa.com (a holiday focused hub and e-commerce site). Similarly, Curiosity will be collaborating with Dynamite Entertainment to create a pipeline of children’s books based on Curiosity’s original content including PAW Patrol and Baldwin’s Big Adventure.

Grom Observes Major Uptick in Active Users Through Tokyo Olympics Surfing Docu-series

At the start of the 2021 Tokyo summer Olympics, Grom announced their main ambassador Caroline Marks would be competing in the surfing competition, and that users would gain access to one-of-a-kind series documenting her time and experience throughout the games.

Marks did not disappoint viewers, making it all the way to the bronze medal round before narrowly losing to Japan’s own Amuro Tsuzuki. All this led to the docu-series being an overwhelming success with Grom seeing a massive surge in downloads leading up to and throughout the games, totalling nearly 11,000 new users to the platform. The success from this new initiative is further evidence that Grom’s mission of creating original and interesting content, while also reinforcing proper safety and etiquette of surfing the web is resonating in a major way with their target audience.

Key Takeaway

With kids returning to school marks a major opportunity and flattering market condition for Grom as the youngsters will surely be talking about what kept them busy over the lock-down and summer break. Undoubtedly, Grom Social and the exciting new content the company has consistently delivered to their (now over 2.3 million) users will come up in conversation, bringing with it a new wave of subscribers to their platform. This back-to-school trend was underscored at the Benzinga Reopening Stocks Summit which took place on August 18-19 with Grom’executives , helping investors truly understand the incredible opportunity that lies ahead.

This company is firing on all cylinders leading up to what could very well be the biggest year in Grom’s history, with the content schedule already full for years to come and with adolescents returning to school, spells the perfect formula for this up-and-coming social media company to continue making waves.

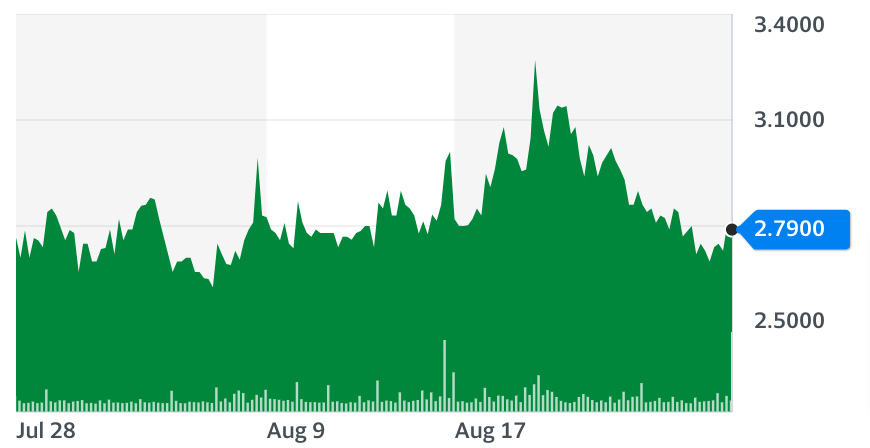

And finally, with an approximate market cap of only $29 million and trading at a very low price-to-sales ratio of 4.75, Grom has the near-term catalysts, low market cap and diversified revenue streams that’s associated with gigantic upside potential.

Disclaimer

No Positions