Harrow’s MELT Acquisition Could Disrupt IV Sedation—But Is It The Hottest Pharma Small-Cap Buy?

Harrow Inc. (NASDAQ:HROW), a small-cap pharmaceutical player known for its ophthalmic focus, is looking to expand its sedation portfolio through the acquisition of Melt Pharmaceuticals—a clinical-stage company developing non-opioid, non-IV sedative formulations. Melt’s flagship candidate, MELT-300, combines midazolam and ketamine in a sublingual formulation aimed at replacing traditional IV sedation for medical procedures. With patents across multiple global regions, the product holds significant promise. Harrow plans to commercialize the product in the U.S. while seeking out international partners. This move comes amid Harrow’s drive to deepen its non-ophthalmic offerings and diversify revenue streams. As Harrow eyes this acquisition, the strategic fit and potential synergies merit a closer look—especially for investors tracking small-cap pharmaceutical consolidations.

Vertical Integration Of Non-Opioid Sedation Solutions

Harrow's core business lies in ophthalmology, but its expanding pipeline reflects a deliberate push into adjacent therapeutic areas. The acquisition of Melt Pharmaceuticals brings with it MELT-300, a proprietary sublingual sedation compound combining midazolam and ketamine. Unlike traditional IV-based sedation, MELT-300 offers an orally administered alternative, potentially transforming how sedation is delivered across outpatient, in-office, and hospital settings. By acquiring this asset at the clinical stage, Harrow gains the ability to vertically integrate a novel sedation option into its broader anesthetic and procedural care strategy. Importantly, this move aligns with shifting physician and patient preferences toward opioid-free, non-invasive treatment pathways. Harrow’s acquisition rationale also taps into growing resistance to IV sedation due to its complexity, cost, and logistical constraints—especially in resource-constrained settings. The synergy here is not just commercial but operational. With Harrow already operating compounding pharmacies and ophthalmic distribution channels, it can repurpose much of its infrastructure for MELT-300's launch. Integration into its existing customer base—particularly ambulatory surgical centers and ophthalmic clinics—could significantly reduce SG&A scaling costs. Furthermore, the company has expressed plans to identify global partners for ex-U.S. markets, thereby reducing commercialization burden while retaining licensing upside. From a cost control standpoint, Harrow’s in-house manufacturing and distribution capabilities can enhance MELT-300’s gross margins once commercialized. Thus, the acquisition gives Harrow a strategic foothold in procedural sedation while unlocking vertical integration potential across the pharmaceutical value chain.

Cross-Selling To Ophthalmic & Procedural Networks

Harrow’s established relationships with ophthalmologists, ambulatory surgery centers (ASCs), and outpatient clinics create a fertile ground for cross-selling Melt’s non-IV sedation solution. As MELT-300 is positioned to replace traditional IV sedation in various procedural settings, Harrow can leverage its existing sales infrastructure to promote the product without building a new distribution channel from scratch. MELT-300’s ease of administration, via sublingual tablet, could prove particularly appealing in ophthalmic surgeries, where patient throughput, rapid onset, and minimal post-op grogginess are essential. According to Harrow’s Q2 2025 earnings call, the company is placing increasing emphasis on scaling procedural adjuncts and products that improve patient flow and clinician efficiency. Integrating MELT-300 into these conversations may allow Harrow to offer a more complete procedural toolkit, increasing its value proposition per clinical touchpoint. Additionally, Melt’s candidate dovetails well with Harrow’s current compounding pharmacy capabilities, potentially allowing Harrow to bundle sedation and ophthalmic products for procedural settings. This bundled offering could enable preferential contracting and rebate arrangements with surgery centers, further solidifying Harrow’s presence in specialty care. Cross-sell synergies are also enhanced by the regulatory pathway MELT-300 is on, as its sublingual formulation simplifies administration and may reduce compliance burdens compared to controlled IV sedatives. The scalability of this approach, particularly for small-cap firms with limited marketing budgets, could drive higher return on invested capital (ROIC) than standalone product launches would. In essence, Harrow’s existing commercial footprint significantly lowers the barrier to entry for Melt’s platform, providing a credible path toward post-acquisition value extraction.

Intellectual Property Leverage & Global Licensing

MELT-300 is protected by a robust patent portfolio spanning North America, Europe, Asia, Australia, and the Middle East, offering Harrow a multi-year exclusivity runway. For a small-cap acquirer like Harrow, securing proprietary rights to a novel delivery mechanism for sedation opens doors to monetization strategies beyond direct sales. By acquiring Melt Pharmaceuticals, Harrow gains the opportunity to pursue out-licensing and co-development partnerships for non-U.S. markets, which could generate milestone payments and royalties with minimal incremental investment. During its Q2 2025 earnings call, Harrow emphasized its intention to identify global development and commercialization partners for MELT-300. This is a capital-efficient strategy, especially critical for a company that reported an LTM EV/Revenue multiple of 8.42x and an EV/EBITDA multiple of 61.64x—levels that imply premium expectations for margin expansion and revenue growth. Partnering internationally could deliver near-term non-dilutive capital inflows to fund domestic commercialization. Moreover, leveraging MELT-300's intellectual property in combination therapies or alternate formulations—such as pediatric dosing or dental applications—could unlock new indications. The breadth of Melt’s IP could also help Harrow expand into adjacent therapeutic areas or develop a follow-on platform around sublingual sedation. Given Melt’s deep bench of patent filings and the clinical momentum around MELT-300, Harrow could use these IP rights as negotiating chips in broader licensing discussions. Thus, this acquisition presents a clear pathway for IP-driven monetization strategies—a rare opportunity for a small-cap firm typically dependent on narrow product lines and limited lifecycle extension tools.

Pipeline Diversification & Clinical Optionality

Harrow has historically relied on ophthalmic therapeutics and compounded formulations for revenue, which exposes it to concentration risk both in terms of therapeutic area and payer mix. The Melt Pharmaceuticals acquisition could rebalance this exposure by bringing a differentiated pipeline asset with a non-ocular focus into the portfolio. MELT-300’s ongoing development provides Harrow with optionality around future clinical milestones, which can drive valuation re-ratings and broaden investor interest beyond ophthalmology-focused funds. As a small-cap company, Harrow operates under scrutiny from both institutional investors and analysts regarding pipeline durability. Diversifying into procedural sedation addresses this critique by adding an entirely new growth vertical. Furthermore, MELT-300’s regulatory and clinical pathway—focused on sedation in hospital and outpatient settings—may offer faster reimbursement opportunities given the ongoing demand for alternatives to opioids and IV-based therapies. This is particularly true in elective surgeries and in-office procedures, where MELT-300's administration profile fits the logistics better than existing solutions. From a risk perspective, adding a clinical-stage asset also balances Harrow’s largely commercial-stage portfolio, providing a source of medium-term upside without requiring immediate sales execution. However, the success of this diversification depends on execution and capital allocation discipline. Should MELT-300 fail in its clinical trajectory or encounter regulatory hurdles, the acquisition could dilute Harrow’s focus and stretch its R&D budget. Still, the potential for pipeline expansion, backed by Melt’s delivery technology and IP portfolio, provides Harrow with optionality that could prove beneficial in a therapeutics landscape increasingly driven by platform innovation.

Final Thoughts

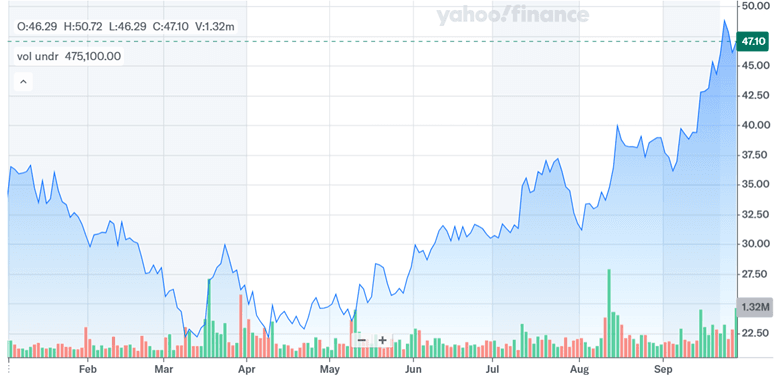

Source: Yahoo Finance

As we can see in the above chart, Harrow’s stock price has been on a solid upward trajectory since mid-April, long before the proposed acquisition of Melt Pharmaceuticals. The company trades at a trailing EV/Revenue of 8.42x and EV/EBITDA of 61.64x—multiples that suggest high level of market expectations. The Melt acquisition aligns with Harrow’s stated objectives of broadening its procedural care footprint and reducing reliance on ophthalmology. However, the move is not without risk. MELT-300 remains a clinical-stage asset, and the absence of near-term revenues could weigh on Harrow’s already elevated valuation multiples. Additionally, the regulatory, clinical, and commercial timelines associated with MELT-300 introduce a layer of uncertainty. Overall, we see this deal as a double-edged sword for Harrow and we believe that it is certainly not the correct time to invest in Harrow’s stock especially at such high valuation multiples despite a possible upside from the acquisition.