Here’s why the stock market’s big bounce doesn’t mean investors will outrun the bear

[ad_1]

Market whiplash is one thing to behold today.

That 1,000-point rally the market handed the Dow on Wednesday is threatening to unravel in a market missing merchants and a few onerous information. But earlier than we go any additional, the denizens of monetary Twitter need everybody to cease obsessing over the level factor, which they observe is deceptive in relation to monitoring traits:

Nothing on twitter actually bothers me. I can ignore the trolls, the chart crimes, the bizarre those that randomly drop in to conversations, the smugness, the snark from each journo… ever, however use “points” as a measure of an increase or fall of the stock market and I will torch you.

— Raoul Pal (@RaoulGMI) December 26, 2018

The prevailing opinion proper now appears to be that the 5% achieve for the S&P 500 and equally biggish beneficial properties for the relaxation, quantities to nothing greater than a sucker’s rally. And that sort of market can work very properly for knowledgeable, quick-as-a-whip merchants, however much less nice for retail investors:

Which headline in 24 hours would shock you the LEAST?

1) S&P 500 Sets Record For Best Two-Day Return Ever

2) S&P 500 Gives Back All Of Yesterday’s Gains

3) S&P 500 Gives Birth to Healthy Twins

4) Right Testicle Shuts Down Nation’s Beaches— OddStats (@OddStats) December 27, 2018

More numbers. The S&P’s leap was the 18th largest single-day rise for the index since 1970, notes Russ Mould, AJ Bell’s funding director. But eight of these “came during the bear market of 2007-2009 and three more during the market downturn of 2000-2003, to suggest there is still a risk that this year’s Boxing Day bonanza could be no more than a wicked bear trap set to lure investors into more trouble,” he says.

Our name of the day says investors must be much more affected person than a child at Christmastime in the event that they wish to see the backside are available for shares and an uptrend resume. It comes from Dan Wantrobski, director of analysis at Janney, who tells shoppers he’s anticipating declines in extra of 20% from the highs earlier than we get a “meaningful bottom”

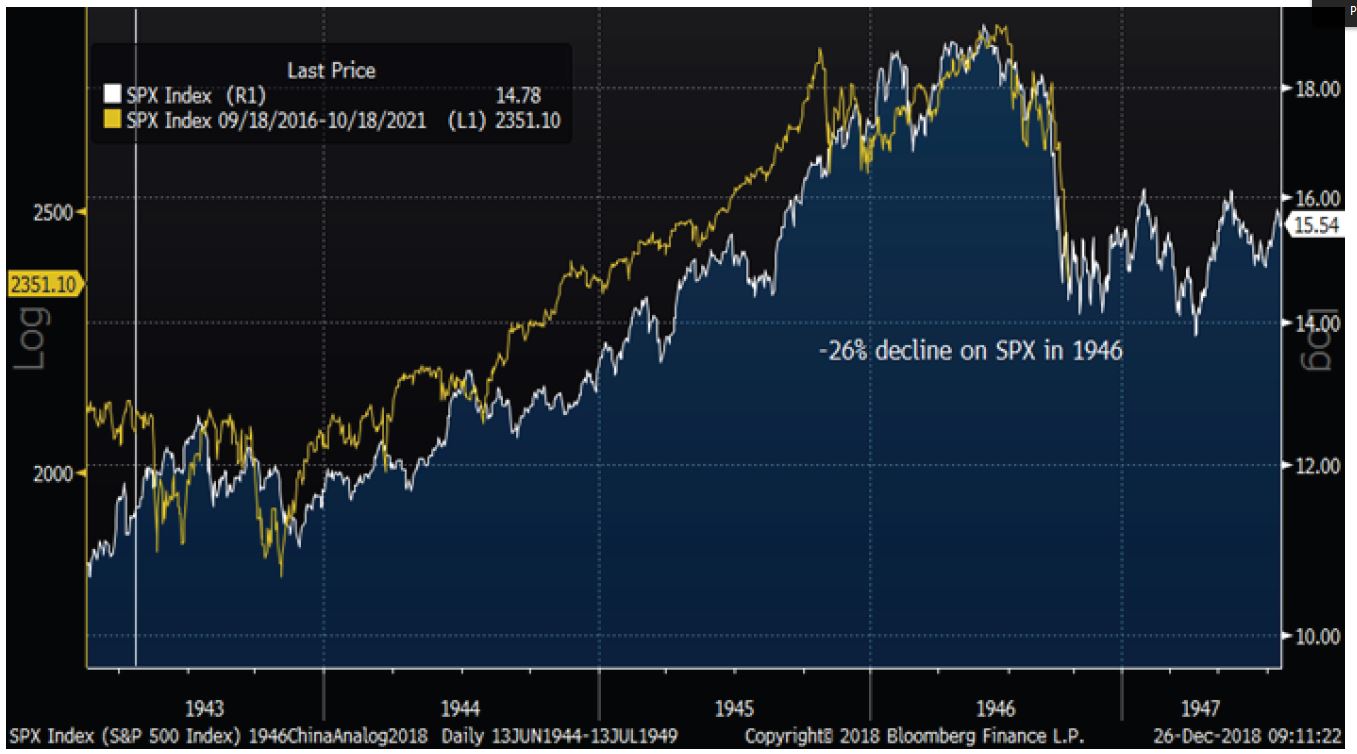

He bases this on a chart that overlays the S&P’s efficiency from 1943 to 1946, which exhibits how the market reacted ahead of a decadeslong rise in bond yields, to that of 2015 to present. If the latter interval retains monitoring the former, investors may even see a low established, then “volatility in the form of a choppy, multi-month base-building process that can take several months before resolving higher again.”

Janney/Bloomberg

Janney/Bloomberg

Wantrobski additionally famous that “deeply oversold conditions” are in place for 80% of NYSE shares proper now and whereas capitulation is getting nearer, a “series” of 90% down days are wanted to “flush out the weaker hands and tee up attractive valuations for new buyers.”

“Oversold conditions promise at least a trading rally ahead as we approach the New Year — but for now, stay buckled as we likely have some more miles to travel in this correction cycle,” he says, noting that they’re sticking to utilities, staples, health care, REITs and gold, silver and the greenback.

The market

It’s a sea of crimson for Dow

YMH9, -1.48%

S&P 500

ESH9, -1.42%

and Nasdaq

NQH9, -1.44%

futures. That’s affer Wednesday’s highly effective rally for the Dow

DJIA, +4.98%

S&P 500

SPX, +4.96%

and Nasdaq

COMP, +5.84%

.

The dollar

DXY, -0.19%

and crude

US:CLU8

are additionally sliding, with gold

US:GCU8

regular.

Check out Market Snapshot for extra protection

European shares

SXXP, -1.13%

are again from an prolonged vacation break and sagging. In Asia, the Nikkei

NIK, +3.88%

logged a 3.9% achieve, however China shares

SHCOMP, -0.61%

fell 0.6% as knowledge confirmed a sharp fall in industrial production.

The chart

Everything you ever wished to learn about market bottoms however had been afraid to ask is obtainable up in our chart of the day from Irrelevant Investor’s Michael Batnick, who has so many to select from:

Take March 1978, which he describes as “the most uneventful bottom ever,” which concerned a 1% achieve and a 1% decline for the Dow. On the day the index bottomed, the achieve amounted to 0.16%:

Michael Batnick

Michael Batnick

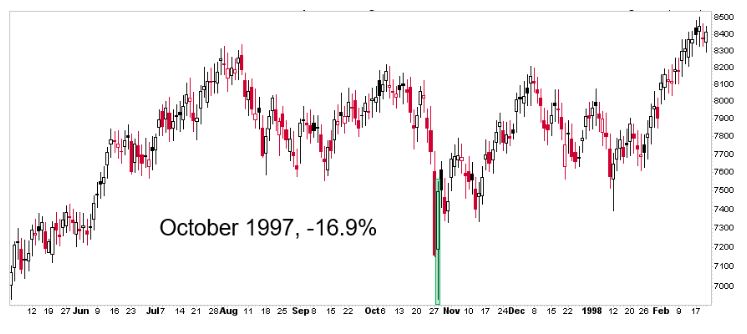

And from the “market’s don’t bottom like this” class, take this 4.7% achieve for the Dow in October 1997:

Micheal Batnick

Micheal Batnick

Check out the relaxation on Batnick’s weblog here.

The buzz

On the commerce entrance, Bloomberg is reporting midlevel, face-to-face talks between Beijing and Washington officers will happen the week of Jan. 7. Meanwhile, the Trump administration is nearing an govt order to ban U.S. companies from utilizing telecom tools from China’s Huawei

002502, -3.63%

or ZTE

000063, +0.20%

says Reuters.

Buzz is constructing for Netflix’s

NFLX, +8.46%

“Black Mirror” stand-alone movie “Bandersnatch,” which is ready to debut Friday.

Don’t do it. pic.twitter.com/dZUeyxW50x

— Black Mirror (@blackmirror) December 27, 2018

The financial system

Weekly jobless claims will hit early, together with shopper confidence, however the shutdown means no new-home gross sales knowledge.

Read: Government shutdown: What economic reports are suspended?

Random reads

American Colin O’Brady has grow to be the first person to cross Antarctica by himself, and with out assist

Two Michigan officers take plea deals over Flint water disaster

Snow pants for Christmas? 7-year outdated calls 911 to complain

And millennials appear the least happy with their vacation presents

Modern parenthood is a drag

Midwesterners. How nice are (we) they?

Need to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e mail field. Be positive to test the Need to Know merchandise. The emailed model will be despatched out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Providing essential info for the U.S. buying and selling day. Subscribe to MarketWatch’s free Need to Know e-newsletter. Sign up here.

[ad_2]