Infobird (IFBD): International expansion and Big-Pharma Partnership

Amidst the backdrop of record setting inflation, rising interest rates, and the possibility of a recession has put a darkened mood throughout the investing world. Previously in 2021, equities reached new highs daily, as investors cheered the progress made from the economy reopening from lockdowns.

But today, shows a different picture. Most indexes are down 20-30% and many portfolios are down even more. The times of every company setting new highs is over for at least the intermediate term, and in its place, comes investing into businesses with good financial standing and clear avenues for further growth.

And one company that we have touched on before which is showing investors that they are still thriving despite the market downturn, is China-based tech firm Infobird (IFBD). As a quick refresher, Infobird engages in developing and providing customer engagement cloud-based services for their customers. Infobird is a software-as-a-service provider of innovative AI-powered customer engagement solutions throughout mainland China. The Company provides holistic software solutions to help corporate clients proactively deliver and manage end-to-end customer engagement activities at all stages of the sales and marketing process. It also offers AI-powered cloud-based sales force management software including intelligent quality inspections and intelligent training software to help clients monitor, benchmark, and improve the performances of sales agents.

As we will soon see, so far in 2022 Infobird is showing they have what it takes to not only survive during these uncertain times, but to thrive and emerge from this market turmoil a stronger enterprise.

Infobird Announces International Expansion Plan

Recently, Infobird announced they would be entering into a channel partner agreement with Harbor Private Limited – a Singapore-based company focused on providing software solutions to enterprise sized clients. This agreement signifies Infobird is officially expanding their software offering internationally, yet the responsibility of sales and implementation will fall to Harbor Private. Infobird will provide support and technical training to Harbor Private as they begin to learn the broad range of customer service and software offerings Infobird can provide.

Singapore is known to be an economic hub of Southeast Asia with an economy valued at approximately $462 billion. Further, one of the most prominent and fast-growing sectors within Singapore is the financial industry, which is a sector Infobird already serves back in China. And with Singapore’s financial sector having assets under management totalling over $2 trillion this is a sizeable new market for Infobird (through Harbor Private) to capitalize on.

This agreement is a first step to broaden Infobird’s operations globally. And through the agreement with Harbor Private, Infobird can assess the demand and growth capabilities of their software without having to outlay significant cash to expand internationally.

Infobird Partners with Big Pharma Company

Infobird has also recently partnered with a global pharmaceutical company, specifically its subsidiary operating in China. This important new customer will rely on Infobird to supply its AI Chatbots and experience in the healthcare industry to provide fully integrated support for the client’s digital and intelligent customer engagement project designed to support the client’s patient notification process for vaccines including COVID-19, HPV, and various childhood vaccines.

This marks a significant milestone for Infobird as this will be their first entry into the vaccine industry. The global vaccine market is growing significantly, with estimates from Vernoster Sullivan stating the market will reach $80.9 billion by 2025 and $136.7 billion by 2031. A sizeable amount of this market growth will take place in China, where technological innovation, as well as favourable government policy is allowing for pharmaceutical companies to innovate at an unprecedented rate. Further, China has now become the second largest vaccine producer in the world, meaning demand for companies who can optimize the customer service process for consumers will become extremely important.

Infobird already has rich experience within the healthcare space and has scalable software solutions which should provide easy-to-implement and cost-effective solutions for the pharmaceutical industry. This partnership allows Infobird to get their foot in the door to one of the largest and fastest growing markets throughout China.

Thoughts on Valuation

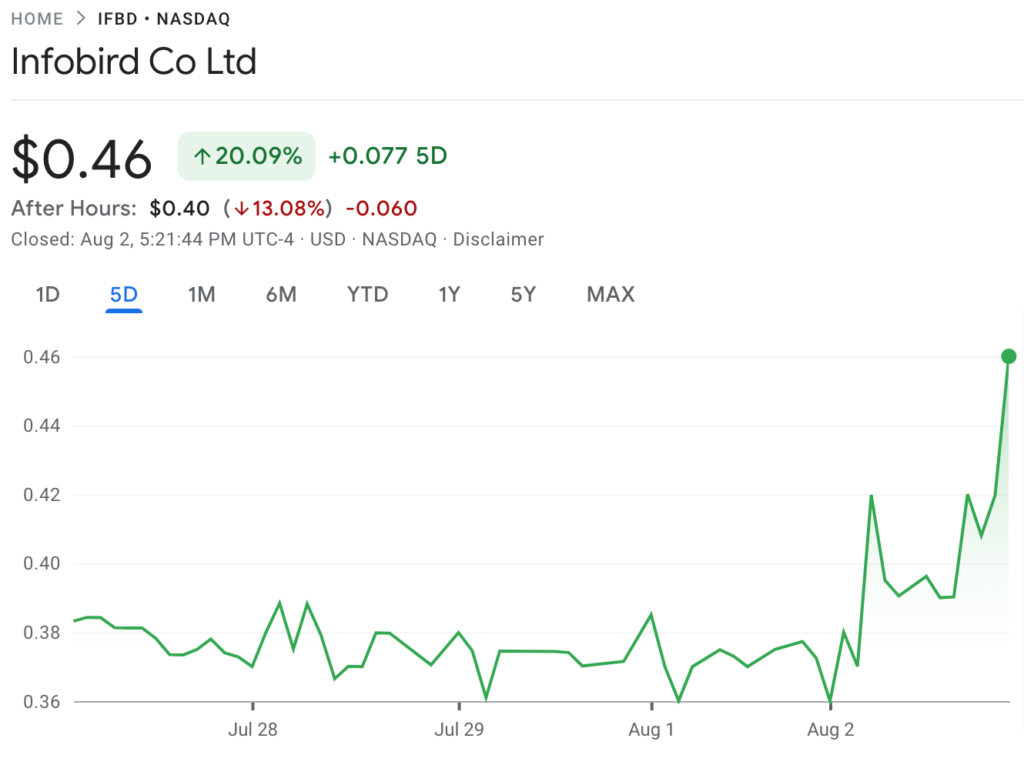

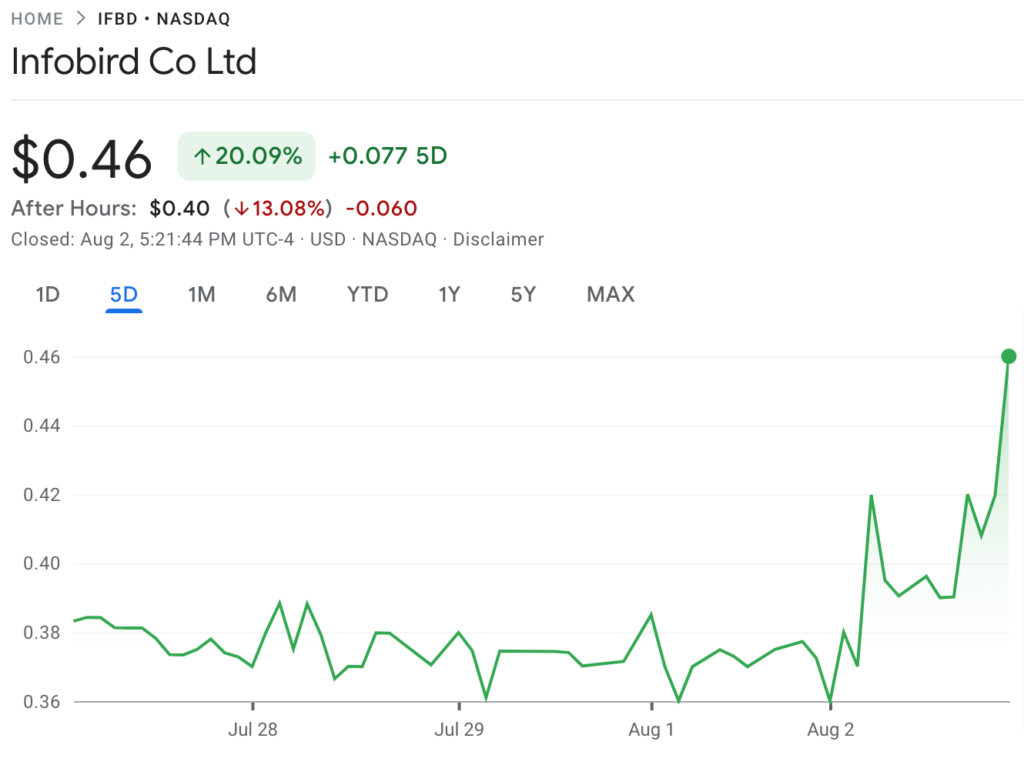

Infobird has seen their market cap decline by over 60% since the start of 2022 (see chart below) to hit a low of $10 million. This is not because of the company’s business model deteriorating but rather Infobird, like so many of its peers, has suffered from the broader tech sell off that started earlier this year.

When beginning to look at the company’s fundamentals, as well as their future growth prospects we can begin to see an opportunity of buying a company with a bright future at a steep discount. Considering the company is expanding internationally, while also signing a major contract with a big pharma company, today’s share price of $0.40 is lower than where the company fundamentals suggest it would be.

Infobird’s share price has become disconnected to the company’s fundamentals as the company begins to expand internationally, as well as find new and fast-growing markets at home. Considering this, today’s price appears to be a great long-term buying opportunity for growth and value investors alike.

Final Thoughts

Infobird is operating in what is soon to be the largest economy in the world. They have proven their software solutions are highly valued and have demonstrated their ability to continuously upsell to new and existing customers. Now, the company is expanding their reach by pushing into the Singaporean market – which represents a large and new opportunity.

Infobird has a strategy in place coupled with an aggressive growth plan to come out of the current market downturn stronger than ever. And with share prices currently down over 60% since the start of the year, now marks a great opportunity to buy shares at a discount.