Integral Ad Science Gets Snapped Up? Inside Novacap’s $1.9 Billion Bet On AI Ad Tech

Integral Ad Science (NASDAQ:IAS) has become the latest small-cap software name to attract private equity interest, as news broke that Canadian private equity firm Novacap will acquire the company in a $1.9 billion all-cash deal. Under the agreement, Novacap will purchase all outstanding shares of IAS for $10.30 per share—representing a 22% premium over the stock's September 23, 2025 close. The deal sent shares surging nearly 20% in premarket trading and, if completed, will take IAS private before the end of 2025. As demand for AI-powered advertising solutions surges globally, Novacap appears to be positioning itself to capitalize on IAS's expanding product suite, AI infrastructure, and strategic CTV and social media partnerships. But what makes this small-cap ad verification platform such a compelling buyout target? Let us find out!

Expanding AI-Driven Product Ecosystem Aligned With Performance Marketing Shift

IAS has spent the last several quarters aggressively expanding its product suite toward AI-first, performance-oriented solutions that cater to advertisers’ growing demand for measurable, transparent media buying. At the heart of this strategy is Total Media Performance (TMP), a bundled offering that integrates verification, optimization, and post-bid measurement across platforms. Its QSP (Quality Sync Prebid) product is now live across all major DSPs, including DV360 and Amazon DSP, allowing brands to track CTV supply path efficiency in real time. Performance products like TMP have demonstrated real-world value, with a cited campaign achieving 8x more efficient eCPMs and nearly $9 in return on ad spend per dollar spent—93% above client benchmarks. IAS’s Vault and Publica offerings further reinforce its monetization toolkit on the CTV side, while new contextual tools launched with Meta, Snap, and Lyft extend its optimization reach across mobile and social formats. From a buyout lens, Novacap stands to inherit a platform already built for the AI-driven advertising ecosystem, capable of driving ROI across display, CTV, and social media channels. The firm’s Gen AI models, which now handle 97% of model validation, have increased speed by 29x and accuracy by 45% compared to human annotation, underscoring IAS's infrastructure scalability. Novacap could accelerate monetization through enterprise-level bundling and expanded penetration of mid-market accounts, particularly via the Signal platform's self-serve tools. The combination of proprietary technology, multi-channel execution, and expanding AI capabilities offers Novacap an immediate footprint in next-gen adtech with scalable margins and demonstrable client demand.

Strategic Footprint In High-Growth Channels: CTV, Social, & Global Markets

IAS's differentiated footprint across CTV and social formats makes it a unique platform asset in the fragmented adtech ecosystem. CTV remains the fastest-growing media channel by spend, and IAS’s Publica business grew 36% YoY in Q2 2025, buoyed by deals with Samsung, SBS Australia, and a major German publisher. The Vault product—which boosts bid density and monetization for CTV publishers—has also gained traction, while Prebid optimization solutions are being adopted internationally, with EMEA and APAC clients doubling quarter-over-quarter. In social, IAS's TMQ and Prebid Social Optimization products have achieved widespread adoption, especially across Meta and TikTok, with more than 50% of Q2 adoption coming from outside the Americas. A new ThreadsFeed measurement partnership with Meta further entrenches IAS as a key verification player. From a geographic lens, international revenue now comprises 30% of total sales, with 45% of measurement revenue in Q2 derived from non-U.S. markets. Strategic expansions into China (with luxury and CPG clients already live), alongside global deals in live sports, retail, and auto, position IAS as a rare adtech name with genuine global scale. This footprint offers Novacap immediate revenue diversification and access to high-growth, brand-safe media environments where advertisers demand third-party validation. In a market shifting away from open web display and toward closed ecosystems and premium video, IAS's embedded integrations with OEMs, platforms, and publishers form defensible moats that could be leveraged more broadly under private ownership.

Strong Financial Profile With Cash Flow, Margin, & Upsell Leverage

Integral Ad Science has demonstrated consistent financial discipline, posting 16% YoY revenue growth in Q2 2025 and a 35% adjusted EBITDA margin—driven by product mix, cross-sell execution, and spend from large social and CTV accounts. Optimization revenue rose 16% to $68 million in Q2, while measurement climbed 8% to $57 million, driven by retail and financial services verticals. Publisher revenue jumped 36% as Publica and Vault scaled. IAS reported $55 million in operating cash flow in Q2 and exited with $91 million in cash and zero long-term debt after paying down its obligations. Its $300 million credit facility (expandable to $550 million) provides additional liquidity for investments. Key performance metrics also show strength: Net Revenue Retention stood at 110%, with 87% of ad revenue coming from large customers, which grew to 240 in total. On a trailing basis, IAS currently trades at 2.86x LTM EV/Revenue, 2.97x LTM Price/Sales, and 14.81x LTM EV/EBITDA—below historical software deal multiples, especially for verticalized adtech firms with recurring revenue and scalability. The valuation arbitrage becomes even more attractive considering IAS’s leverage to AI infrastructure and its ability to shift spend from legacy Moat clients to higher-margin optimization products. Novacap could further improve margins through go-to-market simplification, bundling strategies, and potential carve-outs of slower-growth open web assets. The company’s disciplined capital allocation, coupled with proven operating leverage, makes it well-suited for a private equity structure aiming to extract upside through operational optimization and targeted reinvestment.

Proven Client Wins, Oracle Migration Tailwinds, & Ethical AI Certification

One underappreciated asset IAS brings to the table is its diversified, blue-chip client base across verticals and geographies, with notable recent wins in automotive, luxury retail, apparel, and financial services. In Q2, IAS secured a major deal with Volkswagen of America to extend TMQ across social platforms, built on an existing multiyear optimization partnership. It also won a U.S. measurement contract with a global apparel brand due to its brand suitability tech and supply path transparency, while a luxury retailer switched over from a competitor citing efficiency improvements. These wins indicate a sustained ability to displace incumbents and grow wallet share. Importantly, IAS is actively converting legacy Moat clients—acquired during the Oracle transition—into optimization and measurement upsells. Management confirmed over 75 accounts signed with a 70% renewal rate, with upsell and cross-sell now ramping. Furthermore, IAS recently became the first media quality company to receive ethical AI certification from the Alliance for Audited Media, differentiating its brand amid broader scrutiny around algorithmic transparency. In a privacy-first environment, buyers—especially those in regulated or sensitive sectors—are likely to favor certified, third-party measurement partners. Novacap stands to benefit from IAS’s positioning as a compliance-forward, performance-backed alternative to legacy verification vendors. This credibility, combined with product stickiness and migration tailwinds, adds predictability to revenue streams and enhances the platform’s strategic value in a consolidating ecosystem. As advertisers demand outcome-driven tools underpinned by verified data, IAS offers both the credibility and the AI engine to meet this demand—an appealing proposition for a long-horizon infrastructure investor.

Final Thoughts

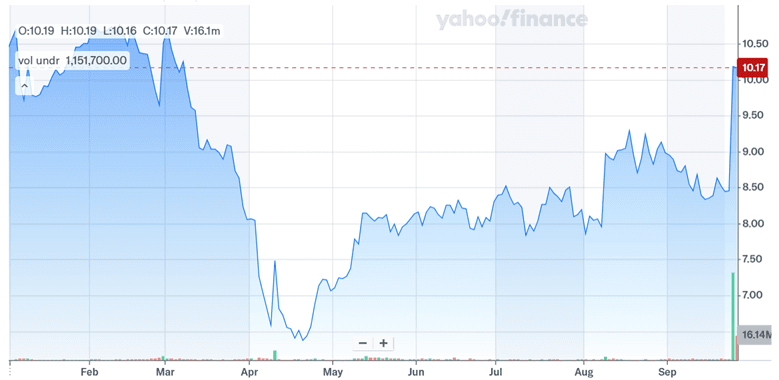

Source: Yahoo Finance

We can see IAS’ stock price climbing as high as $10.17 and trading about 13 cents below the proposed acquisition price. On valuation, IAS currently trades at 14.81x LTM EV/EBITDA and 2.86x LTM EV/Revenue—multiples that suggest room for multiple expansion under private ownership, but also reflect recent volatility in adtech markets. The business still faces concentration in a few large accounts and exposure to macro advertising cycles but its fundamentals remain strong. Overall, we can clearly see Novacap making a strategic move to capture a differentiated, small-cap player in the evolving digital advertising landscape but whether the deal generates a positive IRR for them in the long run is to be seen.