Medolife Rx Initiates Comparative Study of Its Flagship CBD-based Muscle Rub and Competitor Products, Recaps Previous Results

[ad_1]

Burbank, CA –  (NewMediaWire) – October 06, 2021 – Medolife Rx, Inc. (“Medolife”), a global integrated biopharmaceutical company with R&D, manufacturing, and consumer product distribution, which is a majority owned subsidiary of Quanta, Inc. (OTCQB: QNTA), announced today that it has initiated a study on its polarized cannabidiol (CBD) muscle rub product, sold under the brand Aelia. The study will analyze the effectiveness of the product in reducing inflammation through the inhibition of cyclooxygenase-2 (COX-2) enzyme activity in the human body and compare the findings with other non-polarized CBD products currently available on the market.

(NewMediaWire) – October 06, 2021 – Medolife Rx, Inc. (“Medolife”), a global integrated biopharmaceutical company with R&D, manufacturing, and consumer product distribution, which is a majority owned subsidiary of Quanta, Inc. (OTCQB: QNTA), announced today that it has initiated a study on its polarized cannabidiol (CBD) muscle rub product, sold under the brand Aelia. The study will analyze the effectiveness of the product in reducing inflammation through the inhibition of cyclooxygenase-2 (COX-2) enzyme activity in the human body and compare the findings with other non-polarized CBD products currently available on the market.

The study will take place under the supervision of a scientist from BCN Biosciences, Elizabeth Singer, PhD, whose expertise in the field will provide third-party verification of the results. The goal of the study is to show that CBD that is polarized through Medolife’s proprietary methodology is more effective in inhibiting the COX-2 enzyme than other non-polarized CBD products currently available on the market. COX-2 has been widely studied as a precursor of prostacyclin, which is expressed in inflammation in the body. The inhibition of the enzyme is believed to be an effective treatment for inflammation and a COX-2 inhibitor has been approved as a pharmaceutical drug in the US, sold as Celecoxib, which is used for relief of pain, fever, swelling and tenderness caused by osteoarthritis and rheumatoid arthritis, among other indications. CBD is being studied by various organizations for its potential role in COX-2 inhibition. Through the Company’s polarization process, the potency of the CBD in Medolife’s products is significantly increased, lending to the theory that inhibition of COX-2 enzymes by polarized CBD would result in the reduction of pain and inflammation. The Company plans to test this theory through this study.

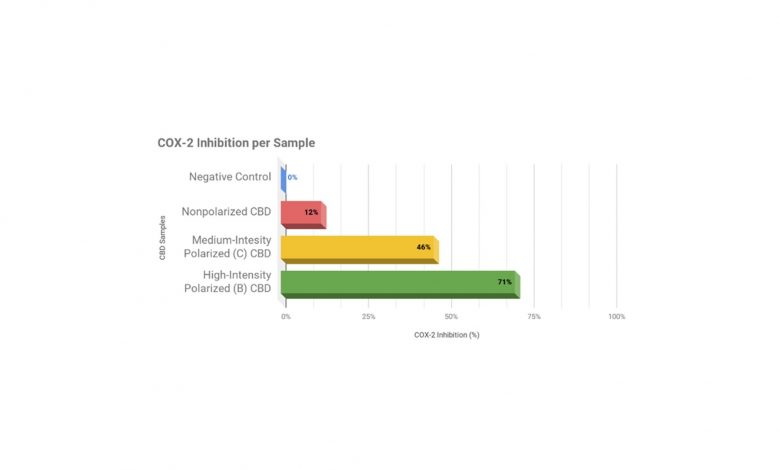

Medolife has conducted a similar study on its polarized CBD before, with positive results showing up to 591% increase in efficacy in polarized CBD samples compared to non-polarized samples. The company examined COX-2 inhibition in four test groups: a negative control group where no CBD or other molecules were present, a non-polarized CBD isolate that was tested at 99% purity levels, a medium-intensity polarized CBD, and a high-intensity polarized CBD. The results showed that 0% COX-2 inhibition occurred in the control group, 12% COX-2 inhibition occurred with introduction of non-polarized CBD, 46% COX-2 inhibition occurred with introduction of the medium-intensity polarized CBD, and 71% COX-2 inhibition occurred with introduction of the high-intensity polarized CBD. (Figure 1.1). The results suggest that not only is CBD effective in COX-2 inhibition, but more potent CBD, such as CBD that is polarized, is even more effective in inhibition of COX-2.

The study was reviewed and endorsed by a renowned physician specializing in cannabinoid research, Dr. Annabelle Morgan, who noted: “COX 2 Inhibition is a key attraction to anti-inflammatory mechanisms today. The understanding of the role that cannabinoids play on COX 2 Inhibition, specifically CBD and its variations, is controversial. The data presented here lends promise to the importance of the stabilization of the CBD molecule whether by delivery or in this case, polarization. Furthermore, the possibility that CBD may cause an upregulation of COX2 while polarized CBD inhibits COX2 with such significance is a striking result and absolutely worth solidifying.”

Medolife also conducted studies testing the efficacy of other polarized ingredients, such as Ibuprofen and the Company’s lead drug candidate Escozine®. The results, which the company will announce at a later time, only further suggest the success in which the polarization process increases the potency of active pharmaceutical ingredients (APIs).

“We know that polarized CBD, along with polarized Ibuprofen and Escozine®, are effective in inhibiting the COX-2 enzyme, as shown by the previous studies we have completed,” said Medolife CEO Dr. Arthur Mikaelian. “While we hope to further prove the hypothesis in future studies, the purpose of this study is to show the variance between COX-2 inhibition in standard CBD products that are currently on the market, which are non-polarized, when compared to our muscle rub product, which includes polarized CBD. We are beyond confident that the variance will be vast and that yet again we will prove we have one of the most effective products in the pain relief category available today.”

“We are honored to have oversight by such a talented PhD scientist and we are confident that their involvement will only further legitimize these results and lay the groundwork for further studies in the future,” added Dr. Mikaelian.

The study will take place at Pasadena Bio Collaborative Incubator. If successful, the Company plans to further investigate the effectiveness of its pain relief products that include polarized CBD for their anti-inflammatory properties, with the potential of seeking regulatory registration of the products as a topical pain relief, should the path be feasible.

About Medolife Rx

Medolife Rx, Inc. is a global biotechnology company with operations in clinical research, manufacturing, and consumer products. Medolife Rx was created through the merger of Medolife, a private company founded by Dr. Arthur Mikaelian who pioneered the unlaying polarization technology that makes the Company’s portfolio of pharmaceutical and nutraceutical products so effective, and Quanta, Inc., a direct-to-consumer wellness product portfolio company. The Company’s lead clinical development programs include Escozine®, a proprietary formulation consisting of small molecule peptides derived from Rhopalurus princeps scorpions which is amplified by the Company’s polarization technology and is being researched as a treatment of various indications, including COVID-19 and cancer. The Company has completed preclinical safety and efficacy research on Escozine® and is pursuing product registration and drug approval in various countries, including the United States and throughout Latin America.

Through its subsidiary QuantRx, Medolife manufactures and distributes consumer wellness and nutraceutical products in high-impact consumer areas such as pain relief, beauty, and general wellness. QuantRx products are designed using Dr. Mikaelian’s polarization technology which applies advances in quantum biology to increase the potency of active ingredients. Currently, QuantRx supports product formulations in pain management, anti-inflammation, skincare, agriculture, nutritional supplements, and plant-based consumables. Ultimately, Quanta’s mission is to deliver better, more effective ingredients to elevate product efficacy, reduce waste, and facilitate healthier, more sustainable consumption.

Beyond its own clinical and consumer applications, the polarization technology used by Medolife and its subsidiaries has many potential applications. From potentiating bio-ingredients, to producing more-effective carbon-trapping plants, to transformative anti-aging solutions, Medolife has the opportunity to upend how commercial and pharmaceutical products are made and increase their benefits, while decreasing their chemical concentration.

Forward-Looking Statements

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This release contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company’s filings with the Securities and Exchange Commission and statements in this release should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Contacts:

[ad_2]