Marker Therapeutics: Buy, Sell, Or Hold? – Marker Therapeutics Inc (NASDAQ:MRKR)

[ad_1]

It is less complicated to struggle for one’s rules than to reside as much as them.”

– Alfred Adler

It is tough to imagine the shut of 2018 is nearly upon us. It has been an eventful 12 months, to say the least. As we shut out a difficult fourth quarter for buyers, we finish our 12 months a small developmental firm.

Company Overview

Marker Therapeutics (MRKR) is a Houston, Texas-based scientific-stage immuno-oncology firm that was based in 1992 however didn’t come public till practically 20 years later. The firm focuses on growing subsequent-era T cell-based mostly immunotherapies for the remedy of hematological malignancies and strong tumor indications. Marker Therapeutics has an approximate market cap of simply over $200 million and trades for just below $5.00 a share. Shareholders haven’t been rewarded up till this level within the firm’s public existence.

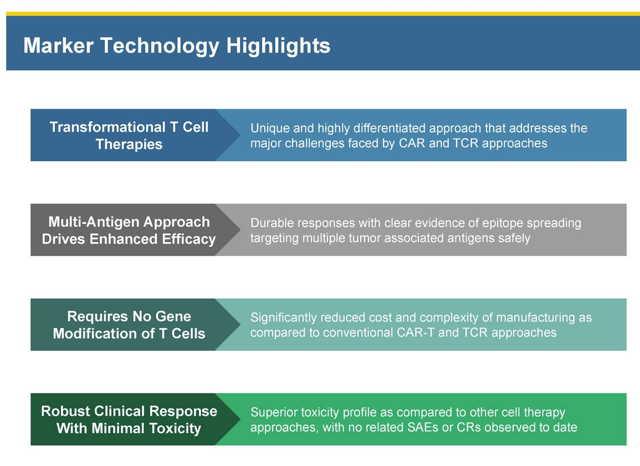

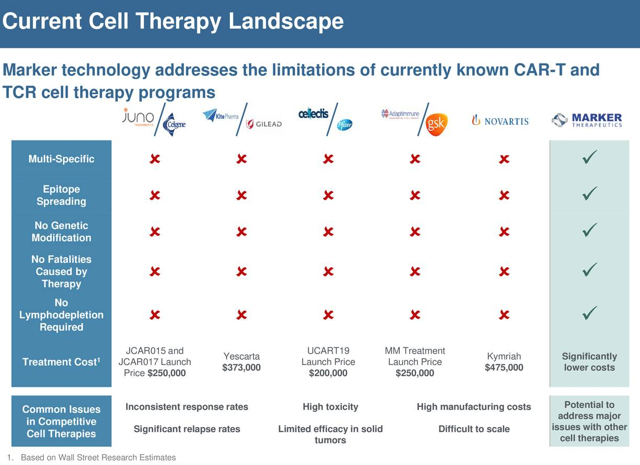

Technology and Pipeline

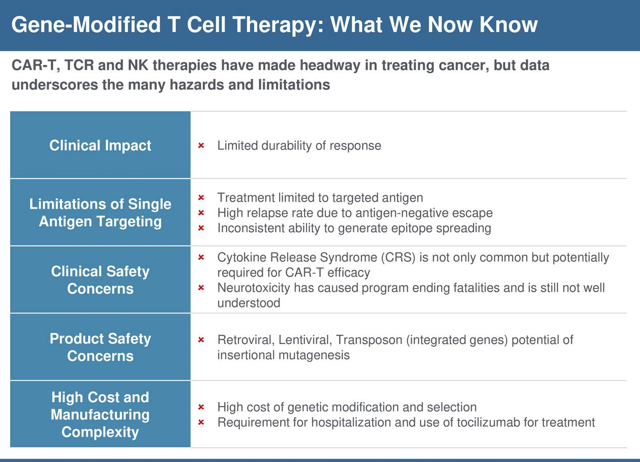

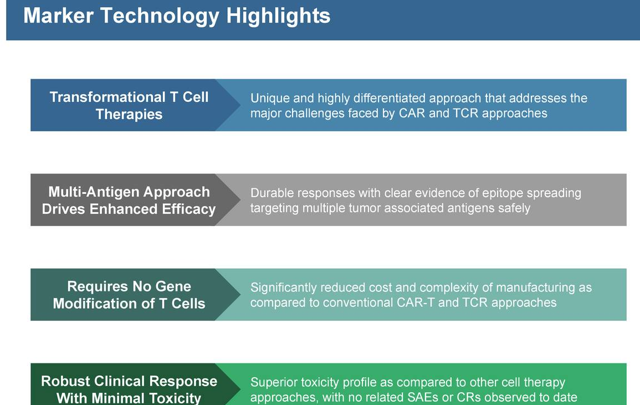

The firm’s cell remedy know-how is predicated on the selective enlargement of non-engineered, tumor-particular T cells that acknowledge tumor related antigens and kill tumor cells expressing these targets. Marker doesn’t genetically engineer its T cells, which, when in comparison with different engineered approaches, gives the next benefits: they’re considerably cheaper, simpler to fabricate, and appear to be considerably much less poisonous. The firm’s pipeline consists of multiTAA T cell remedy, TPIV200, and TPIV100/110.

In latest information, on October 17th, Marker introduced the profitable closing of its merger with TapImmune. Per the association, TapImmune modified its title to Marker Therapeutics and reincorporated from Nevada into Delaware. The merger combines Marker’s T cell therapies and data with TapImmune’s monetary help, public stature, administration, and scientific experience. Concurrent with the merger, the corporate accomplished its $70 million providing. Also, on October 10th, it was introduced that TapImmune, through the Mayo Clinic, has acquired an $11 million grant from the U.S. Department of Defense. The grant will cowl the prices of a giant Phase 2 research of TapImmune’s HER2/neu-focused breast most cancers vaccine, TPIV110, together with one other immunotherapeutic, trastuzumab, for treating ladies with HER2/neu-optimistic breast most cancers. Yet once more, the U.S. Department of Defense has chosen to help the corporate’s therapeutic platform.

Source: Company Presentation

Source: Company Presentation

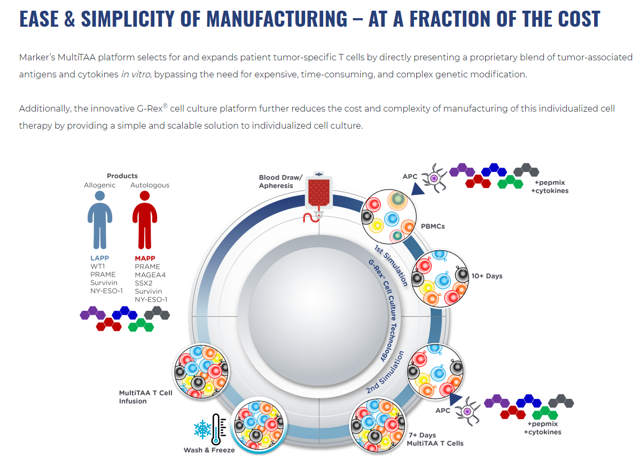

MultiTAA

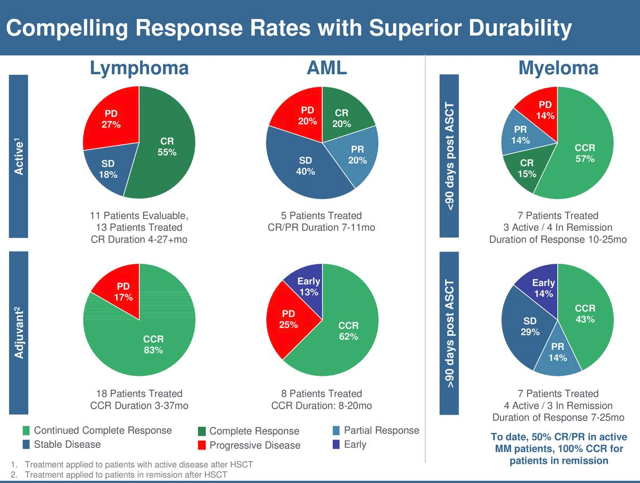

MultiTAA is a various mixture of helper (CD4) and cytotoxic (CD8) T cells that acknowledge the tumor-particular antigens that Marker targets. The firm’s distinctive manufacturing course of selectively expands a variety of naturally occurring, usually extraordinarily uncommon, tumor-particular T cells present in sufferers’ blood that may acknowledge distinctive epitopes of as much as 5 totally different tumor-related antigens. Early outcomes recommend that the remedy is efficient, sturdy, and expands and prompts a affected person’s T cells with out genetic modification or the necessity for lymphodepletion previous to infusion.

Source: Company Presentation

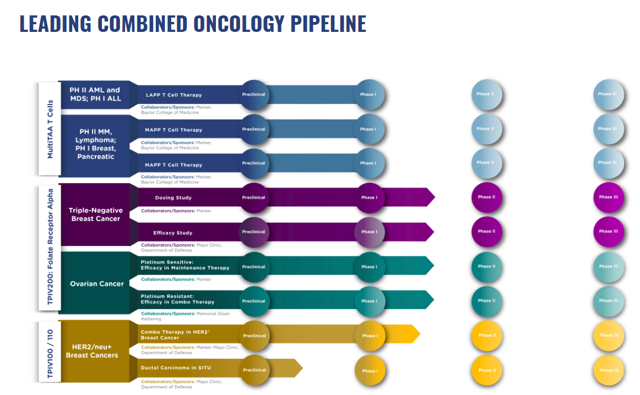

The remedy is at present being evaluated in 6 ongoing trials, that are all within the recruiting section. The trials are testing the therapeutic strategy in acute myeloid leukemia, myelodysplastic syndrome, Hodgkin or non-Hodgkin lymphomas, a number of myeloma, refractory breast most cancers, pancreatic most cancers and acute lymphoblastic leukemia after an allogeneic hematopoietic stem cell transplant. Marker is planning to provoke a number of Phase 2 scientific trials in relapsed/refractory acute myelogenous leukemia, non-Hodgkin’s lymphoma and a number of myeloma in 2019.

Source: Company Presentation

TPIV200

TPIV200 is a vaccine comprised of 5 peptide antigens, which set off an immune response. It is derived from folate receptor alpha, which is present in excessive ranges on tumor cells. The therapeutic is being examined in triple-damaging breast most cancers and ovarian most cancers. The drug has been granted orphan drug and quick monitor designation for remedy of ovarian most cancers. TPIV200 is at present being evaluated in 4 Phase 2 trials, two of that are recruiting and the opposite two are lively however not recruiting.

Source: Company Presentation

TPIV100/110

TPIV100/110 is a vaccine that include 4 peptide epitopes derived from the HER2 protein. To improve immunity, the peptides are admixed with the adjuvant GM-CSF. The Mayo Clinic is anticipated to provoke a Phase 1b/2a research of TPIV100 in ladies with an early type of breast most cancers referred to as ductal carcinoma in situ.

Source: Company Presentation

Analyst Commentary and Balance Sheet

Research and growth bills for the third quarter of 2018 had been $1.8 million, in comparison with $1.6 million for a similar interval final 12 months. General and administrative bills for the third quarter of 2018 had been $2.5 million, in comparison with $2.5 million for a similar interval final 12 months. Overall, the corporate misplaced $4.3 million within the quarter, which is roughly $400,000 greater than the identical interval in 2017.

Marker has little protection on Wall Street. One of the newest suggestions comes from Nomura on November 16th. The firm initiated protection with a Buy score and set a value goal of $16 a share. The analyst acknowledged that Marker is buying and selling at a reduction to its friends and a stream of de-risking knowledge ought to catapult shares increased. Also, he sees the multiTAA platform able to fast approval. On October 22nd, Piper Jaffray initiated protection with a Neutral score. The analyst seems intrigued by the corporate’s multiTAA platform: “it gives a number of key benefits over present autologous CAR-T together with improved manufacturing time and expense, and probably safer, extra sturdy response“. Piper Jaffray reiterated their Buy score and $10 value goal on MRKR on December third.

Verdict

Marker definitely has loads of “shots on goal”. However, its complete pipeline is early and mid-stage. In addition, the corporate has little visibility in the meanwhile. Adding in its disappointing report as far as a public concern, the one name is go on making any form of purchase advice whilst a “watch item” holding. Perhaps if the corporate advances a few of its pipeline to late-stage growth, we are going to revisit Marker sooner or later.

First they ignore you. Then they ridicule you. And then they assault you and need to burn you. And then they construct monuments to you.”

– Nicholas Klein

Bret Jensen is the Founder of and creator of articles on The Biotech Forum, The Busted IPO Forum, and The Insiders Forum.

Disclosure: I/we’ve no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]