McEwen Grabs Canadian Gold: Can Tartan Lake Fuel Its 2030 Gold Ambitions?

McEwen Mining (NYSE:MUX) is making moves—and this time, it’s swinging for a solid, base hit instead of a moonshot. The small-cap gold and silver producer just announced an all-stock deal to acquire Canadian Gold Corp. (OTCQB:STRRF), valuing each Canadian Gold share at C$0.60. The price is modest, but the strategic implications are anything but. The prize? The Tartan Lake mine in Manitoba—a high-grade, past-producing project with real infrastructure already in place. It’s the kind of brownfield asset that fits McEwen’s DNA: familiar geology, lower CapEx needs, and a fast path to potential production. Canadian Gold shareholders will own about 8% of the combined company, and McEwen inches closer to its 2030 target of producing 250,000–300,000 gold equivalent ounces a year. With gold prices still firm and capital still tight, this looks like a savvy, risk-conscious step forward. But as always in mining, the gold isn’t in the press release—it’s in the execution.

Resource Upside & Infrastructure Synergy With The Fox Complex

One reason this deal is catching attention? Tartan Lake looks a lot like McEwen’s Fox Complex, right down to the underground ramp access and modest plant blueprint. That familiarity could be a huge advantage. The Tartan site already has a ramp going 325 meters deep, a power line, tailings storage, and road access—all built before it shut down in 1989. For McEwen, which has extended life at its Froome Mine through drilling and breathed new life into legacy assets in Ontario, this is the kind of playbook it knows well. There’s even a trained workforce in nearby Flin Flon, eliminating the need for costly new infrastructure like housing camps. If McEwen applies the same rehab skills it used at its Stock property—where it turned waterlogged tunnels into profitable operations—Tartan could be producing gold within a few years, without the $100M+ CapEx headaches that plague many juniors. For a small-cap that prides itself on capital efficiency, that’s a big win.

Exploration Scale & Regional Consolidation In Manitoba

This isn’t just about one mine—it’s about staking a claim in one of Canada’s last underexplored gold belts. Canadian Gold controls over 29 kilometers of the Tartan Shear Zone, thanks to recent land grabs from Hudbay and Searchlight. That’s 30km of gold-bearing structure with very little modern exploration. Canadian Gold has already drilled 27,000 meters and hit some exciting results—like 53 meters at 4.3 g/t gold, with even richer zones over 12 g/t. McEwen has been down this road before: its $51 million drilling spree over the last 2.5 years has yielded real growth at Grey Fox. Applying that same resource-boosting playbook here could turn Tartan into something much bigger. Bonus: Manitoba wants this. The provincial government is actively backing mining as an economic engine, especially after Hudbay’s VMS mine shutdown hit Flin Flon hard. With a 500 tpd mining permit already in place, McEwen skips a huge part of the regulatory slog. If it can build out Tartan like it did Timmins, we might be looking at McEwen’s second regional production hub.

Accelerated Production Timeline & Permitting Advantages

One of the biggest things going for Tartan Lake? Speed. This isn’t a greenfield project where McEwen needs to spend years pushing permits through. The power is back on (post-forest fire), the roads are good, and a modern-standard ramp is already there. The mining permit is active, too—which means amendments, not applications, are the name of the game. That could save years. McEwen’s team says it could re-enter the mine for as little as $3 million, dewater it, and start moving toward production. Compare that to most junior projects, where budgets balloon before a single ounce is poured. This fits McEwen’s strategy to avoid megaprojects and instead chase bite-sized, high-return opportunities. Plus, with other projects like Windfall and Lookout Mountain still maturing, Tartan offers near-term production to balance the long-term bets. And if there’s one thing McEwen knows how to do, it’s navigate permitting—its track record at Fox and Grey Fox proves that. The company’s hope? Tartan is cash-flowing while the big stuff is still years away.

Strategic Portfolio Balance & Small-Cap Production Scalability

Let’s not forget the big picture: McEwen is a small-cap with a complicated portfolio. Its flagship copper play, Los Azules in Argentina, could be massive—but it’s also expensive, slow-moving, and politically fraught. Tartan, by contrast, is compact, capital-light, and in a jurisdiction with far fewer headaches. This gives McEwen a better balance between long-cycle upside and short-cycle cash flow. Financially, the company has $54 million in cash, $62 million in working capital, and $16 million in marketable securities. That’s enough to get Tartan moving without tapping debt or printing more shares—a real win for shareholders in a sector where dilution is often the default.

Final Thoughts

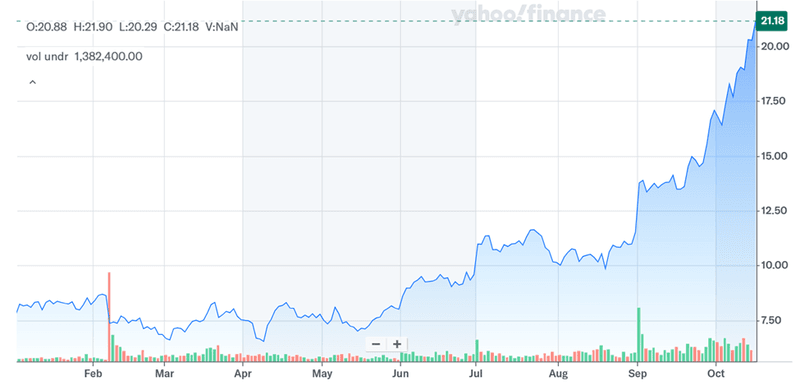

Source: Yahoo Finance

McEwen’s stock price has been on a terrific upward trajectory long before the company announced its proposed acquisition of Canadian Gold Corp. Financial experts would argue that McEwen’s valuation looks stretched: LTM EV/EBITDA is 43.69x, Price/Sales is 6.53x. Adding a new, near-term revenue source could help bring those multiples back down to earth. Tartan Lake offers near-term production, a fast-tracked permitting process, and real infrastructure—things most juniors can only dream of. And McEwen knows how to extract value from these types of assets. But the risks are real. Execution matters. Restarting a dormant mine isn’t plug-and-play, and even with a clear regulatory path, delays and cost overruns are always lurking. Meanwhile, the company’s other projects, especially Los Azules, will continue to soak up management attention and cash. Still, if McEwen can bring Tartan online without overreaching, it’ll prove it can scale production without diluting shareholders or chasing billion-dollar builds. For a small-cap miner in a volatile market, that might be the most valuable gold of all.