Mineralys Stock Exploded 86% On Astrazeneca News – What’s Going On?

Mineralys Therapeutics (NASDAQ:MLYS) witnessed an extraordinary 86.4% surge in its stock price on September 2, 2025, triggered not by its own clinical trial data, but by AstraZeneca’s unexpected Phase III hypertension drug results. AstraZeneca’s baxdrostat, an aldosterone synthase inhibitor (ASI), showed strong efficacy in reducing systolic blood pressure in patients with resistant hypertension, validating the therapeutic potential of the ASI drug class. Though ostensibly a competitor, AstraZeneca’s news acted as a catalyst for Mineralys, whose own ASI candidate, lorundrostat, is nearing FDA submission. Moreover, the sudden spike has drawn attention to comparative clinical data, strategic differentiation between the two assets, and ongoing partnership interest in lorundrostat. Let us try and delve deeper and understand the answer to the question that why a virtually unheard of small-cap like Mineralys is now in the spotlight.

ASI Class Validation Triggers Rerating Of Lorundrostat

The most significant factor behind the 86.4% rally in Mineralys shares was the strong clinical data released by AstraZeneca for baxdrostat, its aldosterone synthase inhibitor for resistant hypertension. AstraZeneca reported a placebo-adjusted reduction in systolic blood pressure of 9.8 mmHg for its 2 mg dose and 8.7 mmHg for its 1 mg dose over 12 weeks, results that exceeded expectations and set a new benchmark in the field. These outcomes validated the therapeutic approach of targeting dysregulated aldosterone production—a mechanism shared by Mineralys’ lorundrostat. Importantly, Mineralys’ own data from the Launch-HTN and Advance-HTN trials demonstrated a placebo-adjusted reduction of 11.7 mmHg over 12 weeks with lorundrostat, suggesting competitive, if not superior, efficacy. The rally was not a reaction to a head-to-head comparison, but rather a recognition that AstraZeneca’s success de-risked the entire ASI class. This positive read-across effect confirmed the role of aldosterone modulation in managing hypertension, especially among patients unresponsive to multiple existing therapies. Clinical feedback supported this narrative; Mineralys cited physician surveys showing 95% of cardiologists and primary care doctors would likely prescribe lorundrostat upon approval. Additionally, the robust response in Mineralys' Explore-CKD trial, with patients concurrently on SGLT2 inhibitors, further demonstrated the drug’s promise across hypertension comorbidities. Investors interpreted AstraZeneca's results as an endorsement of the mechanism of action, elevating expectations for lorundrostat's regulatory approval and commercial adoption. In effect, the strong data from baxdrostat converted a perceived competitive threat into a powerful class validation event that justified a significant revaluation of Mineralys' pipeline.

Competitive Differentiation Enhances Perceived Value Of Lorundrostat

While the success of AstraZeneca’s baxdrostat validated the aldosterone synthase inhibitor class, investors have also been parsing the nuanced differences between the two drugs, which work through the same mechanism but diverge on pharmacokinetics, absorption, and trial execution. A key differentiator is the half-life of the drugs. Baxdrostat has a long half-life of 25 to 30 hours, which AstraZeneca markets as beneficial for 24-hour blood pressure control. In contrast, lorundrostat has a 10–12-hour half-life, which Mineralys argues is closer to the diurnal rhythm of aldosterone production and supports morning dosing. Lorundrostat’s efficacy data—measured at trough levels before morning dosing—demonstrated sustained blood pressure reductions, reinforcing its 24-hour control claim. Furthermore, baxdrostat appears more selective in its drug interaction profile, notably not affected by proton pump inhibitors (PPIs). Lorundrostat, which requires an acidic environment for absorption, showed diminished efficacy in patients on chronic PPIs, though Mineralys mitigated this in its trials through scheduling recommendations. Despite these headwinds, clinical efficacy data for lorundrostat remained strong even among patients permitted periodic PPI use. From a safety standpoint, Mineralys reported hyperkalemia rates comparable to ACE inhibitors (0.6% incidence above 6 mmol/L), an outcome likely to be scrutinized further in AstraZeneca's upcoming data. Lorundrostat also demonstrated significant reductions in urinary albumin-to-creatinine ratio (UACR) in CKD patients, signaling renal protective effects potentially comparable to finerenone and offering another angle of differentiation. As AstraZeneca prepares to file for regulatory approval, the stage is set for competition within the ASI space. However, the view that there is ample room for two differentiated products in a market of over 20 million affected U.S. patients has gained currency among analysts and investors. This perceived differentiation, coupled with real-world positioning of lorundrostat as a third-line therapy, has been instrumental in the bullish repricing of Mineralys stock.

Massive Market Opportunity In Resistant Hypertension & Comorbidities

Beyond mechanism and differentiation, the sheer size and treatment dissatisfaction in the resistant hypertension market provide a substantial runway for lorundrostat’s commercial potential. According to Mineralys, nearly 9 million U.S. patients initiated third-line or later antihypertensive therapies in 2024, pointing to a vast population underserved by existing generics and combination therapies. Total U.S. prevalence of uncontrolled or resistant hypertension exceeds 20 million individuals, and the failure of multiple drug classes to control blood pressure in these patients has created a clear need for novel mechanisms. The company’s strategy to position lorundrostat as a third-line therapy, with emphasis on superior efficacy and renal protection, aligns with existing payer expectations and prescriber behavior. Surveyed payers reportedly do not anticipate requiring a step-through of spironolactone due to its limited (~2%) market share in hypertensive treatment, suggesting that access hurdles may be modest. Furthermore, the comorbid burden of hypertension—particularly with chronic kidney disease (CKD) and obstructive sleep apnea (OSA)—opens additional therapeutic pathways. Mineralys’ Explore-CKD trial showed meaningful blood pressure and UACR reductions in patients on stable SGLT2 inhibitors, while the ongoing Explore-OSA trial is evaluating nighttime dosing to target nocturnal aldosterone surges, a suspected contributor to OSA pathophysiology. With potential label expansions on the horizon, the company’s broader vision is not limited to hypertension but extends to a cardiorenal risk management paradigm. Combined with the drug’s oral dosing, morning administration, and straightforward titration, the commercial opportunity extends beyond cardiologists to primary care physicians—a segment that accounts for a substantial share of third-line hypertension prescribing. This multi-indication appeal and a large, addressable patient pool were fundamental to investor recalibration and help explain why AstraZeneca’s successful results—far from discouraging confidence—acted as a market signal pointing to the underappreciated commercial value of lorundrostat.

Strategic Interest & Readiness Bolster Investor Confidence

In parallel with clinical development, Mineralys has been making significant strides in pre-commercial readiness, which further fueled investor enthusiasm following the AstraZeneca catalyst. The company now has four completed trials—Launch-HTN, Advance-HTN, Explore-CKD, and an open-label extension—comprising a comprehensive data package across multiple patient populations. Mineralys has confirmed that it has scheduled a pre-NDA meeting with the FDA for Q4 2025, with the intent to file for regulatory approval thereafter. Its cash position of $324.9 million as of June 30, 2025, is sufficient to fund operations through 2027, providing runway for regulatory and early commercialization efforts. Simultaneously, Mineralys has signaled openness to strategic partnerships, particularly for ex-U.S. territories. Management noted active dialogues and highlighted that they’re open to U.S. partnerships if it helps maximize reach and value. Market research supports a sales strategy that targets 47,000 to 50,000 physicians concentrated in third-line prescribing, mostly primary care and cardiology, which could be effectively covered by a mid-sized commercial footprint or co-commercialization model. The company has expanded its medical communications team to build awareness and disseminate clinical data, while ongoing interactions with payers have informed a value-based access strategy. Unlike first-line hypertension therapies, which face generic pricing pressures and steep access barriers, lorundrostat is expected to bypass spironolactone and only require step-through of two generics—a process streamlined through electronic systems. These operational updates, coupled with a favorable prescriber outlook—95% of surveyed physicians indicated high intent to prescribe—have contributed to heightened strategic visibility. As investors reassessed the company’s standalone and partnered value in light of AstraZeneca’s success, the rerating was as much about readiness as it was about validation.

Final Thoughts

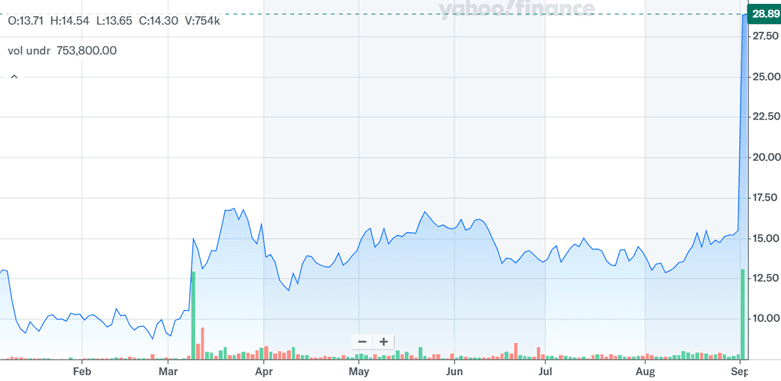

Source: Yahoo Finance

In the above chart, we can clearly see Mineralys’ stock price nearly doubling in response to AstraZeneca’s hypertension trial results. The current situation is a complex interplay of class validation, competitive benchmarking, large unmet medical need, and strategic momentum. Although some limitations remain—such as lorundrostat’s sensitivity to PPIs and shorter half-life—investors have weighed these against its efficacy, differentiated safety profile, and practical dosing. Importantly, despite recent stock performance, Mineralys continues to trade at deeply negative LTM valuation multiples with a Total Enterprise Value/EBIT of (7.82x) and Price-to-Earnings of (8.26x) as of September 2, 2025, suggesting that expectations remain grounded in future execution. As the ASI space matures, investor focus will likely shift toward regulatory outcomes, commercial partnerships, and real-world data—factors that will ultimately determine if the market’s rerating of lorundrostat is sustainable.