Nektar Therapeutics Gains New Life On Buyout Rumors & Atopic Dermatitis Breakthrough

Nektar Therapeutics (NASDAQ:NKTR) has returned to the biotech spotlight with a sharp 8% stock surge following social media speculation and reporting from StreetInsider suggesting Eli Lilly (NYSE:LLY) may be exploring a potential acquisition. While unconfirmed, this development comes as the small-cap immunology player posts a dramatic year-to-date rally of 294%, lifting its market capitalization above $1 billion. Beyond the buyout buzz, the company recently delivered positive Phase IIb data for its lead candidate rezpegaldesleukin (REZPEG) in atopic dermatitis, earning Fast Track designation from the FDA. The asset is advancing toward a Phase III launch in 2026, with additional data from an alopecia areata trial due in December. With a cash runway projected through early 2027, no debt, and multiple clinical readouts ahead, Nektar finds itself in a pivotal phase. However, ongoing litigation against Eli Lilly, steep valuation multiples, and lingering clinical risks warrant a deeper analysis of what’s driving renewed investor interest—and where uncertainty persists.

REZPEG’s Treg Modulation & Fast Track Status Drive Pipeline Re-Rating

Nektar’s lead asset, rezpegaldesleukin, is reshaping the small-cap biotech’s clinical trajectory after Phase IIb results in atopic dermatitis met all endpoints. The 393-patient REZOLVE-AD trial demonstrated a statistically significant dose response for key efficacy metrics including EASI-50, EASI-75, and EASI-90 at Week 16. Additionally, the asset showed a favorable safety profile with no increased rates of conjunctivitis or oral ulcers, issues seen with IL-13 inhibitors. The FDA granted Fast Track designation for both atopic dermatitis and alopecia areata, signaling regulatory confidence in the differentiated mechanism of action that centers on T regulatory (Treg) cell expansion rather than immune suppression. REZPEG’s clean tolerability profile, with minimal injection site reactions, supports its use in both biologic-naive and experienced patients—a key commercial advantage. Nektar is initiating Phase III-enabling studies and anticipates beginning pivotal trials by early 2026. The compound also holds promise in alopecia, with a data readout expected in December 2025. Beyond these lead indications, REZPEG has the potential for expansion into other autoimmune diseases such as Type 1 diabetes, where NIH-sponsored TrialNet is planning a trial. The Treg pathway differentiates REZPEG from IL-4/IL-13 and JAK inhibitors, offering a mechanism that promotes immune homeostasis rather than blunt suppression. As such, the molecule has drawn attention not only for its efficacy but also for long-term safety and chronic use potential. The progress made in dosing optimization, patient response modeling, and manufacturing scale-up further de-risk development and provide the company with optionality—whether to advance independently or through partnership.

Strong Cash Position & Low Leverage Improve Strategic Flexibility

Nektar’s improved financial profile strengthens its position in a sector where small-cap biotechs often struggle with dilution risk and financing headwinds. As of Q2 2025, the company held $175.9 million in cash and investments, and management expects this figure to reach up to $185 million by year-end. There is no outstanding debt, and recent equity financing brought in $115 million in gross proceeds through an oversubscribed offering. With this capital, Nektar has extended its operational runway into early 2027—providing coverage for Phase III activities and ongoing work on next-generation preclinical candidates such as NKTR-0165 and NKTR-0166, both TNFR2 agonists. R&D expenses for the year are guided at $125–$130 million, and SG&A between $70–$75 million, showing discipline even as clinical programs advance. The company is also exploring monetization of non-core assets, including a 3%–4% royalty interest in UCB’s dapimab for lupus, which could deliver non-dilutive capital. These elements provide operational flexibility and strengthen the case for collaboration discussions that are already underway. Unlike many early-stage peers, Nektar can proceed with its late-stage programs without immediate reliance on further dilution or debt issuance. Moreover, the company is building out a clinical and CMC infrastructure to support REZPEG’s advancement through pivotal trials, and management has signaled readiness for commercial partnering if strategic interest materializes. This financial cushion, paired with an active partnership process, gives Nektar multiple levers to create value as it moves toward a Phase III-ready position.

Competitive Pressures & Market Saturation Risk In Dermatology

While Nektar’s lead candidate shows potential, the atopic dermatitis market remains highly competitive and clinically demanding. Established players like Sanofi’s Dupixent, LEO Pharma’s Adbry, and Lilly’s lebrikizumab dominate the landscape with robust efficacy, deep market penetration, and years of physician familiarity. REZPEG’s Treg-based approach is novel, but it must demonstrate durable outcomes across longer pivotal trials to justify differentiation. The upcoming Phase III study will need to maintain the clinical profile seen in Phase IIb—especially given that biologic-experienced cohorts are inherently harder to treat. Competitive dynamics also pose risk in alopecia areata, where Pfizer’s Litfulo and Lilly’s Olumiant have already achieved FDA approval. Any delay in data readouts, issues with patient recruitment, or weaker-than-expected efficacy in the December 2025 alopecia results could significantly undercut sentiment. Furthermore, while REZPEG avoids certain IL-13-related side effects, it still involves subcutaneous injection—limiting differentiation from newer oral therapies entering adjacent autoimmune categories. In addition, the introduction of new biologics targeting OX40, IL-31, and JAK pathways adds pressure to establish REZPEG’s value in a crowded pipeline landscape. Without head-to-head trials or biomarker-based stratification, physicians may be slow to switch patients from incumbent therapies. For a small-cap biotech with limited commercial infrastructure, achieving meaningful market penetration without a strategic partner will require not only clinical success but also clear cost-effectiveness and reimbursement outcomes. These headwinds add complexity to the company’s pathway, even if efficacy remains on track.

Valuation Expansion & Litigation Overhang Present Risk Factors

Recent price momentum and takeover speculation have significantly expanded Nektar’s valuation multiples, raising questions about sustainability. As of October 20, 2025, the company trades at 16.0x LTM EV/Revenue and 15.99x LTM P/S—levels that are steep by small-cap biotech standards, especially for a pre-commercial company with negative cash flows. Its LTM EV/EBITDA sits at -8.75x and LTM EV/EBIT at -8.62x, reflecting continued losses and operational deficits. The stock’s sharp rally—up nearly 300% YTD—has priced in much of the optimism around REZPEG and potential acquisition scenarios. However, with no confirmed buyer and litigation against Eli Lilly ongoing, investors face binary risks tied to both clinical and legal outcomes. Management asserts that Lilly’s actions undermined the development of REZPEG under a prior collaboration, and while the lawsuit seeks damages, legal proceedings may be protracted and uncertain. This distraction could affect management bandwidth and investor sentiment if headlines resurface around legal developments. Moreover, any failure to deliver the December alopecia data or if REZPEG’s Phase III study encounters delays, could trigger multiple compression. The forward EV/Revenue multiple of 27.80x and P/S of 27.78x suggest that even modest disappointments may prompt sharp revaluations. While the stock remains liquid and supported by recent institutional interest, these valuation metrics indicate that expectations are high and any deviation from the bull case may have amplified downside consequences. For a small-cap biotech without commercial revenue, the market premium reflects optimism more than fundamental earnings visibility.

Final Thoughts

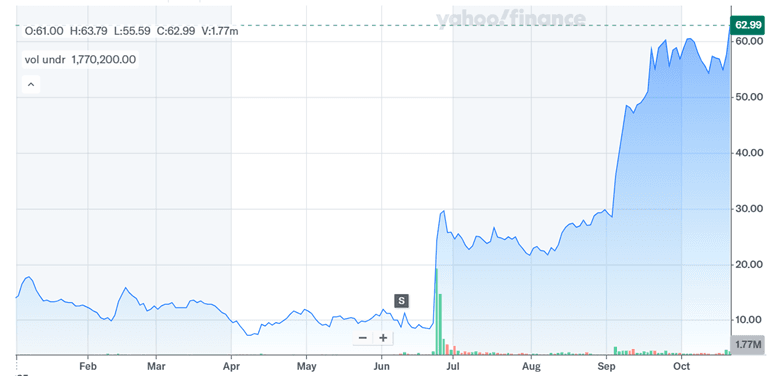

Source: Yahoo Finance

Nektar Therapeutics’ stock has been on a dream run ever since July 2025 given its promising clinical progress in atopic dermatitis and alopecia areata balanced against execution and market risks. The REZPEG program has received Fast Track designation and demonstrated encouraging Phase IIb data, supported by a healthy cash position and no debt. Ongoing partnership discussions, preclinical pipeline development, and strategic optionality add further upside dimensions. However, any missteps in Phase III trials or legal uncertainties with Eli Lilly could significantly affect future prospects. As of October 2025, Nektar’s LTM valuation metrics—including a 16.0x EV/Revenue and 15.99x P/S—reflect considerable market optimism. These elevated multiples underscore both the opportunity and fragility of the current investment thesis. While speculation of a buyout by Eli Lilly has lifted sentiment, Nektar’s trajectory will ultimately depend on its ability to translate scientific innovation into commercial outcomes.