Pinnacle’s $8.6 Billion Power Play: Will The Synovus Buyout Reshape The Regional Banking Landscape?

In a bold move shaking up the U.S. regional banking sector, Pinnacle Financial Partners (NASDAQ:PNFP) has agreed to acquire Synovus Financial Corp. (NYSE:SNV) in an all-stock transaction valued at $8.6 billion. The merger, which will form a new entity under the Pinnacle Financial Partners and Pinnacle Bank brand, is expected to close in the first quarter of 2026, pending regulatory and shareholder approvals. The deal follows recent reports that Synovus had been exploring strategic options after receiving acquisition interest. Under the agreement, Synovus shareholders will own approximately 48.5% and Pinnacle shareholders 51.5% of the combined entity. Synovus CEO Kevin Blair will serve as CEO of the merged company, while Pinnacle CEO Terry Turner will become Chairman. Market reaction was immediate: Synovus stock dropped 9.2% after hours and Pinnacle fell 5%. All of this points towards 2 big questions – what made Pinnacle go for such a large acquisition of Synovus? And what was the reason for the market’s negative reaction?

Expanded Southeastern Footprint In High-Growth Markets

The acquisition of Synovus significantly broadens Pinnacle’s geographic reach into some of the fastest-growing banking markets in the Southeastern United States. Synovus operates across Georgia, Florida, South Carolina, Alabama, and Tennessee—regions experiencing consistent economic growth, business expansion, and inbound migration. Pinnacle’s own strongholds in Tennessee and adjacent states will now be complemented by Synovus’ deep local presence in Florida and Georgia, especially in metro hubs like Atlanta, Jacksonville, and Miami. This geographic overlay enables cross-market client synergies, especially in middle-market and business banking, where Synovus has built a loyal customer base. Moreover, this footprint expansion allows Pinnacle to increase deposit share in core Southeastern MSAs while simultaneously leveraging Synovus’ established commercial and specialty banking networks. This move is expected to enhance Pinnacle’s competitive positioning against other regional and super-regional banks that have been consolidating in the same space. It will also enable better scaling of digital products and advisory services across a wider footprint. While integration costs may be significant, the long-term strategic access to high-growth metro markets provides a compelling rationale for the deal.

Strengthening Operating Leverage & Revenue Diversification

Synovus enters the deal with improving financial performance and strong operational metrics, which could enhance Pinnacle’s earnings quality. In Q2 2025, Synovus reported adjusted EPS of $1.48, up 28% year-over-year, and expanded its net interest margin to 3.37%. It also delivered 60% year-over-year growth in loan production, while maintaining tight control over noninterest expenses, which rose just 1% sequentially. Synovus’ operating leverage—achieved through controlled headcount growth, technology investments, and repricing initiatives in treasury services—can support Pinnacle’s goal of driving sustainable profitability. Moreover, Synovus’ noninterest revenue, particularly from wealth management, capital markets, and treasury solutions, provides important diversification for Pinnacle’s earnings stream. The merged entity could also streamline duplicated functions across back-office operations, compliance, and IT systems, further improving efficiency. With the deal expected to be 21% accretive to Pinnacle’s operating EPS by 2027, integration success could materially improve Pinnacle’s valuation metrics, which have already rebounded from a P/E multiple of 21.81x in Dec 2024 to 13.87x in July 2025. While merger execution will be crucial, the complementary cost and revenue structures offer a path toward superior return on assets and equity in the medium term.

Enhanced Commercial Talent Pool & Relationship Banking Strategy

Pinnacle will gain immediate access to Synovus’ robust team of commercial bankers and relationship managers, which it has aggressively expanded under its 2025 strategic plan. Synovus hired 12 commercial bankers in H1 2025, with a plan to reach 25 hires by year-end, and targets 30–40 additional hires in 2026 and 2027. These new recruits span high-opportunity markets like Florida and the Carolinas and support business banking, middle-market lending, and private wealth strategies. With Pinnacle also pursuing growth via relationship-based banking, the expanded talent pool will reinforce its client-facing capabilities in key verticals. Furthermore, Synovus’ internal engagement metrics—such as an 89% employee engagement score—suggest a strong cultural alignment that could facilitate smoother integration and higher talent retention. The acquisition also brings in specialists in treasury, foreign exchange, receivables, and liquidity management, as well as tech-savvy bankers accustomed to platforms like nCino. This creates a highly synergistic environment for scaling relationship-driven banking services. While aligning incentive structures and retaining top performers post-merger will be critical, the combined institution is well positioned to deepen client relationships across the Southeast and increase cross-sell potential in commercial and wealth advisory segments.

Leveraging Technology Infrastructure & Fee-Based Growth Potential

One of the more strategic benefits of acquiring Synovus is inheriting its modernized digital infrastructure, which includes recent investments in loan origination (nCino), syndication platforms, ERP-integrated treasury portals, and multi-rail payment processing systems. These capabilities align well with Pinnacle’s goal of offering scalable, tech-forward banking solutions to mid-market and business clients. Synovus has also built a growing ecosystem around treasury and payment services, capital markets, and third-party payments—all of which contributed to 12% sequential growth in noninterest revenue in Q2 2025. Importantly, Synovus has begun pricing treasury products more effectively, boosting core banking fee growth by 9% year-over-year. For Pinnacle, this offers an immediate opportunity to absorb a more mature fee-based income engine without significant upfront investment. Additionally, tech integration enables the merged bank to offer better customer onboarding, self-service tools, and cash management services—all critical to attracting and retaining business clients. Though merger-related tech rationalization may require short-term capex and training, the long-term uplift in client satisfaction and noninterest income can help insulate the combined entity from future margin compression tied to rate volatility.

Final Thoughts

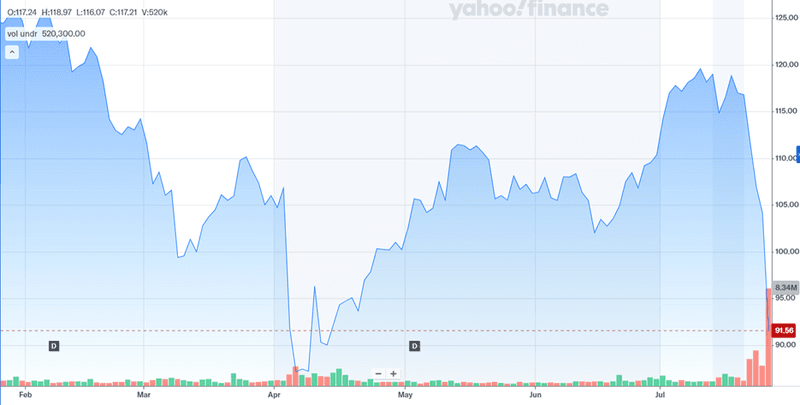

Source: Yahoo Finance

We can see the sharp, negative market reaction given the dilution impact during the acquisition of Synovus by Pinnacle. Apart from the dilution, we also need to understand the fact that the transaction introduces immense complexity. Cultural alignment, technology integration, and deposit retention in a volatile interest rate environment remain execution risks. From a valuation standpoint, it is important to understand that as of July 24, 2025, Pinnacle trades at a NTM P/E of 12.64x and an LTM P/E of 13.87x, a notable contraction from its peak LTM P/E of 21.81x in December 2024. While this deal could support multiple expansion over time if synergies are realized and earnings remain strong, investor sentiment remains cautious. The merger represents a high-stakes bet by Pinnacle to scale into a dominant Southeastern regional banking platform. Whether this becomes a blueprint for value creation or a cautionary tale will depend on execution in the coming quarters.