PublicSquare’s Big Fintech Bet: Why Buying Tandym Could Supercharge Its Strategy!

PublicSquare (NYSE:PSQH) just made headlines again. This time, it's not about politics—but payments. On November 10, 2025, the small-cap fintech firm announced its intent to acquire key software assets from Tandym, Inc. in a stock-and-cash deal valued at up to $6.75 million. The assets include turnkey tools for launching private-label credit and debit programs—technologies that align tightly with PSQ Holdings’ recently declared strategy to double down on its fintech business. This acquisition comes at a pivotal moment for the company, as it works through the monetization of its legacy Marketplace and Brands segments while reporting strong Q3 growth, particularly in payments (up 50% QoQ) and credit (up 22% QoQ). PublicSquare’s fintech revenues have reached $4.4 million for the third quarter alone, with the company affirming $32 million+ in revenue guidance for 2026. So, what could the Tandym deal mean for this evolving business? Let us dig into the four main synergies this acquisition could unlock for PSQ Holdings.

Fintech Platform Expansion & Embedded Revenue Opportunities

One of the clearest benefits of the Tandym acquisition is the immediate expansion of PublicSquare’s fintech platform. Tandym brings white-labeled credit and debit card infrastructure, allowing merchants to offer co-branded cards under their own names. This is a natural extension to PSQ’s growing “bundled checkout” model, which already combines payments, credit, and marketing into one experience. These new capabilities could introduce fresh, embedded revenue streams through interchange fees, interest income, and merchant processing fees, all while enhancing the value proposition to PSQ’s merchant clients. This is particularly relevant given PSQ’s emphasis on attracting values-aligned businesses in politically charged sectors like firearms, faith-based retail, and independent e-commerce. By offering a merchant-branded credit card, PSQ can help its clients build stronger customer loyalty while participating in recurring transaction economics. With early fintech revenues totaling $10.9 million year-to-date and projected to rise in Q4 from expected Christmas retail demand, the addition of Tandym’s tools could improve both merchant acquisition and retention. Furthermore, because the company has already been investing in AI-driven underwriting (used in its Credova credit product), Tandym’s platform could help refine credit strategies and further improve first-payment default metrics. Importantly, this would not require substantial new infrastructure development, making it a relatively capital-efficient way for a small-cap firm like PSQ to move up the fintech value chain. It’s a plug-and-play asset that fits neatly into its existing product roadmap.

Enhanced Merchant Stickiness Through Private Label Offerings

Bundling is central to PSQ’s strategy, and Tandym could strengthen that bundle by making PSQ an even stickier partner for merchants. Currently, PublicSquare is already bundling payment processing, credit financing, and brand marketing tools under one roof. According to the Q3 call, most enterprise customers are using multiple elements of this suite, and that’s significantly improving merchant retention. With Tandym’s tech, merchants could now issue their own branded credit cards and payment options, which makes switching away from PSQ much harder. If a merchant embeds PSQ across payments, credit, and now private-label financial services, the integration cost of changing platforms rises dramatically. This is especially crucial for the small-to-medium merchant segment PSQ serves, where operational simplicity is key. From the merchant’s point of view, having one vendor manage their entire transaction layer—including POS checkout, credit issuance, and backend processing—reduces overhead and simplifies support. From PSQ’s point of view, this creates a deeper commercial relationship that’s harder for competitors to unseat. Additionally, merchant-branded cards often come with loyalty rewards and marketing tie-ins, creating yet another incentive to maintain the relationship. This strategy also reinforces PSQ’s goal of being a parallel economic ecosystem centered around values-aligned commerce, where the tech stack reflects the brand identity of the merchant. For a company that wants to grow without chasing every customer, depth can matter more than breadth. Tandym enables that depth.

Long-Term Gross Margin Optimization Via Revenue Mix Shift

While PSQ’s Q3 gross margin dropped to 68% (from 97% YoY), the mix shift toward lower-margin but high-volume payment processing was the key reason. However, with Tandym’s integration, there’s a chance to stabilize and eventually grow gross margins by layering in higher-margin credit revenues and value-added services. Branded credit and debit programs typically command better margins than pure payment processing because of the interest income and interchange share they generate—especially if PSQ retains the receivables or earns fees from managing them. Moreover, these programs often carry minimal incremental cost once established, particularly if PSQ can leverage its existing infrastructure and AI underwriting tools. As the Q3 transcript highlighted, the company has already improved early payment behavior on its credit portfolio, which bodes well for margin expansion as credit scales. Also, PSQ’s decision to retain $3.4 million in receivables on the balance sheet shows a move toward more yield-focused, profitable fintech lending—another margin booster. The potential addition of crypto treasury and digital fundraising services in 2026 may further diversify revenue while supporting stronger blended gross profit metrics. In a small-cap environment where every dollar of cost efficiency matters, shifting toward high-margin, scalable services like those enabled by Tandym could ease pressure on PSQ’s path to profitability, especially given its current GAAP operating loss of $9.7 million in Q3 and $24.2 million year-to-date.

Strengthening TAM Diversification Beyond Legacy Verticals

While PSQ began with a merchant base focused on niche verticals like firearms, its recent onboarding momentum points to much broader appeal. As stated on the Q3 earnings call, PublicSquare’s pipeline now includes e-commerce, nonprofits, and even B2B SaaS providers. The addition of Tandym’s technology could accelerate this TAM diversification by making PSQ’s platform more attractive to mainstream mid-market merchants who already value private-label card capabilities. Whether it’s a wellness brand looking to offer cashback on direct-to-consumer purchases or a nonprofit that wants donation-linked credit tools, Tandym opens doors to non-political verticals with scalable unit economics. This also hedges PSQ’s political concentration risk and appeals to institutional investors wary of a values-driven brand being overly reliant on controversial sectors. Additionally, PSQ’s integration of crypto treasury services through IDX could dovetail with Tandym’s capabilities in digital payments and assets, offering a broader suite of modern financial tools. With more use cases across diverse industries, PSQ can expand beyond ideological alignment as its primary sales pitch, transitioning toward a full-stack fintech platform capable of serving any brand that wants control, customization, and efficiency. For a small-cap name trading at a relatively modest LTM EV/Revenue multiple of 3.91x and LTM P/S of 3.07x, breaking into new merchant categories is one of the few levers it can pull to rerate meaningfully.

Final Thoughts

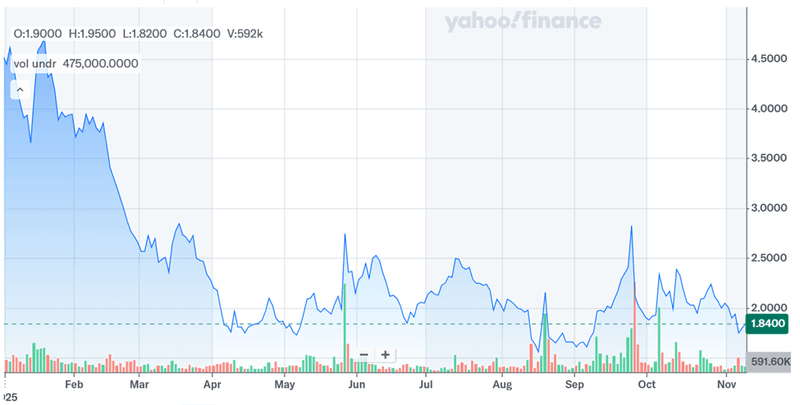

Source: Yahoo Finance

PublicSquare’s stock performance has been rather deplorable and the big hope is that the acquisition of Tandym’s software assets could represent a strategic leap in its transformation from an ideological marketplace to a full-stack fintech platform. The synergies are clear: deeper merchant integration, higher-margin revenue opportunities, and access to new markets that go beyond its roots. However, risks remain. PSQ is still loss-making, with LTM EV/EBITDA multiples deeply negative (-2.57x), and its small-cap status limits capital flexibility. Gross margin pressures and competition from larger fintech players could also erode some of the gains from the Tandym integration. On the other hand, at current LTM valuation levels—3.91x EV/Revenue and 3.07x P/S—the market seems to be pricing in execution risk and discounting optionality. The Tandym acquisition could become a turning point or a costly distraction but this will depend on how efficiently PSQ can integrate the new tools while preserving its cost discipline and growth runway. For now, the deal looks like a calculated risk in the pursuit of fintech scale.