Railroad Wars: How FTAI’s $1.05 Billion Move To Acquire W&LE Ups the Ante In Freight M&A!

The railroad freight industry is buzzing with acquisitions. After the big news about Union Pacific’s (NYSE:UNP) interest in acquiring Norfolk Southern (NYSE:NSC) and CSX (NYSE:CSX) exploring a sale, we now see FTAI Infrastructure (NASDAQ:FIP) making a bold move to expand its freight railroad footprint with a definitive agreement to acquire The Wheeling Corporation, the parent of Wheeling & Lake Erie Railway Company (W&LE), for $1.05 billion in cash from a Larry Parsons-controlled entity. The deal, announced on August 6, 2025, adds over 1,000 miles of track spread across Ohio, Pennsylvania, West Virginia, and Maryland to FTAI’s growing logistics empire. W&LE, a Class II regional freight railroad, currently serves more than 250 customers and has interchanges with Transtar’s Union Railroad, a key FTAI asset near Pittsburgh. But this brings us back to the bigger question about what exactly is driving this spree of acquisitions in this industry and why exactly did FTAI Infra have to execute this deal now? Let us dig deeper and find out!

Strategic Network Integration With Transtar

One of the most immediate synergies from the acquisition of W&LE is the seamless network integration with FTAI’s existing rail assets under Transtar. W&LE’s track runs through a geography that directly complements Transtar’s Union Railroad, with interchange capabilities near Pittsburgh. This means FTAI could unlock more efficient rail corridors for bulk commodities like steel, chemicals, and energy products. The integration offers not just geographic continuity, but the ability to improve end-to-end logistics by optimizing scheduling, reducing delays at interchange points, and boosting network reliability. With FTAI already positioning Transtar as a platform for consolidating rail assets, adding W&LE strengthens that thesis by expanding reach in the Midwest and Mid-Atlantic—regions rich in industrial activity. The acquisition also potentially gives FTAI pricing leverage in a fragmented Class II railroad market. Transtar has already been EBITDA-positive with $19.9 million reported in Q1 2025, and with W&LE’s similar freight profile, FTAI may be able to cross-utilize locomotive fleets, share maintenance facilities, and implement standardized tech platforms to reduce costs. Over time, unified dispatch, warehousing, and third-party freight handling under a single operator could support stronger operating margins and create a scalable hub-and-spoke model. The fact that W&LE already serves 250+ customers could also provide an instant cross-sell opportunity for FTAI’s other segments, such as Jefferson’s fuel logistics or Repauno’s transloading business.

Boosting Stable EBITDA Through Contracted Freight Volumes

FTAI’s acquisition of W&LE brings with it a large base of contracted freight customers, which aligns with the company’s long-term strategy of locking in recurring EBITDA. With 250+ customers spread across industrial heartlands, W&LE adds stable volumes in sectors like manufacturing, agriculture, and petrochemicals—areas that have proven to be relatively resilient even in cyclical downturns. These contracted volumes could help smooth out revenue volatility across FTAI’s asset base, especially as it invests in longer-term developments such as Repauno’s Phase 2 and Long Ridge’s data center buildout. In Q1 2025, FTAI recorded $35.2 million in adjusted EBITDA, and it claims to have visibility into $330 million in annual EBITDA through executed agreements, with a broader target of $400 million. Adding W&LE’s EBITDA contribution on day one enhances this picture, even before considering post-integration efficiency gains. Importantly, because W&LE operates in states with strong industrial logistics needs, the revenue base is not overly reliant on any one customer. That diversification could prove important in protecting downside risk. And for investors, predictable EBITDA streams could help support the dividend—which stood at $0.03 per share last quarter—and provide cushion for FTAI’s growing debt obligations. Given that the preferred stock backing this deal is being issued at the holding company level, FTAI will likely prioritize stable cash flow to maintain investor confidence and fulfill fixed charges. This acquisition may therefore offer a direct contribution to FTAI’s target of sustainable, contracted infrastructure income.

Enhancing Capital Efficiency Through Platform Scale

The acquisition of The Wheeling Corporation is not just a network or revenue play—it’s also about capital efficiency. FTAI’s model is increasingly built around asset clustering and platform scaling. With Transtar, Long Ridge, Jefferson, and Repauno now contributing varying degrees of EBITDA, adding W&LE enables FTAI to absorb fixed costs across a broader operational footprint. More miles of track under one corporate umbrella reduce per-unit costs on legal, compliance, back-office, and IT systems. Even procurement for locomotives, maintenance parts, and fuel could benefit from economies of scale. And importantly, capital expenditure for future upgrades may be more efficiently allocated through centralized planning. W&LE itself likely has maintenance and upgrade needs for its 1,000+ miles of track and rolling stock, but being absorbed into a larger operator like FTAI means those upgrades could be phased with greater cost discipline and engineering oversight. This is especially relevant given FTAI’s debt picture. The company had $2.8 billion in debt as of March 31, 2025, with most of it sitting at the asset level, and is planning to refinance its corporate bonds and preferreds post-Repauno’s $300M tax-exempt issuance. For a company with an LTM TEV/EBITDA multiple of over 43x and trailing P/S of 2.38x, capital efficiency becomes even more critical. The lower FTAI can drive its fixed cost base through strategic scaling, the more defensible its valuation becomes, particularly as it grows into its lofty EBITDA guidance.

Expanding Strategic Optionality In Industrial Logistics

FTAI’s acquisition of W&LE could significantly enhance its strategic optionality in the U.S. industrial logistics sector. The footprint of W&LE runs through areas with rising potential for renewable fuels, battery-grade material shipments, and intermodal freight—all areas that FTAI has expressed interest in leveraging through Repauno and Jefferson. The company’s playbook increasingly revolves around building multi-modal infrastructure hubs that support long-term supply chain shifts, such as increased U.S. energy exports or reshoring of manufacturing. W&LE’s geographic reach provides direct access to Pittsburgh, Cleveland, and other manufacturing-heavy areas, creating a logistics bridge between inland producers and export terminals. This complements the East Coast positioning of Repauno and the Gulf Coast exposure of Jefferson. More importantly, W&LE may give FTAI the real estate and rail access to support future projects such as transloading terminals, warehousing, or even inland port developments. As seen with Long Ridge’s pursuit of data center partners, FTAI is not shy about monetizing its physical footprint through creative leasing or co-location models. Integrating W&LE provides an additional lever to replicate that model, particularly if FTAI can rezone or commercialize parcels along W&LE’s route. Additionally, should macro dynamics around tariffs or reshoring accelerate—especially under a potential second Trump administration—having a diverse freight rail network may offer FTAI an advantage in adjusting to demand shifts across key commodity flows. In this way, W&LE becomes more than just a bolt-on—it could serve as a platform for broader industrial investment strategies in logistics.

Final Thoughts

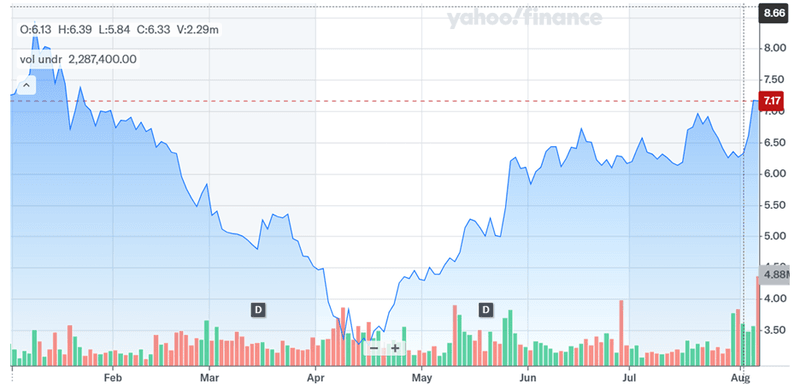

Source: Yahoo Finance

FTAI Infrastructure’s stock trajectory is more or less in line with broader indices over the past 6 months though the acquisition of The Wheeling Corporation has resulted in a slight spike in the stock. The deal aligns well with FTAI’s current portfolio strategy and adds scale in a way that could enhance capital efficiency. It is important to highlight FTAI Infra’s LTM valuation metrics which remain elevated, with an LTM EV/EBITDA multiple of 43.05x and an LTM EV/Gross Profit of 42.21x, suggesting that much of its growth story may already be priced in. While preferred equity issuance to Ares Management provides short-term funding security, it also adds long-term obligations that depend on strong performance across all business units, including the newly acquired W&LE. Ultimately, while the acquisition may offer upside through strategic integration, its success will depend on how efficiently FTAI can align its expanded rail network with customer needs and infrastructure investment returns—without compromising balance sheet discipline.