Semler Scientific’s Quiet Cash Machine Is Fueling A Bitcoin Empire—The Real Reason Behind Strive’s 210% Buyout Offer!

Semler Scientific (NASDAQ:SMLR), a small-cap healthcare and Bitcoin treasury hybrid, made headlines this week after announcing an all-stock acquisition agreement with Strive Asset Management (NASDAQ:ASST). The deal, which values Semler at a staggering 210% premium to its prior closing price, underscores a new chapter in the convergence of digital asset exposure and public equity strategies. In exchange for each Semler share, shareholders will receive 21.05 shares of Strive, positioning the combined entity as one of the largest Bitcoin treasury firms in the U.S. with over 10,900 BTC. Beyond Bitcoin, the companies will explore monetizing Semler’s diagnostics unit through CardioVanta, with a renewed focus on heart failure detection and preventative diagnostics. Let us dive deeper into the deal and try to analyze why Strive Asset Management saw so much value in a small-cap player like Semler.

Bitcoin Leverage & Treasury Synergy

Semler Scientific’s core appeal to Strive lies in its potential to maximize Bitcoin-per-share growth through intelligent capital structure leverage—a strategy modeled after high-profile Bitcoin treasury leaders. Semler's unique positioning as both a healthcare operator and a Bitcoin accumulator offers synergies not commonly found in other small-cap treasury firms. As of July 31, Semler held 5,021 BTC with a market value of $586 million and a cumulative unrealized gain of $110 million. Through a combination of $100 million in long-dated convertible debt and continued ATM share issuances—$204 million raised YTD—Semler has demonstrated the ability to grow its BTC position without overly diluting shareholder value. From Strive's standpoint, acquiring a small-cap firm that already generated a 300% Bitcoin yield since May 2024 provides a platform for scale and momentum. With 97% of institutional capital unable to directly own Bitcoin or ETFs, publicly traded equity proxies like Semler become critical exposure vehicles. The deal allows Strive to absorb this infrastructure and investor access, enabling it to deploy capital more effectively through a proven vehicle. In addition, Semler’s operational Bitcoin dashboard and transparent BTC acquisition disclosures enhance investor confidence and visibility—elements that align with Strive’s strategy of maintaining a public-facing, asset-backed Bitcoin standard. The broader implication for Strive is the ability to consolidate balance sheets, streamline disclosures, and expand financing flexibility through preferred equity and fixed-income instruments to meet ambitious BTC targets: 10,000 by YE2025, 42,000 by YE2026, and 105,000 by YE2027.

Healthcare Cash Flows As A Strategic Hedge

While Semler Scientific is recognized for its Bitcoin holdings, its health care business remains an underappreciated cash-generating engine that could serve as a stabilizing force for Strive. In 2024, Semler's healthcare operations generated $24 million in free cash flow, and despite Q2 2025 headwinds related to CMS rate changes, the company remains focused on expanding into more scalable and higher-value markets such as cardiac diagnostics. The newly created CardioVanta subsidiary reflects this pivot, with a focus on heart failure and arrhythmia detection through a SaaS model. For Strive, this provides more than just non-correlated cash flows—it introduces operational diversification that can be used to fund additional Bitcoin acquisitions in accretive ways. While the Bitcoin treasury model hinges on macro conditions and capital markets receptivity, having a functioning healthcare unit provides a hedge against BTC volatility and broader asset market swings. Strive can either choose to spin off CardioVanta for a capital injection or retain the business for ongoing cash flow. The diagnostics unit also presents optionality, with recent regulatory milestones including a forthcoming 510(k) submission for heart failure and potential AI-based product expansions. Importantly, the healthcare business’s margin profile—historically high due to software-driven sales—and the lack of long-term debt on Semler’s books further increase the attractiveness for an acquirer like Strive. This dual-engine structure allows Strive to offer a more nuanced investor proposition: a Bitcoin leverage vehicle with downside protection via operational cash flows.

Deep Undervaluation & Equity Arbitrage Opportunity

From a valuation standpoint, Semler Scientific represents a deep-value small-cap play relative to its asset base and strategic optionality. The company's LTM enterprise value to EBITDA multiple has surged from 7.5x in mid-2024 to 105.1x as of September 22, 2025, driven largely by mark-to-market gains in Bitcoin holdings and forward-looking investor sentiment. However, on an LTM price-to-earnings basis, Semler trades at only 8.14x, with trailing price-to-sales at 11.3x—substantially lower than the high-growth SaaS or crypto proxy peers. The company’s net income for Q2 2025 was $66.9 million, translating to a fully diluted EPS of $5.04 and a forward PE of just 1.7x. This disparity reflects investor skepticism about sustainability, but also creates room for arbitrage, especially for an acquirer like Strive that can issue its own equity to finance the purchase. The merger’s 210% premium—$90.52 vs. $29.18 at the time of announcement—is justified more by Bitcoin holdings than healthcare fundamentals, but the valuation compression presents a clear opportunity for accretive issuance and mNAV arbitrage. The equity exchange ratio (21.05 ASST shares per 1 SMLR share) implies a relatively low cost of acquisition for Strive, which is critical given its own valuation constraints. Moreover, Semler’s shareholder base has expanded to over 32,000, up from 11,000 in 2023, giving Strive access to a broad and BTC-aligned investor cohort. If sentiment normalizes, the combined entity could see valuation uplift through multiple expansion, enhanced liquidity, and broader institutional coverage—especially given recent sell-side initiations from Cantor Fitzgerald, Benchmark, and Maxim.

Structural & Strategic Alignment In Treasury Philosophy

The final major synergy between Strive and Semler Scientific lies in their philosophical alignment around Bitcoin as a balance sheet asset and the deployment of corporate capital toward long-term BTC accumulation. Semler’s decision to become the second U.S. public company to adopt the Bitcoin standard in May 2024 was not a one-off pivot but a structural shift. The company has since institutionalized this strategy by appointing a Director of Bitcoin Strategy (Joe Burnett), adding Bitcoin evangelist Natalie Brunell to its board, and incorporating BTC KPIs like BTC yield into corporate reporting. This strategic focus is reinforced by the use of intelligent leverage—low-interest, long-duration debt—to fund BTC purchases, rather than short-term or dilutive instruments. Strive, which seeks to dominate the Bitcoin treasury landscape, gains immediate scale and credibility by acquiring a company that already ranks sixth in the U.S. among active Bitcoin treasuries by BTC holdings. Furthermore, the two companies share similar views on the institutional barriers to direct BTC ownership and the opportunity for equities to fill that gap. Semler’s commentary on fast-money (premium to mNAV) vs. slow-money (leverage and debt-financed BTC accumulation) strategies aligns closely with Strive’s need to manage shareholder expectations in volatile asset environments. The merger thus allows Strive to absorb not just a balance sheet, but an operational playbook, personnel expertise, and brand credibility. The integration of corporate governance, financing, and capital allocation models under a unified Bitcoin-centric vision has the potential to yield process efficiency and investor coherence.

Final Thoughts

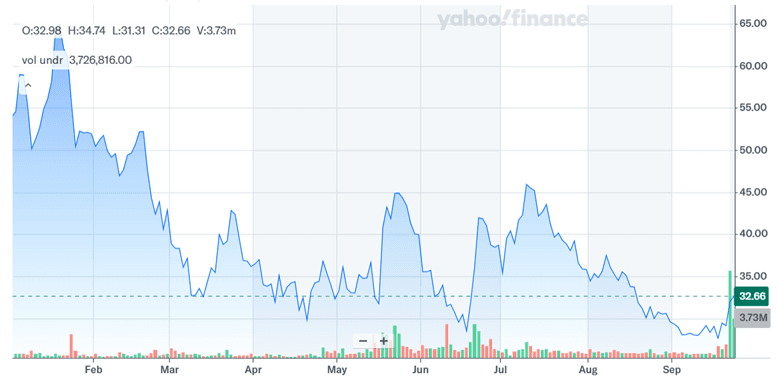

Source: Yahoo Finance

As we can see in the above chart, Semler shares jumped 33% but as a matter of fact, Strive saw its stock price decline, indicating market scrutiny around valuation and integration. Both boards have unanimously approved the deal, and the combined firm intends to retain Strive's management, with Semler’s Executive Chairman, Eric Semler, joining the board. The valuation picture of Semler is even more interesting. Its trailing valuation multiples—such as 105.1x LTM EV/EBITDA and 109.3x LTM EV/EBIT—reflect Bitcoin markups more than core operations, its trailing P/E of 8.14x suggests underlying earnings power may still be undervalued. We believe that on one hand, the deal offers potential scale benefits, access to institutional capital, and operational synergy through Semler’s diagnostics unit and BTC-leveraged balance sheet. However, on the other hand, recent financials highlight declining healthcare revenues and increased volatility driven by Bitcoin’s fair value adjustments are points that should not be ignored. Overall, we see this transaction as a double-edged sword for Strive and its success or failure will be seen in the years to come.