Splash Beverage Group: A Delicious Beverage Player With A Phenomenal Growth Story In Progress

As the beverage industry battles with the rising inflation and supply chain issues, there are certain definite niches which have been relatively unperturbed by the current macroeconomic scenario in the U.S. and have shown significant resilience. Sports drinks, premium wines, and flavored alcoholic beverages are three categories where beverage giants are not only seeing good growth but also a significant ability to pass on the inflationary impact back to the consumers given the fast-growing demand. Our small cap pick for the day is one of the fastest growing beverage companies in the U.S. that has unique product offerings, strong brands and that has scaled up its distribution dramatically in the past year – Splash Beverage Group (NYSEMKT:SBEV).

Company Overview

Splash Beverage Group manufactures, distributes, and markets a wide range of beverages in the United States. Its core product line includes hydration and recovery isotonic sports drinks under the TapouT Performance brand. The company also manufactures and sells flavoured tequilas under the SALT Naturally Flavored Tequila label, premium wine under the Copa di Vino brand, and flavored Sangrias from Spain-based Pulpoloco. The Company’s unique e-commerce platform, Qplash, also provides a fully integrated distribution platform for selling all its beverage categories as well as selected other grocery products. Management looks to develop early-stage companies in its portfolio as well as acquire and then accelerate brands with high visibility and create new category pioneers. Splash is led by a management team that has established and managed some of the top global beverage brands and guided sales from the point of product launch to multi-million dollar brands. The company has its headquarters in Fort Lauderdale, Florida.

Excellent Brand Portfolio

Splash offers a wide variety of beverages that should provide the company a pathway to becoming one of the leading brands in the U.S. Its biggest brand within the sports drinks domain is known as TapouT. TapouT is an international lifestyle brand that has been at the forefront of Mixed Martial Arts (MMA) since the brands creation in 1997. The TapouT brand includes a full range of high-performance sports beverages includingTapouT Performance, a 3-in-1 superior performance mix that promotes hydration and cellular recovery. TapouT Performance works to replenish what the body loses via physical effort with its unique combination of vitamins, minerals, and electrolytes. Interestingly, industry behemoths like Coca-Cola have also recognized the growth in the performance beverage domain as demonstrated by its recent acquisition of the BodyArmor sports drinks company and the increased push to their Powerade offering to compete with market leader, Gatorade (owned by PepsiCo). It is evident that consumers are looking for more variety in this category and TapouT could be the difference they are seeking. Management sees immense potential to capture market share with a high-quality, all-natural product. Splash CEO Robert Nistico, a veteran of the Red Bull Executive team that built that brand into a $1.6 billion franchise see an opportunity to replicate that success.

Robust Brand Portfolio

In addition to TapouT, Splash produces, distributes and markets high-quality brands within the alcoholic beverages space. Salt Tequila is Splash Beverages’ naturally flavoured tequila drink, believed to be the first 100% blanco agave 80-proff tequila popular for its clean and sweet flavour. The product is produced and bottled in the region of Jalisco, Mexico. Salt Tequila offers a large variety of naturally flavoured tequilas, including berry, citrus, and salted chocolate.

Splash’s premium wine brand, Copa Di Vino is also distinguishing itself. Copa makes a ready-to-drink wine glass that can be taken anywhere. No bottle, corkscrew, or glass required. The concept of not having premium wine confined to the bottle is not a new concept, but Copa’s single serve size, ergonomic shape, splash proof cap and freshness seal is a unique twist to the “single-serve wine” concept. “Launched” on the hit television series Shark Tank, Copa Di Vino is now a global leader of single serve premium wine.

Splash Beverages’ other premium brand is Pulpoloco Sangria, which is made and imported from Spain. It is a light-bodied, fruity, and delicious sangria created from the finest Spanish ingredients. Each of Pulpoloco’s products is filled and packed aseptically in a unique eco-friendly Carta-Can to keep the authentic aromas of real Spanish sangria while also extending shelf life without the use of preservatives. The Carta-Can is not just reclycable, but is biodegradable, a truly unique feature, and one for which Splash has the exclusive distribution rights. The company’s unique approach to sustainable packaging and is one of the key factors driving gross margins as consumers increasingly embrace innovative packaging approaches that both extends shelf life and maintains high-quality taste.

Distribution Partnership With AB-InBev

Splash Beverage Group recently announced a distribution partnership with AB ONE, a subsidiary of AB-Inbev. In addition to multiple independent AB distributors, Splash will be using AB ONE’s network of corporately-owned delivery operations in order to expand the accessibility of Splash Beverage’s TapouT performance beverages, Copa di Vino wine by the glass, and Pulpoloco Sangria across its all-inclusive network. AB-InBev, which bought Anheuser-Busch in 2008, owns AB ONE, serves around 50,000 accounts across the United States, including retail businesses, restaurants, pubs, and venues. The AB One distribution network will expand the Splash brands’ reach into significant new territories over and above the independent Anheuser Busch wholesalers that Splash had acquired in the Copa di Vino acquisition in December 2020. The distribution network of AB ONE includes significant U.S. markets such as New York, Boston, and Los Angeles and its broad coverage, execution strength and customer service should significantly scale Splash’s existing multi-state distribution network This distribution deal could definitely be a defining moment for Splash Beverages and its brands, bringing millions of new customers onboard from New York to Los Angeles and will validate Splash’s brand development and growth strategy.

Final Thoughts

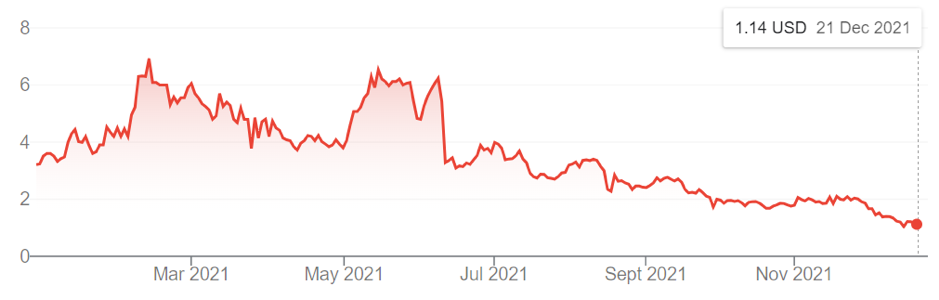

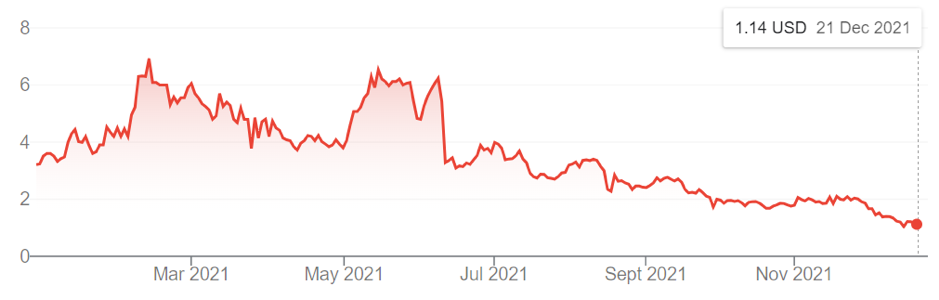

There is no reasonable justification as to the current stock valuation of Splash Beverages today. The company’s revenues should increase significantly as it scales up distribution. It is worth highlighting that apart from the AB-InBev tie-up, Splash Beverages also has agreements in place with Golden Beverage Company, Johnson Brothers, Bernie Little, and branches of Gulf Distributing Holdings, LLC. The company also announced a significant expansion into Walmart, Total Wine where its SALT Citrus flavoured tequila is now available in 42 locations. Given these factors coupled with the strong brand portfolio, the company’s current enterprise-value-to-revenue multiple of 3.3x appears well below the industry averages and has immense scope for expansion. We believe that Splash Beverages is a steal at current levels and has the potential to provide triple-digit returns to small cap investors.