The Fed, And Short The U.S. Dollar

Fed Discussion

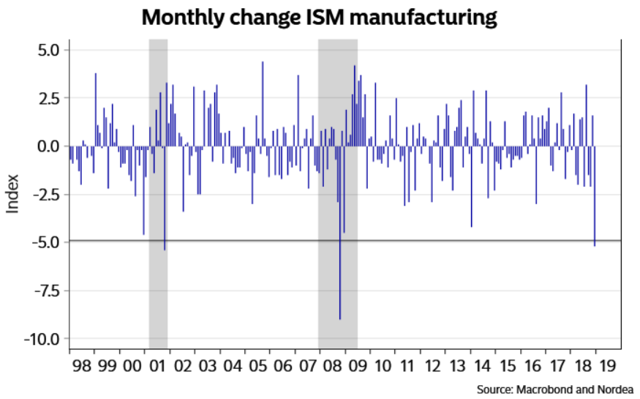

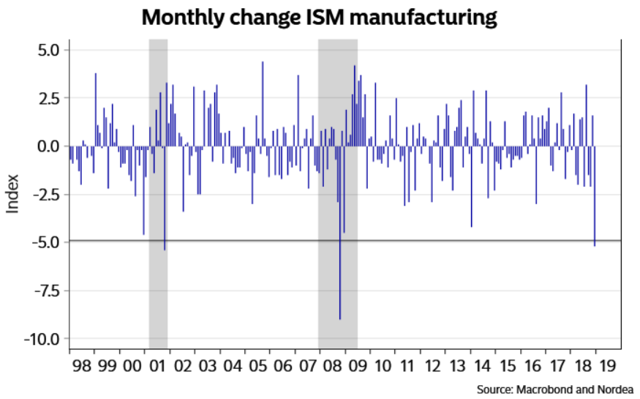

The Fed has projected 2 rate hikes for 2019. The most up-to-date GDP progress fee is 3.4%, the inflation is 2.2%, and the unemployment fee stands at 3.7%. Given these numbers, it’s laborious to argue in opposition to the reasoning by the Fed. Having stated that, these are all lagging indicators, and we now have seen many information factors that point out an financial slowdown. I’ve mentioned this before, and it may be illustrated by the extraordinarily weak change within the newest ISM manufacturing PMI studying.

Figure 1 – Source: AndreasStenoLarsen on Twitter

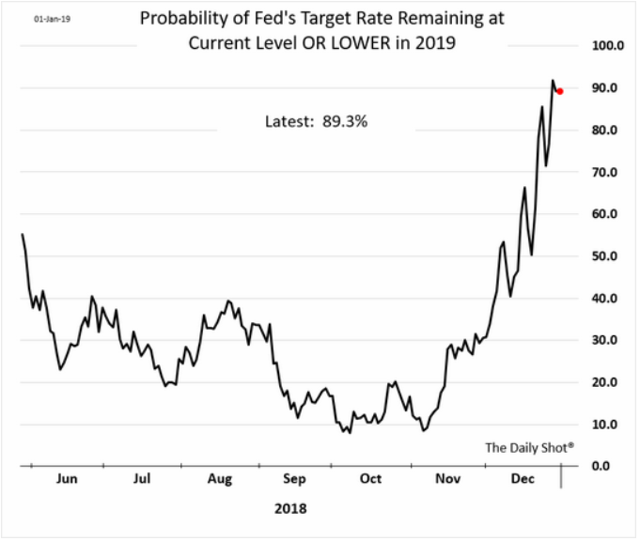

The overwhelming majority of the market is claiming the Fed will be unable to undergo with any fee hikes in 2019. I agree with this situation, despite the fact that it’d take one other 3-6 months for the Fed to comprehend this and alter its tune. It is definitely attainable that yet another hike goes via, however I might argue that the longer the Fed stays hawkish, the extra forceful the coverage response must be. The query is that if the market will start worth this in in the course of the first half of the 12 months, or first the Fed involves the identical realization because the market. Regardless of the precise turning level, I count on the greenback shall be decrease by the top of 2019, which is able to possible be bullish for less-cyclical commodities.

Figure 2 – Source: WSJ Blog

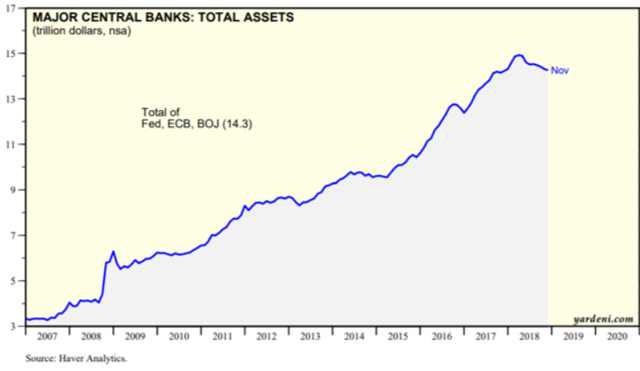

The Fed has additionally communicated that stability sheet normalization shall be on autopilot. The under graph is illustrative as to what has occurred with the worldwide stock market after the Fed started stability sheet normalization; greater rates of interest have naturally had an impression as properly.

Figure 3 – Source: Amit Noam Tal on Twitter

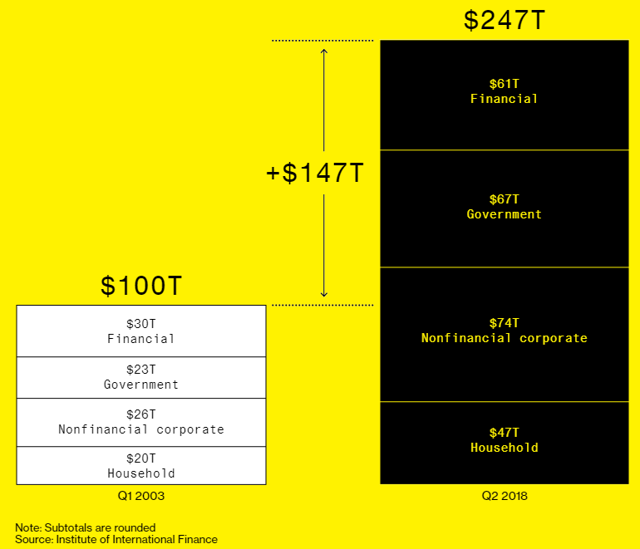

We have, during the last decade and a half, grown international debt ranges massively, as present within the under determine. I might argue debt and liabilities worldwide are greater than belongings, no matter what we depend as belongings, and money flows are additionally comparatively low in comparison with whole debt ranges.

Figure 4 – Source: Bloomberg

If we use a thought experiment, with money owed being bigger than belongings and dwarfing money flows – whether or not that’s on a family, company, state or authorities degree – and also you then attempt to deleverage, which successfully is what stability sheet normalization is, asset values finally go to zero, all else equal. When push involves shove, I extremely doubt any politician or central banker shall be keen to take ache of deleveraging this pile of debt. It must be inflated away eventually. The final decade’s struggle on deflation is an efficient instance of the unwillingness to deleverage when it could have been a viable various.

It is essential to bear in mind the quantity of ache that has been precipitated (together with greater rates of interest) by an especially small quantity of central financial institution deleveraging, when contemplating the aggregated stability sheet from the ECB, BOJ, and the Fed. I reiterate that politicians or central bankers are impossible to have the ability to bear the ache of creating an actual dent within the under chart.

Figure 5 – Source: Yardeni

If the Fed continues climbing rates of interest and stability sheet normalization, I count on important issues for the U.S. financial system. This will consequently flip up in lagging indicators the Fed appears to concentrate on. Then the Fed must step again in, possible with each stability sheet growth and decrease rates of interest, simply at a a lot bigger scale.

- 2019 U.S. fairness returns shall be unfavourable – considerably, if we return to historic valuations.

- U.S. tax receipts will fall from poor fairness efficiency, and the 5% price range deficit will possible develop considerably.

- Interest expense may also proceed to tick up and put additional strain on the deficit.

- The next deficit means extra treasury provide and better rates of interest from the elevated provide, which possible compounds the issue.

- U.S. state and native pension funds are seriously underfunded, and the poor 2018 efficiency wouldn’t have helped the scenario. A big fairness sell-off in 2019 may imply many defaults, because the funding ratio shall be extraordinarily low, so fake and lengthen may not be an possibility.

Conclusion

I believe the choice for the Fed is to pause now with each rate of interest hikes and stability sheet normalization, or push ahead one other 3-6 months after which should do a U-turn. I count on the market can work out the route this can take.

Maybe I’m giving the market an excessive amount of credit score and the brief greenback commerce ought to be placed on in 3-6 months. Regardless of the timing, I count on less-cyclical commodities will do properly in 2019.

Disclosure: I/we now have no positions in any shares talked about, and no plans to provoke any positions inside the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.