Baidu’s AI Battle Plan: Can ERNIE 4.5 and Apollo Go Outmaneuver DeepSeek & Alibaba?

Baidu (NASDAQ:BIDU) has intensified its artificial intelligence (AI) initiatives, unveiling the ERNIE 4.5 Turbo and ERNIE X1 Turbo models. These multimodal models process text, audio, images, and video, aiming to reclaim Baidu's leadership in China's AI sector amid fierce competition from domestic players like Alibaba, Tencent, and Huawei. The company has also decided to open-source its upcoming ERNIE 4.5 series and make the ERNIE bot free for end users, a strategic move influenced by the success of DeepSeek's open-source approach. Despite these advancements, Baidu faces challenges, including a 2% year-over-year decline in total revenues for Q4 2024, primarily due to a 7% drop in online marketing revenue. However, the AI Cloud segment showed robust performance with a 26% year-over-year revenue growth, highlighting the company's shift towards AI-driven services.

Open-Sourcing ERNIE 4.5: A Strategic Shift In AI Model Deployment

Baidu's decision to open-source its ERNIE 4.5 series marks a significant strategic pivot in its AI model deployment. This move is influenced by the success of DeepSeek's open-source model, which accelerated the adoption of foundation models. By making ERNIE 4.5 open-source, Baidu aims to drive broader adoption and expand its impact across various scenarios. The open-sourcing is backed by Baidu's deep confidence in its technology leadership, stemming from a decade-long commitment to R&D investment and continuous technological innovation. The company believes that open-sourcing will help more developers and users recognize ERNIE's true value, driving even broader adoption. This approach aligns with Baidu's application-driven strategy, focusing on using ERNIE to renovate its products and serve enterprise customers. Internally, Baidu has leveraged ERNIE to transform consumer-facing products like Baidu Search and Baidu Wenku, while externally, through its MaaS platform, it enhances the model and application development experience for enterprise clients. The open-sourcing of ERNIE 4.5 is expected to further expand market awareness of ERNIE's capabilities and enable broader adoption across an increasing array of industries.

AI Cloud Growth: Driving Revenue Amidst Advertising Decline

Baidu's AI Cloud business demonstrated robust momentum in Q4 2024, with revenue growth accelerating to 26% year-over-year, offsetting the softness in its online marketing business. The growth was primarily driven by broad market recognition of Baidu's AI capabilities, particularly the ERNIE model. In December 2024, ERNIE handled approximately 1.65 billion API calls daily, with external API calls growing 178% quarter-over-quarter. This surge indicates strong external demand, as businesses find value in integrating ERNIE into their daily operations. The AI Cloud's success is also attributed to Baidu's comprehensive AI solutions that permeate key operational processes across various sectors, including education, e-commerce, entertainment, and recruitment. For instance, Baidu collaborated with a leading recruitment company to adopt an ERNIE-powered outbound calling product for campus recruitment, achieving a 50% higher acceptance rate for job fair invitations and 70% lower labor costs. These developments underscore the AI Cloud's role in driving revenue growth amidst the decline in online marketing revenue.

Transforming Search With AI: Enhancing User Engagement

Baidu has aggressively leveraged ERNIE to transform its search engine, aiming to redefine and enhance the quality of AI-generated search results. Currently, 22% of Baidu's search result pages contain AI-generated content. The company has expanded beyond text generation to include diverse content formats such as short videos, notes, agents, digital humans, and live streaming. This dynamic and varied content combination allows users to discover a broader range of information presented in more engaging ways. By analyzing the nature and intent of each query, the Gen-AI-enabled search can determine the optimal content format and presentation style, ensuring users receive the most relevant results in the most effective and easy-to-understand format. These enhancements have led to improved user metrics, with users exposed to AI-generated search results demonstrating higher engagement levels, conducting more search queries, and showing higher retention rates and longer time spent. In December, daily search queries per user increased by 2% year-over-year, indicating the effectiveness of Baidu's AI transformation of search.

Apollo Go: Scaling Autonomous Driving Operations

Baidu's autonomous ride-hailing service, Apollo Go, has proven the viability of its business model, strengthening the company's confidence in pursuing global expansion and exploring asset-light business models. In Q4 2024, Apollo Go provided approximately 1.1 million rides to the public nationwide, representing a year-over-year growth of 36%. By January 2025, the cumulative rides provided to the public exceeded 9 million. Notably, Baidu achieved 100% fully driverless operations nationwide, eliminating the need for safety drivers on the vehicles. This milestone underscores Baidu's industry-leading standards in autonomous driving. In November 2024, Apollo Go secured permits to conduct testing on open roads in Hong Kong, marking Baidu's first entry into a right-hand drive, left-hand traffic market. This achievement showcases Baidu's ability to adapt its autonomous driving technology to different traffic systems while maintaining rigorous safety standards. Building on this momentum, Baidu plans to expand beyond Mainland China, bringing safe, reliable, and convenient autonomous ride-hailing services to more cities and regions worldwide.

Final Thoughts

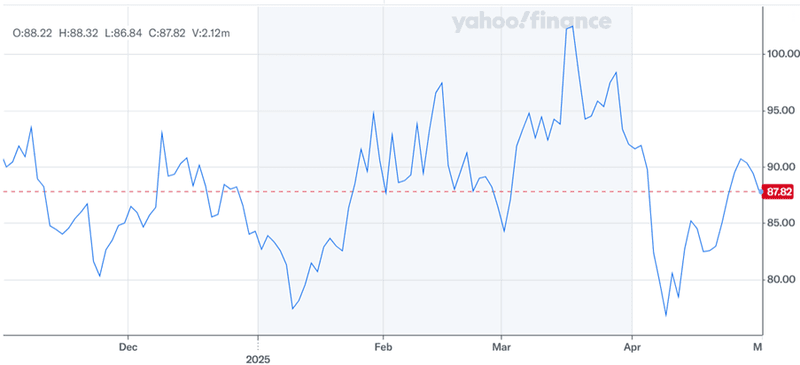

Source: Yahoo Finance

Baidu's stock price has been volatile and the impact of its AI initiatives is not yet fully incorporated in its performance. However, these strategic initiatives in open-sourcing its ERNIE 4.5 model, expanding its AI Cloud services, transforming its search engine with AI, and scaling its autonomous driving operations through Apollo Go demonstrate the company's commitment to leading in the AI sector. These efforts have shown promising results, with significant growth in AI Cloud revenue and increased user engagement in AI-enhanced search. We see immense promise in the growth in AI-driven services of Baidu despite the recent challenges such as the decline in online marketing revenue and intense competition from domestic and international players. Overall, we believe that Baidu is a very interesting watchlist candidate that investors should keep an eye on, that could easily become a player with the next big AI breakthrough.