The Market’s Forward P/E – SPDR S&P 500 Trust ETF (NYSEARCA:SPY)

Since the S&P 500 (SPY) hit its native peak on September 20th, the broad market gauge is down 13.1% on a worth return foundation. This correction has come throughout a interval of pretty robust earnings progress. With rising issues about an financial slowdown, some market individuals might be questioning the place the market is at present buying and selling as a a number of of ahead earnings. This article will reply that query and provides almost a 3 decade comparability of the present ahead earnings a number of versus historical past.

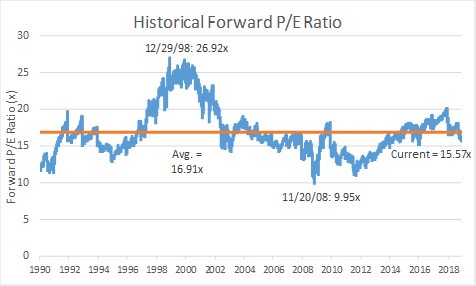

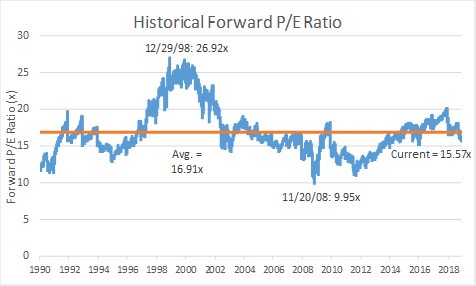

The chart beneath makes use of the index worth degree and divides by consensus Bloomberg estimates for earnings over the subsequent 4 quarters. This ahead-wanting measure is obtainable traditionally again to January 1990.

Currently, the ahead earnings a number of is at 15.57x. This measure is roughly 7.9% decrease than the common over this horizon relationship to early 1990. The ahead earnings a number of is a whopping 22.5% decrease than its 52-week excessive of 20.1x, a degree reached one-12 months in the past immediately.

Over the entire of the dataset, a 22.5% or higher drop within the 12 months-over-12 months ahead earnings a number of has been fairly uncommon. It final occurred final in late 2010. Over that point horizon, annual declines within the ahead earnings a number of of that diploma have occurred throughout recessionary contractions (2001, 2008) or throughout early components of the market restoration (2002, 2003, 2010). This appears like a late-cycle normalization in earnings multiples pushed by a mix of upper 12 months-over-12 months rates of interest and slowing earnings progress, however maybe this sharp reversal is pointing in direction of one thing extra significant. A decline within the ahead earnings a number of this sharp has tended to return throughout financial transitions.

The ahead earnings a number of final traded at this degree (15.57x) in mid-February 2016, through the height of the commodity disaster. That proved to be a great time to purchase shares as multiples subsequently expanded. Even with the latest promote-off, the S&P 500 has produced a 44% whole return since that interval. That episode proved to be a mid-cycle blip within the lengthy bull market, however this kind of a number of re-pricing might be signalling an financial transition.

Multiples have cheapened. Given the a number of enlargement over the previous decade, ahead earnings multiples should not traditionally very low cost – even after a uniquely swift contraction. Market individuals can hope that this episode proves to be a mid-cycle blip just like the 2015-2016 selloff, however this degree of contraction within the ahead earnings a number of can be distinctive for a mid-cycle interval.

Disclaimer

My articles could include statements and projections which can be ahead-wanting in nature, and due to this fact inherently topic to quite a few dangers, uncertainties and assumptions. While my articles concentrate on producing lengthy-time period, danger-adjusted returns, funding selections essentially contain the danger of loss of principal. Individual investor circumstances differ considerably, and knowledge gleaned from my articles needs to be utilized to your individual distinctive funding scenario, targets, danger tolerance and funding horizon.

Disclosure: I’m/we’re lengthy SPY. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.