The Novavax Crisis Deepens: Why Shah Capital Wants Out Now!

Novavax (NASDAQ:NVAX), once hailed as a promising alternative to mRNA vaccines during the COVID-19 pandemic, is facing escalating pressure from its largest active shareholder, Shah Capital, to explore a sale. The small-cap biotech firm, whose non-mRNA COVID-19 shot was once expected to command significant market share, has struggled to generate sustainable revenue, retain market relevance, or instill investor confidence. Despite regulatory approvals and a technology platform considered scientifically robust, the company’s stock is down nearly 30% year-over-year. In a public letter, Shah Capital accused Novavax’s leadership of poor execution and declared that its intellectual property would be better leveraged in the hands of a larger pharmaceutical company. Meanwhile, Novavax’s financial disclosures point to heavy dependence on one-off milestone payments, deep operating inefficiencies, and deteriorating revenue visibility. As its market capitalization hovers around $1.4 billion, the company’s trajectory increasingly resembles a cautionary tale of missed opportunity in the biotech sector.

Collapsing Market Presence & Sales Decline

Novavax's market presence has collapsed, especially in the critical COVID-19 vaccine segment where it once held promise as the sole non-mRNA option. The company's COVID vaccine, Nuvaxovid, has fallen sharply out of favor, with just $11 million in recognized product sales during Q2 2025, including a $2 million revenue reduction from returns and U.S. market closeouts. These figures represent a dramatic decline from prior years and underline the company’s failure to capitalize on its differentiation. Sales visibility remains weak, with management indicating that most remaining 2025 revenues would materialize in Q4, further reinforcing the seasonal and volatile nature of its revenue stream. The erosion in sales is compounded by Novavax’s transition of commercial responsibilities to Sanofi in key markets, effectively reducing it to a backend R&D and manufacturing player. Even its malaria vaccine success—more than 20 million doses administered in Africa through its Serum Institute partner—has not translated into meaningful top-line growth. Year-to-date, the only significant boost came from a $175 million milestone tied to a regulatory approval, not recurring operations. Forward valuation multiples reflect growing market concern, with its NTM EV/Revenue multiple spiking to 3.30x compared to 0.74x just two quarters ago. This surge, disconnected from actual sales performance, suggests elevated expectations without clear catalysts. In sum, Novavax’s diminished commercial footprint and unreliable revenue base highlight a company that has failed to evolve beyond its pandemic-era peak and now faces the risk of strategic irrelevance.

Chronic Execution & Leadership Failures

Execution missteps and leadership shortcomings have become a recurring theme at Novavax, drawing increasing scrutiny from shareholders. Despite CEO John Jacobs outlining a three-part strategy to improve operational focus and accelerate R&D programs, Shah Capital has publicly declared that the leadership lacks the discipline and execution skills to extract value from the company’s assets. The latest earnings call reinforced these concerns, as management admitted to limited visibility around clinical timelines, an ongoing reliance on external partners for product development and sales, and uncertainty around the realization of key milestones. The company’s only active commercial vaccine, Nuvaxovid, is now fully in Sanofi’s hands for global marketing, signaling Novavax’s diminishing autonomy in product strategy. Meanwhile, its broader pipeline remains in early or preclinical stages, including potential applications of its Matrix-M adjuvant in RSV, shingles, C. difficile, and even oncology—yet none of these have entered registrational trials or secured licensing deals. Three material transfer agreements for Matrix-M in cancer therapies have been initiated with large pharmaceutical companies, but these remain non-binding and without disclosed economics. The missed opportunity around COVID-19 commercialization further eroded investor faith, especially as Moderna and Pfizer extracted billions in revenue during 2021–2022 while Novavax stumbled on manufacturing and regulatory delays. The failure to lock in post-pandemic vaccine contracts or leverage existing approvals underscores a broader organizational incapacity. For a small-cap firm competing in a capital-intensive industry, poor execution can be fatal, and Novavax’s chronic underperformance has made its standalone future increasingly questionable.

Strong Science & Acquisition Optionality

Despite the financial headwinds and operational failings, Novavax’s scientific foundation remains a compelling asset—particularly its proprietary Matrix-M adjuvant platform. The technology continues to generate interest from global pharmaceutical companies, evidenced by its role in the WHO-approved malaria vaccine, which is now being distributed at scale across African nations. Matrix-M’s compatibility with protein-based and recombinant vaccines differentiates Novavax in a market dominated by mRNA technologies, offering clear optionality for potential acquirers looking to diversify modality risk. The company’s existing regulatory approvals in the U.S., EU, and other major markets add to its acquisition appeal by providing a de-risked path for market entry. Additionally, its combination vaccine programs—including a COVID-19-influenza candidate partnered with Sanofi—could become commercially relevant if successfully brought to market, though current progress remains early-stage. Oncology interest in Matrix-M is also a potential wildcard; three separate pharma firms are evaluating the adjuvant for possible immuno-oncology use, a space with significant unmet need and investment interest. While these exploratory avenues are not currently generating revenue, they represent longer-term optionality that a larger, better-capitalized firm could exploit.

Final Thoughts

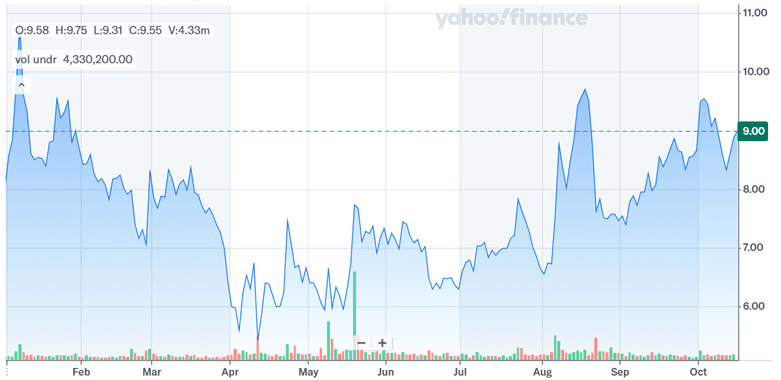

Source: Yahoo Finance

Novavax has had a volatile stock trajectory but it remains inexpensive on several metrics: its LTM EV/EBITDA at 2.60x and LTM P/S at 1.34x suggest low expectations and embedded downside protection for an acquirer. In a consolidating biotech environment, where large-cap players seek differentiated platforms, Novavax’s scientific assets could serve as the cornerstone of a strategic portfolio, particularly given its small-cap valuation and distressed equity position. The company now faces a defining moment in its history. The company retains a scientifically credible platform in Matrix-M, validated through global deployments and promising early-stage research. It has achieved critical regulatory approvals and built notable partnerships, most prominently with Sanofi and the Serum Institute. However, its collapsing commercial footprint, deteriorating financial visibility, and continued reliance on milestone payments have led investors to question its viability as an independent entity. Shah Capital’s public demand for a sale underlines growing investor impatience, especially in light of missed opportunities and persistent execution failures. Whether a buyer steps in—or Novavax finally rights the ship internally—remains to be seen. But one thing’s clear: this small-cap biotech is running out of room to get it wrong.