Transocean: My Top Offshore Drilling Pick For 2019 – Transocean Ltd. (NYSE:RIG)

The offshore drilling business has been hammered just lately. The SPDR Oil & Gas Equipment Services ETF (NYSEARCA: XES) has dropped greater than 50% since early-October. As a consequence, all the business is on sale. However, as we’ll see on this article, a restoration in oil capex, a powerful portfolio of belongings, and a safe monetary place make Transocean (NYSE: RIG) my high offshore drilling choose for 2019.

Transocean – Houston Chronicle

Oil Market Recovery

Oil markets had a tough 4Q 2018. American oil firms continued to extend provide, whereas on the similar time, Saudi Arabia elevated provide in anticipation of Iranian manufacturing going offline. However, Iranian manufacturing didn’t go offline. As a consequence, this resulted in a short glut within the market, which pushed oil costs down exhausting. Fears of worldwide development slowing down did no favors for this course of.

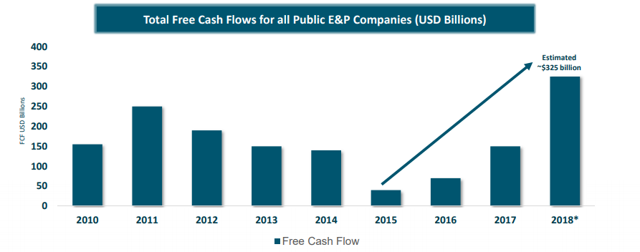

Tranocean Free Cash Flow – Transocean Investor Presentation

However, that’s anticipated to vary in 2019. Iran’s oil manufacturing is anticipated to go down by 1 million barrels per day, and OPEC is contemplating a value discount too. On high of this, firms are discovering methods to scale back spending and maximize money circulate. This is vital to remember as a result of Transocean’s fortunes don’t depend upon greater oil costs a lot as they depend upon capital spending.

As a consequence, in a world of decrease oil costs, Transocean can carry out extremely effectively, as oil firms enhance margins. The firm doesn’t want $100 oil to carry out effectively. This is proof above. Despite oil costs being dramatically decrease in 2018 than in 2014, the entire FCF for all public E&P firms is anticipated to be virtually double what it was in 2014, earlier than the crash.

Companies will start to take a position this cash into capital spending, which suggests large alternatives for Transocean. We’ll focus on the backlog in additional element later, however nowhere is that this extra evident than in Transocean’s latest $830 million drilling contract with Chevron.

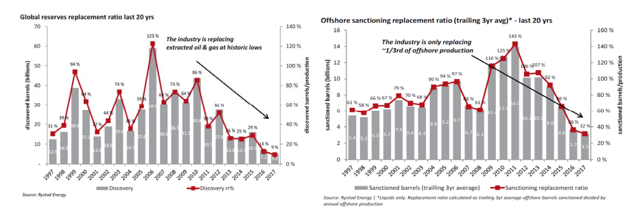

Global Offshore Drilling – Transocean Investor Presentation

As could be seen above, the world has not been changing reserves at adequate charges. The business is changing solely a 3rd of offshore manufacturing and I don’t see this margin getting higher within the rapid future, with out an instantaneous uptick in spending. Given that some oil majors corresponding to Royal Dutch Shell are looking at offshore drilling to drive future development, this can require further spending going ahead.

Another instance of this development that’s required and anticipated is offshore FID (remaining funding selections) are rising quickly. Offshore FID in 2016, the worst 12 months of the crash, had been small with a mere $40 billion in FIDs. In 2018, that reached $170 billion, beating the degrees in 2014 for the primary time. For 2019, that is anticipated to extend considerably, with FIDs anticipated to whole virtually $400 billion or double that of 2014

Over the following 18 months, Transocean anticipates that there are 37 rig years to be awarded. If the corporate can benefit from this, and achieve a number of of those contracts, that’ll imply important development within the firm’s backlog and continued earnings energy.

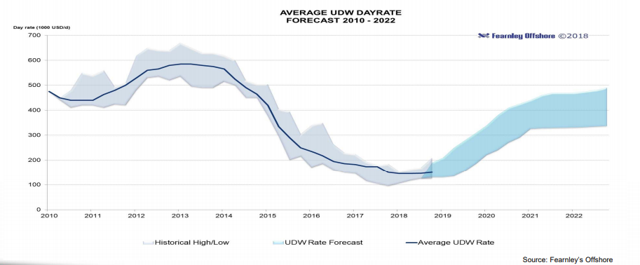

UDW Forecast – Transocean Investor Presentation

Looking at forecast UDW charges, it seems as if markets are starting to succeed in the tip of their backside. From right here, they need to start to recuperate, reaching charges of greater than $300 thousand per day within the early-2020s. Those are robust charges, which can be very worthwhile for Transocean, and assist to assist the corporate’s earnings.

It seems there’s a restoration on the horizon, which can imply good issues for Transocean. Another vital factor to remember is to purchase when others are fearful and promote when others are grasping. Given that individuals consider the market is faltering now, there’s a superb probability, in my private opinion, that not solely is there a restoration on the horizon, but it surely’ll be bigger than anticipated.

Transocean Fleet Transformation

Transocean plans to benefit from this spectacular market by enhancing its fleet.

Transocean Rig Changes – Transocean Investor Presentation

Transocean has been targeted on considerably enhancing its portfolio because the start of the crash. The firm has divested older rigs, with an astounding 60 divestitures since 2014. These divestitures value cash on the time, however have saved the corporate considerably on working prices. Those financial savings will assist tremendously with the corporate dealing with a doubtlessly drawn out oil crash, and people negatives.

At the identical time, the corporate has checked out selectively upgrading its rigs. An instance of that is the corporate spent $20 million to improve the Discover India shifting its UDW rating from 75 pre-improve to 50 publish-improve. The firm has a number of different drillships that will be equal candidates. Transocean is working to place itself on the high finish of the drilling market, as a dominant firm.

At the identical time, Transocean has been targeted on worth-added acquisitions. The firm acquired Songa Offshore, Ocean Rig, and the Transocean Norge. Through this, the corporate acquired 19 extra extremely top quality rigs and an unimaginable quantity of backlog. This reveals the corporate making selections to purchase high quality firms at fireplace sale costs, which ought to make the corporate’s place a lot stronger as soon as costs recuperate.

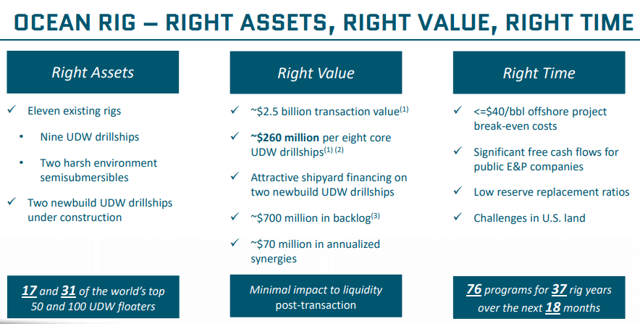

Ocean Rig Acquisition – Transocean Investor Presentation

As an instance of Transocean’s capacity to enhance its asset portfolio, right here’s Transocean’s rational behind buying Ocean Rig. As a aspect observe, Transocean occurring an acquisition spree this 12 months by shopping for Songa Offshore too, spending virtually $4 billion on acquisitions, $4 billion on firms which have dropped >50%, ought to imply the corporate is in a powerful place for when oil costs restoration.

The transaction resulted in 11 present rigs and two newbuild rigs, leading to Transocean holding greater than 30% of each the Top 50 and Top 100 UDW floaters. The transaction value a mere $260 million per every of the core drillships. At the identical time, the transaction has $70 million in synergies and $700 million in backlog. This transaction, I and Transocean consider, occurred on the proper time given an anticipated offshore 2019 restoration.

As a fast observe of reference for the Ocean Rig transaction, new builds value $600-700 million and up to date transactions have been for nearly $300 million. This previous one was for simply $260 million.

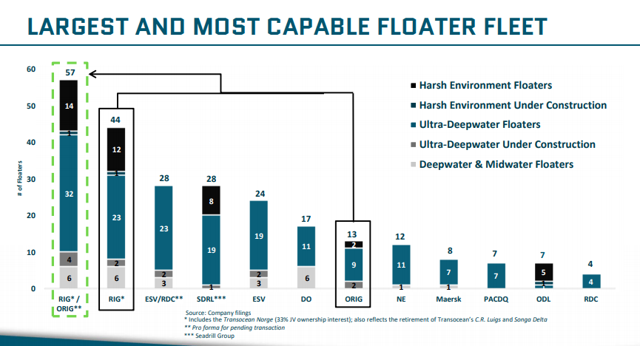

Transocean Floater Fleet – Transocean Investor Presentation

As we are able to see, after this transaction, Transocean can have by far the most important and most succesful floater fleet. The firm’s fleet can be double the scale of the following largest competitor, ESV and RDC, which is itself a mixture of two of the bigger firms earlier than the start of the oil crash. This extremely robust market place, reveals the potential market domination and earnings for Transocean going ahead.

Transocean’s spectacular portfolio of rigs transition to unimaginable expertise. The firm has a mixed virtually 400 years of expertise in UDW and 600 years of expertise in harsh setting drilling. This UDW expertise is sort of 4 occasions that of the following closest competitor, and that harsh setting drilling is greater than 6 occasions that of the following closest competitor. That’s an unimaginable quantity of expertise.

And it’ll transition to prospects taking a look at Transocean for the upper profile jobs. That latest Chevron contract, for an astounding $830 million backlog, was performed solely as a result of Transocean was constructing the primary rig able to 20 thousand PSI. That, mixed with the corporate’s expertise, is one thing that no different competitor has.

Transocean Financial Position

Now that we’ve mentioned the oil market enhancements and Transocean’s fleet transformation, let’s focus on the meat of Transocean’s 2019 potential, the corporate’s monetary place.

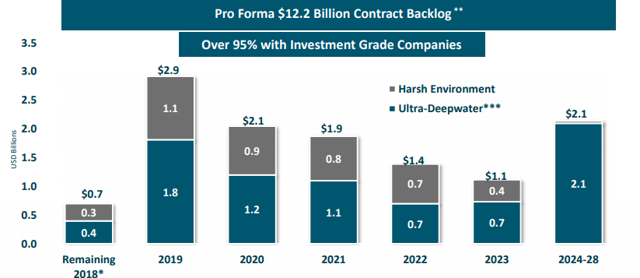

Transocean Backlog – Transocean Investor Presentation

Transocean has an astounding $12.2 billion in backlog, greater than 95% of which is with funding grade firms. This is greater than triple the corporate’s market cap and ensures the corporate can have greater than $1 billion in annual backlog till the mid-2020s. At the identical time, the backlog dwarfs the rivals with greater than 4x the backlog of the closest competitor. That’s spectacular to see.

As a fast observe, the above backlog numbers don’t depend the latest 5 12 months $830 million contract with Chevron signed in late December. That contract, not solely an indication of enhancing oil industries, ought to add $0.08 billion in capex to 2021, pushing it to $2.0 billion, and add $0.17 billion to every of the following 4 years. That means a further important enchancment within the firm’s income going ahead.

At the identical time, Transocean is extremely environment friendly to changing that backlog to money. The firm’s income effectivity has continued to be extremely robust at 96%, and will stay robust going ahead. To have a look at Transocean’s robust monetary conversion price, the corporate’s income has declined by 60% since 2015. However, the corporate has managed to maintain EBITDA up, with the corporate’s adjusted EBITDA margin staying at >40%.

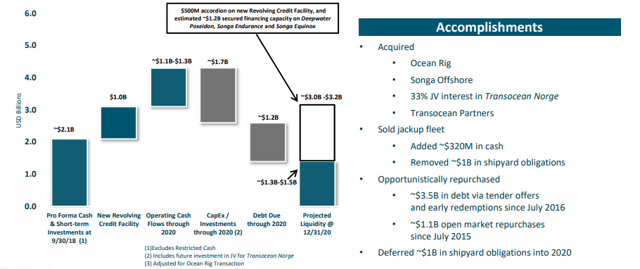

Transocean Liquidity – Transocean Investor Presentation

At the identical time, Transocean is sustaining extraordinarily robust liquidity that ought to proceed via 2020. The firm is planning on spending al great amount of capex to enhance its fleet, however plans to exist 2020 with roughly the identical liquidity, if no more since late-2018. The firm plans to have $1.2 billion in working money circulate over the following two years, or $0.6 billion in annual money circulate for a $4 billion firm.

At the identical time, the corporate has opportunistically repurchased its debt to enhance its monetary place. The firm repurchased $3.5 billion in debt by way of tender provides and $1.1 billion in open market repurchases. That meant a $4.6 billion discount within the firm’s debt, a formidable enchancment at fireplace sale costs. The firm has additionally deferred $1 billion in shipyard obligations, enhancing financials.

Transocean nonetheless has $9 billion in debt, however the firm ought to be capable of proceed being profitable from its companies and opportunistically paying that off.

Transocean Risks

Despite Transocean’s robust fleet and backlog the corporate does have important dangers, as an funding. The first is that the corporate’s stock value is unstable. For instance, the corporate’s stock value has dropped by 50% since early-October. While the basics of the corporate haven’t modified in that point, the corporate trades with oil costs, which make an infinite affect on its enterprise.

The second huge danger for the corporate is that the corporate must develop its backlog. The firm’s $9 billion debt load and $12 billion backlog means its whole backlog isn’t sufficient to cowl its debt, the whole lot else included. That means for the corporate to start producing robust shareholder returns, it must important develop its backlog. While I anticipate that’ll occur because the market recovers, that continues to be to be seen.

As a consequence, for the rapid time period, it’s a huge danger for the corporate.

Conclusion

Transocean has had a troublesome time over the previous few months, with an much more troublesome time because the start of the oil crash. However, the corporate is working in a market that needs to be returning to development quickly, and the corporate has been engaged on consolidating belongings. The firm made greater than $4 billion price of asset additions in 2018, which ought to assist the corporate’s portfolio.

Going ahead, I extremely advocate investing in Transocean, as a play on the restoration of the oil markets. The firm’s fleet is extremely robust and the corporate is concentrated on rising its backlog. The firm’s latest $830 million Chevron contract is testomony to this. The firm’s low valuation means within the occasion of an offshore drilling restoration, the corporate’s stock may recuperate by 100+% right now.

As a consequence, I like to recommend investing within the firm right now, as a small a part of your portfolio, with a 3+ 12 months time horizon.

Disclosure: I’m/we’re lengthy RIG. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.