Treehouse Foods Rockets On Buyout Buzz — Inside The $3B Investindustrial Takeover Rumor!

TreeHouse Foods (NYSE:THS) shares spiked 14% on Monday after reports surfaced that London-based private equity firm Investindustrial is preparing a roughly $3 billion offer to take the U.S. food processor private. The rumor, first posted by Octus (formerly Reorg) on LinkedIn and quickly circulated among traders, would mark one of the largest recent buyouts in the private-label packaged food space. TreeHouse, a small-cap leader in private label manufacturing for U.S. grocers, currently has a market capitalization less than $1 billion and has spent the past year reshaping its portfolio to prioritize margin expansion over volume. The company has closed underperforming plants, invested in high-potential categories like coffee and tea. While the management declined to comment on the report, the stock reaction highlights investor appetite for sponsor-backed take-privates in small-cap consumer staples. Let us take a closer look at the biggest factors shaping the buyout speculation.

Potential Equity Infusion / Sponsor Support

For a small-cap like TreeHouse Foods, sponsor support from a firm such as Investindustrial could provide a critical infusion of both equity and strategic bandwidth. TreeHouse’s current playbook—exiting low-value SKUs, consolidating production, and investing in high-growth private label categories—has been capital-intensive despite improved cash flow. Management has set a target of $250 million in gross supply chain savings through 2027 and is on track for at least $130 million in free cash flow this year, but the pace of transformation is constrained by its balance sheet. A buyout could accelerate that process, funding further acquisitions like the Harris Tea deal or deeper investments in high-performing segments such as coffee, pretzels, and broth. In an environment of elevated input costs and tariff volatility (notably on Brazilian coffee), having a financial sponsor with patient capital could buffer TreeHouse against market shocks. Sponsors also often provide operational advisors and portfolio synergies that a small-cap standalone entity cannot easily replicate. As a major supplier to retailers like Walmart and ALDI—both of which are expanding private label offerings—TreeHouse sits at the intersection of favorable demand trends but requires capital and executional agility to seize them. Investindustrial’s equity injection could thus unlock capacity to scale these partnerships more rapidly without eroding liquidity or delaying strategic moves.

Operational Synergies & Track Record With Investindustrial

Investindustrial brings a deep track record of reshaping mid-market and small-cap food manufacturers across Europe. Its past investments in businesses like La Doria (canned foods) and Natra (chocolate and cocoa) show a pattern of operational streamlining, international scaling, and category focus—precisely the levers TreeHouse is already pulling. TreeHouse, with more than 30 production facilities and a fragmented cost structure, is currently implementing plant closures and SKU rationalization to boost efficiency. This self-directed margin management mirrors the value creation plans private equity sponsors typically impose post-acquisition, suggesting cultural alignment. A firm like Investindustrial could accelerate TreeHouse’s $250 million supply chain savings target, deploy lean manufacturing practices, and open doors to European markets for shelf-stable products. Additionally, the sponsor’s experience in integrating supply chains and optimizing category portfolios could help TreeHouse better navigate its broad assortment and align capacity with profitability. TreeHouse’s current adjusted EBITDA margin of 9.1% leaves room for upside if scale efficiencies and higher-margin product mix can be achieved. For a small-cap leader with entrenched retailer relationships but uneven operating leverage, pairing with an operationally minded sponsor could narrow execution gaps. However, integration risks remain, particularly around sustaining service levels during further consolidation or aligning multi-plant production schedules with customer demand—a delicate balance in private label categories with tight deadlines and razor-thin margins.

Leverage Impact From LBO Financing

Any $3 billion take-private of TreeHouse Foods would be financed with a meaningful debt component, introducing leverage risks typical of a small-cap leveraged buyout (LBO). TreeHouse’s trailing LTM EBITDA of about $315 million places its current EV/EBITDA multiple at 8.24x, below historical peaks but still reflective of execution risk. A buyout priced at 9.5x–10.0x EBITDA would imply $3.0–$3.2 billion in total deal value, requiring significant debt funding. Assuming a 60% debt / 40% equity split, pro forma leverage could exceed 6.0x EBITDA—a level that could constrain TreeHouse’s free cash flow, especially as it continues to invest in capacity expansions and innovation. The company’s forward multiples have steadily compressed, with NTM EV/EBITDA at 6.99x and NTM P/S at just 0.29x as of September 2025, signaling investor skepticism but also creating an attractive entry point for sponsors. Yet a more levered balance sheet could limit pricing flexibility and marketing investment at a time when branded competitors are ramping promotional spend. For a small-cap like TreeHouse, which must remain nimble to retain private label contracts, high fixed obligations could restrict agility and elevate refinancing risk. While LBO structures often assume margin expansion to offset higher interest costs, TreeHouse’s ability to deliver such expansion amid volatile commodity inputs and retailer-driven pricing dynamics is not guaranteed, making leverage a critical swing factor in any deal’s success.

Execution & Industry Pressures

TreeHouse’s recent performance underscores both its operational discipline and the persistent pressures facing small-cap private label manufacturers. In Q2 2025, the company delivered $73.3 million in adjusted EBITDA, up 4% year-over-year, and raised margins by 20 basis points despite soft volumes. However, underlying organic volume and mix declined more than 2.5% year-to-date and are guided to drop about 1% for the full year. Management’s Q3 outlook anticipates high single-digit declines in organic volume/mix even as the griddle and broth businesses recover, suggesting that the volume reset is not yet complete. Meanwhile, branded competitors are increasing promotional spend in H2 2025, creating a tougher environment for private label growth. Although TreeHouse maintains strong retailer relationships and expects stable support for its programs, it remains exposed to tariffs (notably on coffee), input cost volatility, and shifts in consumer demand. The company is also managing the phased restart of its griddle operations and rebuilding broth share after prior service issues—two key swing factors for H2 performance. For any prospective sponsor, executing on TreeHouse’s margin management plan while reigniting volume growth will require a fine balance of cost discipline, innovation investment, and customer retention. Failure to deliver on any of these could erode the very cash flows needed to service a leveraged structure. This complexity, coupled with macro uncertainty, defines the challenge of transforming TreeHouse from a margin-reset small-cap into a growth platform under private ownership.

Final Thoughts

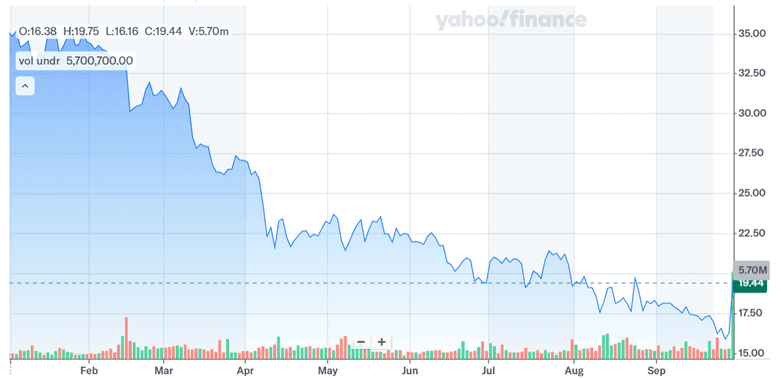

Source: Yahoo Finance

TreeHouse Foods’ stock jump reflects renewed investor attention to small-cap packaged food companies as attractive take-private targets. The rumored $3 billion Investindustrial bid to buy out a company with an enterprise value of about $2.5 billion implies a significant premium and also coincides with TreeHouse’s strategic reset—margin improvements, plant closures, and category focus. A sponsor-backed acquisition could provide equity capital, operational expertise, and potential synergies that TreeHouse as a standalone small-cap might struggle to unlock quickly. On valuation, TreeHouse trades at an LTM EV/EBITDA of 8.24x, an LTM EV/Revenue of 0.79x, and an LTM P/S of only 0.29x, underscoring both its discounted market perception and its limited earnings power relative to larger peers. Whether a deal materializes or not, the current dynamics highlight the tension between opportunity and risk for TreeHouse Foods at this critical juncture in the small-cap private label sector.