TSMC’s $165 Billion U.S. Bet: Can the Chip Giant Avoid a Meltdown?

Taiwan Semiconductor Manufacturing Company (NYSE:TSM), the global powerhouse behind the most advanced chips in Apple iPhones, Nvidia GPUs, and AMD processors, is undergoing one of the most ambitious expansions in semiconductor history. With a staggering $165 billion committed to building six cutting-edge fabs, two advanced packaging plants, and a major R&D center in Arizona, TSMC is doubling down on its U.S. presence amidst geopolitical tensions, client reshoring preferences, and government subsidies. But this American expansion comes at a cost. While TSMC simultaneously builds out new capacity in Japan and Europe and scales up production in Taiwan, it’s beginning to face real-world strains: gross margin dilution, supply-demand balancing, and capacity duplication risks. The company’s latest earnings shed light on a 2%–3% annual hit to margins from overseas fabs, rising to 3%–4% later this decade, and delays in Japan due to resource concentration in the U.S. As TSMC balances political pressures with investor expectations, a closer look reveals some critical challenges that could define its investment trajectory.

Gross Margin Dilution From Overseas Fab Ramp-Up

TSMC’s aggressive overseas expansion is starting to reflect clearly in its financials, with management guiding for a 2% to 3% margin dilution in 2025 due to cost inefficiencies from new fabs, especially in Arizona and Kumamoto. Over time, this impact is expected to widen to 3% to 4% annually as labor shortages, inflationary pressures, and potential tariff-related costs mount. In the first quarter of 2025 alone, gross margin dropped to 58.8%, partly due to dilution from overseas operations. The company has already begun recognizing the operational burden, citing the cost-heavy nature of new fabs and their long ramp-up timelines. Even though TSMC remains committed to a long-term gross margin target above 53%, achieving this depends heavily on operational efficiency gains and pricing negotiations with customers. The overseas facilities, unlike those in Taiwan, do not yet enjoy the same level of scale, engineering maturity, or logistical support. Additionally, government permitting delays and labor constraints in Arizona could stretch construction and production schedules further, leading to slower-than-anticipated economies of scale. While TSMC is attempting to pass some of the added cost burden onto customers by emphasizing geographic manufacturing flexibility as a value proposition, these discussions are ongoing and could take time to materialize into improved pricing. Moreover, concerns linger that the Arizona cluster might continue to lag behind Taiwan in advanced node manufacturing efficiency, even as the company brings 2nm and eventually A16 technology online. These cumulative issues raise long-term questions about sustainable profitability and the true financial viability of such an expansive global footprint.

Capacity Duplication & Potential Overbuild Risk

TSMC’s global expansion into the U.S., Japan, Germany, and continued investments in Taiwan has raised investor concerns around the potential for excessive capacity, especially in the context of specialty and mature nodes. While the company justifies each regional investment as driven by “customer need” and “government support,” the cumulative effect is a capital-intensive global footprint that may not be fully utilized in all geographies. For instance, the new fab in Kumamoto, Japan, which has already entered production, is facing delays on its second phase as internal resources are redirected toward the U.S. expansion. Similarly, the European fab in Dresden targets specialty technologies, where global demand is already showing signs of oversupply. Even though TSMC insists that demand for such specialty nodes remains strong—particularly because competitors lack the necessary technical depth—utilization remains a lingering concern. The company has admitted that certain mature nodes remain underloaded, yet it is not slowing down its overseas expansion. This raises the risk that utilization at these new sites may lag original projections, especially if macroeconomic uncertainties or export restrictions impact customer demand. Moreover, TSMC’s strategy of not relocating existing equipment from Taiwan but instead pursuing greenfield construction adds to the capital intensity. As more fabs come online, coordinating production and ensuring each region hits optimal yield and cost metrics could become increasingly complex. If demand normalizes or falls short of expectations in any region, the company risks locking up billions in underutilized assets, thereby reducing return on invested capital and straining financial flexibility.

Geopolitical & Tariff-Related Uncertainty

TSMC’s global expansion is deeply entangled with geopolitical dynamics, particularly between the U.S., Taiwan, and China. Although semiconductors have so far been exempt from direct tariffs, the U.S. Department of Commerce is actively investigating whether chip imports constitute a national security threat, potentially leading to duties on advanced node semiconductors manufactured overseas. TSMC has stated it is not involved in any direct negotiations between the Taiwan and U.S. governments on tariff exemptions, and that all decisions rest with state actors. However, the company is exposed to this risk nonetheless. A tariff imposition could result in significant cost escalation for chips imported from Taiwan, disrupting customer contracts and supply chain stability. While TSMC’s Arizona expansion may act as a geopolitical hedge and appease U.S. regulators, it also brings heightened scrutiny and expectations. There’s already speculation that this $165 billion commitment could be used as leverage to exempt the company from future duties, but there are no guarantees. The uncertainties are compounded by China's restrictions on certain AI chips and the U.S. ban on high-performance GPU exports to China—two markets critical to TSMC’s AI segment growth. Although management affirmed no observable changes in customer behavior yet, it is conducting sensitivity analyses to prepare for any demand shocks. The company is already forecasting potential cost inflation due to tariff-related risks, which further pressures its long-term margin outlook. Investors must consider the fragility of a business that, despite its technical leadership, operates in a sector vulnerable to fast-changing geopolitical decisions that could materially impact revenues and profitability.

Labor Shortages & Time-to-Yield Challenges In The U.S.

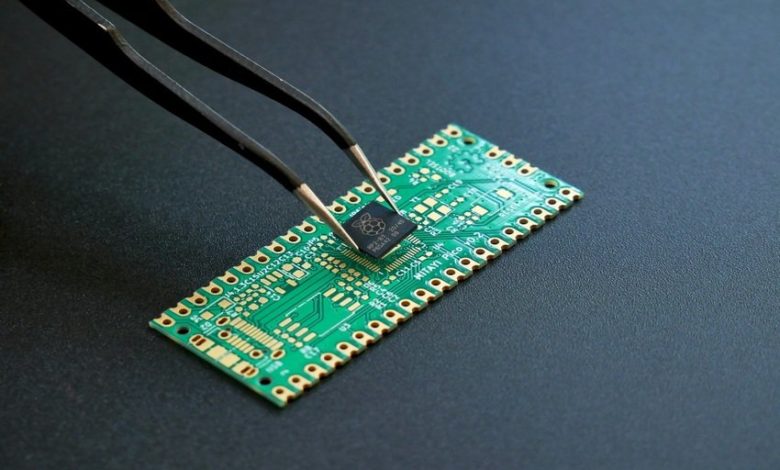

TSMC’s ramp-up in Arizona is not just about constructing buildings—it’s about replicating a highly specialized production ecosystem that the company has perfected in Taiwan over decades. One of the biggest challenges cited by management is the acute shortage of skilled labor in the U.S., which has already delayed timelines and could further impact the operational maturity of upcoming fabs. The company admitted that the construction of the third fab, scheduled to begin in 2025, is already constrained by workforce availability. While the first Arizona fab has entered high-volume production on the N4 node with yields “comparable” to Taiwan, the upcoming 3nm and 2nm fabs are far more complex and may require significantly longer learning curves. Moreover, setting up a new R&D center with 1,000 engineers is meant to support fab operations and localize capabilities, but management has emphasized that the purpose is not to shift core technology development away from Taiwan. As such, any U.S.-based innovation will remain derivative rather than foundational, potentially limiting Arizona’s role in process leadership. Additionally, delays in permitting, high construction costs, and slower-than-expected supply chain localization in the U.S. could extend time-to-yield and impact customer ramp schedules. The broader risk is that delays or inefficiencies in the U.S. could create a mismatch between demand and supply timing, especially given the strong AI-related urgency from clients like Nvidia and Apple. TSMC may have to absorb short-term cost overruns or price reductions to maintain customer relationships if yield targets aren’t met promptly, thereby stressing its financials during the ramp-up years.

Final Thoughts

Source: Yahoo Finance

TSMC’s stock trajectory has been something like a dream for investors especially over the past 3 months as the stock climbed to a new 6-month high. The management’s bold multi-continent expansion strategy reflects its intention to remain a cornerstone of the global semiconductor industry amidst geopolitical shifts, rising AI demand, and client-driven reshoring. However, this strategy is not without significant risk. From margin dilution and underutilization concerns to labor constraints and tariff uncertainty, TSMC faces numerous headwinds that could impact its financial health and operational efficiency over the next five years. While the company is leveraging its scale, customer relationships, and process leadership to mitigate these risks, the outcomes remain uncertain which is why we believe that investors should tread cautiously amidst all the optimism around the stock.