Waystar’s $1.25 Billion AI Bet: Can The Iodine Deal Supercharge Its Growth Engine?

Waystar (NASDAQ:WAY), a leading healthcare payments platform, has announced its plan to acquire health AI company Iodine Software for $1.25 billion in a mix of cash and stock. Once finalized, the deal will leave Waystar shareholders with 92% of the combined entity and Iodine’s equity holders with the remaining 8%. Iodine’s largest shareholder, Advent International, will receive only Waystar stock and has agreed to an 18-month lock-up. The acquisition is expected to immediately boost Waystar’s gross and adjusted EBITDA margins, with further upside to revenue and non-GAAP EPS projected by 2027. This comes on the heels of a strong first quarter, where Waystar reported 14% revenue growth and a 42% adjusted EBITDA margin, prompting an upward revision to its full-year 2025 guidance. Amidst this backdrop, the big question remains – what drove Waystar into pulling off this acquisition?

Accelerating AI-Powered Workflow Automation Across RCM

The acquisition of Iodine Software provides Waystar with an immediate upgrade to its generative AI and automation strategy. Waystar has already made strides with its AltitudeAI suite, automating tasks like prior authorizations and denied claims appeals. Iodine’s AI solutions, which focus on clinical documentation improvement (CDI) and diagnosis accuracy, extend Waystar’s reach upstream into clinical workflows. Together, these platforms could deliver a comprehensive, AI-driven RCM solution—from the point of diagnosis to final reimbursement. This full-stack integration has the potential to reduce manual errors, prevent claim denials before they occur, and improve time to payment. Given that prior authorization alone can take over 20 minutes per case manually, the automation benefits are material. By embedding Iodine’s AI into products like Authorization Manager and AltitudeCreate, Waystar can enhance its ability to automate repetitive tasks, lower costs, and improve cash flow for providers. This synergy is particularly critical in an environment where providers face mounting cost pressures and increasing scrutiny around administrative overhead.

Expanding Enterprise TAM Through Clinical Revenue Integrity

Waystar’s platform already caters to a broad spectrum of U.S.-based healthcare providers, with over 1,244 clients generating more than $100,000 in trailing 12-month revenue. The acquisition of Iodine allows Waystar to expand into a new vertical—clinical revenue integrity—which is becoming increasingly strategic for hospitals and health systems. With Iodine’s tools for CDI and diagnosis precision, Waystar gains access to budgets that were previously outside traditional IT or billing systems. These clinical budgets are now being allocated to AI-driven platforms that can optimize revenue capture directly from documentation practices. This opens a new frontier for Waystar, allowing it to offer a broader set of solutions to hospital CFOs and CMIOs. As providers look to consolidate vendors and seek holistic solutions that span both clinical and financial processes, Waystar’s expanded offerings could help it win more enterprise-scale deals. Furthermore, as reimbursement complexity and regulatory scrutiny increase, the ability to accurately document and code procedures becomes central to maintaining healthy margins. Iodine’s AI tools directly address that need, making this acquisition a strategic fit.

Enhanced Cross-Sell Momentum & Retention In Installed Base

Waystar has consistently demonstrated strong cross-sell capabilities, reflected in a 114% net revenue retention rate. The Iodine acquisition enhances this dynamic by adding new AI-based CDI modules that can be bundled with existing RCM offerings. This creates an expanded wallet share opportunity within Waystar’s existing client base. Many providers that joined the platform following the Change Healthcare cyberattack are still early in their product adoption journey, giving Waystar a clear path to upsell Iodine’s tools as part of integrated workflows. Moreover, Iodine’s solutions can improve client stickiness by embedding deeper into the clinical side of provider operations, further reinforcing Waystar’s value proposition. The ability to offer end-to-end revenue optimization—from clinical documentation to claims reimbursement—positions the company as a one-stop shop in an increasingly consolidated vendor landscape. With healthcare organizations striving to simplify operations and eliminate redundancy, Waystar stands to benefit from offering a more complete stack of tools. This should improve customer lifetime value, reduce churn, and strengthen overall sales velocity.

Operational Synergies & Long-Term Margin Expansion

Waystar’s financial profile is already strong, with a 42% adjusted EBITDA margin and 73% unlevered free cash flow conversion. Management expects the Iodine acquisition to be margin accretive from day one, suggesting meaningful operational synergies. Both companies are cloud-native and highly automated, which could facilitate backend integration and reduce redundancies in R&D, G&A, and infrastructure. Additionally, Iodine’s client base and sales motion in the enterprise hospital market may accelerate Waystar’s enterprise penetration without a commensurate increase in go-to-market expenses. On the product side, joint engineering efforts could lead to faster development cycles and broader feature sets, helping Waystar stay ahead in a competitive RCM landscape. With a cash balance of $224 million and a net leverage ratio of 2.5x, the company retains flexibility to absorb this acquisition while continuing to invest in organic growth and innovation. However, the successful realization of these synergies will depend on smooth integration and alignment of product strategies. Any missteps could dilute the very efficiencies this acquisition aims to create.

Final Thoughts

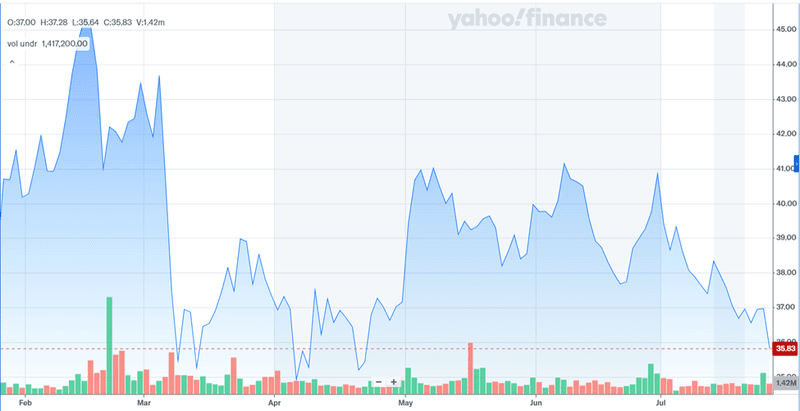

Source: Yahoo Finance

We can see Waystar’s stock having a rather volatile trajectory over the past 6 months and its stock price currently close to its 6-month low. Clearly, the proposed acquisition of Iodine Software has not been perceived too positively by the market. Waystar’s recent valuation trajectory—marked by significant volatility in LTM multiples such as EBITDA (ranging from negative to as high as 157x) and EBIT (deeply negative in multiple quarters)—raises questions about the company's execution consistency and investor confidence. The most recent forward EBITDA multiple of 10.84x and a P/E ratio of 18.76x suggest that the market is cautiously optimistic but not overly exuberant. If the synergies from the Iodine deal materialize within the anticipated timeframe, Waystar may stabilize its valuation and enhance shareholder value. However, until then, the acquisition remains a calculated gamble in an increasingly complex and competitive RCM landscape.