Why Intuitive Machines is Buzzing on Reddit After its Earnings: Is the Stock a Buy?

Intuitive Machines (NASDAQ:LUNR) has recently become a hot topic on Reddit after its latest earnings report, sparking considerable interest among investors. The company's unique position in the space industry, offering services like lunar lander missions, data transmission, and autonomous operations, makes it an intriguing investment opportunity. On the positive side, Intuitive Machines has shown significant revenue growth, reporting $114.5 million for the first half of the year, surpassing its total revenue for 2023. The company has no debt on its balance sheet and a growing backlog, indicating a strong financial position. However, the company also faces challenges, including a higher operating loss of $28.2 million for the quarter, largely due to non-cash impacts and increased SG&A costs. Let us delve deeper into its business and evaluate the biggest drivers that could significantly impact Intuitive Machines' stock in the coming years.

Expansion of Lunar Mission Capabilities

Intuitive Machines' ability to expand its lunar mission capabilities is a critical driver for its future success. The company is currently working on its second and third lunar missions, with the second mission progressing through assembly, integration, and testing phases. The successful qualification of flight engines and the selection of landing sites in partnership with NASA are pivotal achievements that demonstrate the company’s technical prowess. The company's strategy includes offering rideshare delivery services, which fill excess payload capacity on the launch vehicle, improving mission profitability. This approach has already shown success, with rideshare capacity for the second mission being sold out and commercial rideshare services secured for future missions, including asteroid mining and satellite deployment. Moreover, Intuitive Machines is developing heavy cargo-class landers to support lunar prospecting and other activities, which could open up new revenue streams. The company's ability to deliver on these missions and secure additional contracts will be crucial for its growth. However, the challenges of integrating complex technologies and maintaining project timelines pose risks. The market will closely watch the execution of these missions, as any delays or technical issues could impact investor confidence and stock performance. On the other hand, successful mission completions could significantly enhance the company’s reputation and position it as a leader in lunar exploration.

Potential for New Contract Wins

The potential for new contract wins is another significant driver for Intuitive Machines' future growth. The company has already secured $70 million in new backlog so far this year, with more sizable opportunities on the horizon. The OSAM project, which has been marked for $174.5 million in 2025 appropriations, provides a stable revenue base and underpins the company’s confidence in raising its full-year revenue outlook. Additionally, Intuitive Machines is in the running for the Near Space Network Services (NSNS) contract, which is a critical component of NASA's Artemis program. This contract involves deploying data relay satellites around the moon, enabling comprehensive data services for navigation, prospecting, and communications. Winning this contract would position Intuitive Machines as a key player in the lunar economy and open up further commercial opportunities. The company’s unique capabilities in data transmission and autonomous operations make it a strong contender for this contract. However, the competitive nature of government contracts means that there is no guarantee of success. The timing of contract awards can also be unpredictable, adding another layer of uncertainty. If Intuitive Machines secures these contracts, it would provide a significant boost to its financial outlook and solidify its position in the space industry. Conversely, losing out on these opportunities could limit its growth prospects and dampen investor enthusiasm.

Financial Resilience and Cash Flow Management

Intuitive Machines' financial resilience and cash flow management are critical factors that will influence its stock performance. The company ended the quarter with a cash balance of $31.6 million and has paid off its outstanding debt, leaving it debt-free. This strong cash position provides a cushion against potential financial setbacks and allows the company to fund its operations for the next 12 months without the need for additional capital. The company's ability to manage its cash flow effectively will be crucial as it continues to invest in its ambitious projects. Operating cash used in the quarter was $31.3 million, primarily driven by payments to launch providers for its lunar missions. While these payments have helped de-risk the company's cash position, they also highlight the significant capital requirements associated with its operations. Intuitive Machines expects higher cash inflows in the second half of the year, driven by contracted milestone payments and the potential for new contract wins. However, the company remains exposed to risks associated with project delays, cost overruns, and the timing of payments. Effective cash flow management will be essential to navigate these challenges and ensure that the company remains on a solid financial footing. Investors will be closely monitoring the company's cash position and its ability to achieve positive cash flow as it progresses through its lunar missions and other projects.

Final Thoughts

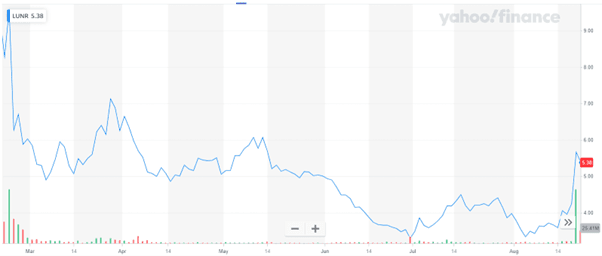

Source: Yahoo Finance

As we can see above, Intuitive Machines’ stock lost a significant amount of value over the past 6 months but showed some recovery after the solid results. The company continues to capture attention with its ambitious space exploration initiatives. However, the challenges of managing complex projects, securing new contracts, and maintaining financial stability cannot be overlooked. Investors considering Intuitive Machines should weigh the potential upside of its innovative space services against the inherent risks associated with its capital-intensive operations. As for our view; we believe that while the company’s recent achievements are promising, the road ahead is filled with uncertainties which is why Intuitive Machines’ stock isn’t for the faint hearted or even for investors with a medium to low risk appetite.