Corporate Office Properties Is The ‘Black Knight’ Of The Government Checkmate – Corporate Office Properties Trust (NYSE:OFC)

[ad_1]

As my loyal readers know, I attempt to keep away from writing on political issues, recognizing that Seeking Alpha is a monetary website. However, every now and then, I need to weigh in on sure political subjects as a result of that’s simply a part of my job.

We’re now within the midst of a partial federal authorities shutdown that started after House and Senate lawmakers failed to finish the funds standoff, and adjourned when final-minute negotiations fizzled.

The House went house and the Senate adjourned, assuring {that a} quarter of the federal government would run out of cash and be pressured to close down at midnight. Once it grew to become a foregone conclusion that the federal government could be partially closed, President Trump took to Twitter, the place he acknowledged the inevitability of a shutdown in a video.

In the video, President Trump referred to as for bipartisanship assist whereas he continued to insist that it’s a “Democratic shutdown.” In a departure from his remarks on the White House earlier, President Trump stated that he was ready for an extended shutdown,

We’re going to have a shutdown. There’s nothing we are able to do about that, as a result of we’d like the Democrats to offer us their votes.”

The standoff between President Trump and Democrats is in its second week and in accordance with CBS News, “that is the 21st authorities shutdown since Congress adopted new budgeting procedures in 1976… and it is also the third this yr alone.”

One of the largest misconceptions, because it pertains to a short lived shutdown, is the influence to DoD spending. While some essential companies are impacted, reminiscent of Homeland Security, Transportation, Interior, Agriculture, State and Justice, in addition to nationwide parks and forests; Social safety, army, Medicare and Medicaid will stay in operation.

The shutdown will influence 800,000 federal staff who will face furloughs or be pressured to work with out pay. Nine of 15 Cabinet-level departments and dozens of companies are additionally affected.

But, to place it bluntly, a authorities shutdown can have zero influence on nationwide safety, the federal government will proceed to pay all obligations (together with hire).

As I stated, I’m purposely avoiding political commentary associated to the extremely debatable political points, surrounding the Trump administration’s firm stance on border management, but I’m standing firm because it pertains to Corporate Office Properties (OFC), the “black knight” of this on-going checkmate.

Pullback Creates ‘Rare’ Investment Opportunity

According to the Congressional Budget Office (or CBO) “spending for the Department of Defense (or DoD) accounts for almost all the nation’s protection funds. The funding supplied to DoD covers its base funds – which pays for the division’s regular actions – and its contingency operations.

CBO analyzes the attainable penalties of deliberate reductions in funding for the army’s pressure construction and acquisitions. The company additionally research the budgetary implications of DoD’s plans, together with these for army personnel, weapon techniques, and operations.”

Funding for assist features consumes extra of the protection funds in the present day than it did within the 1980s, CBO finds. The largest will increase had been in healthcare, DoD administration, communications infrastructure, and the science and know-how program.

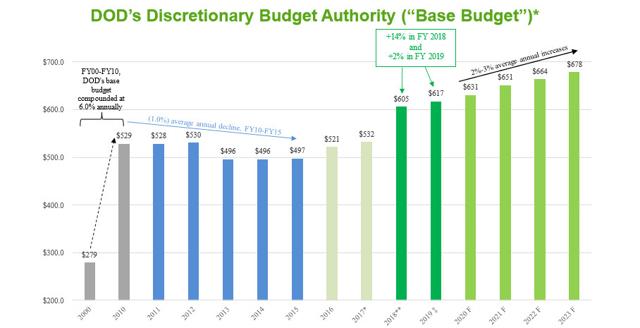

Source: COPT Investor Presentation

The U.S. army’s readiness to answer present and future threats depends upon the standard and availability of army forces – personnel, weapon techniques reminiscent of ships and plane, and different materials assets reminiscent of ammunition and gasoline.

In flip, the standard and availability of army forces depend upon the assist infrastructure. The army makes use of that assist infrastructure – reminiscent of bases, depots, and colleges – to recruit personnel, train items for deployment, purchase and preserve tools, assemble services, present healthcare, facilitate communications, and extra.

From the 1980s to the 2010s, the funding for assist actions in DoD’s base funds rose in relation to funding for forces. Between 1980 and 1989, a interval marked by the speedy protection buildup in opposition to the specter of the Soviet Union, assist prices accounted for 43% of DoD’s almost $500 billion base funds, on common.

Between 1990 and 2000, through the protection drawdown after the Soviet Union’s collapse, the typical share of DoD’s base funds dedicated to assist prices grew to 49%. In the submit–9/11 interval, from 2001 to 2016, it rose additional – to 50% (see beneath).

The Full Year 2018 funds supplied the DOD with a $605 billion base funds – a 14% enhance over Full Year 2017. The Full Year 2019 NDAA presently would enhance DOD funds by one other 2% (FY 2019 displays quantities approved within the FY 2019 NDAA (H.R. 5515), which was appropriated and signed into regulation on September 28, 2018).

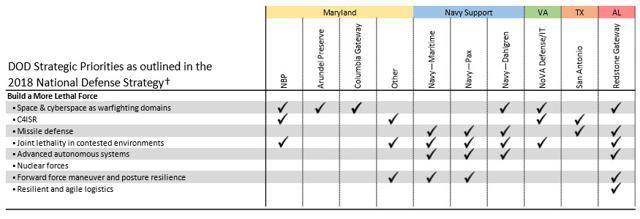

In 2018, the National Defense Strategy highlighted three DOD Strategic Priorities: (1) Build a More Lethal Force, (2) Reform the DOD for Greater Performance and Affordability, and (3) Strengthen Alliances and Attract New Partners. As seen beneath, COPT’s (abbreviated all through the remainder of the article) Defense/IT areas are properly-aligned with the nation’s protection spending priorities:

Source: COPT Investor Presentation

While DOD spending stays a prime precedence for Congress, Mr. Market appears to be much less enthusiastic for shares in COPT, amid the extended phases of the present partial authorities shutdown.

Source: Yahoo Finance

A Mission-Critical REIT On Sale

COPT is the one REIT that’s particularly centered on serving U.S. authorities companies and protection contractors engaged in protection info know-how and nationwide safety-associated actions. This is a really strategic area of interest, and one by which COPT’s tenants are usually centered on information-based mostly actions reminiscent of cybersecurity, R&D, and different extremely technical protection and safety areas.

COPT has a strategic tenant area of interest that gives actual property options serving a specialised cyber-based mostly platform. The protection installations (or authorities demand drivers) the place COPT’s tenants function are R&D, excessive-tech information-based mostly facilities, NOT weapons or troops-associated.

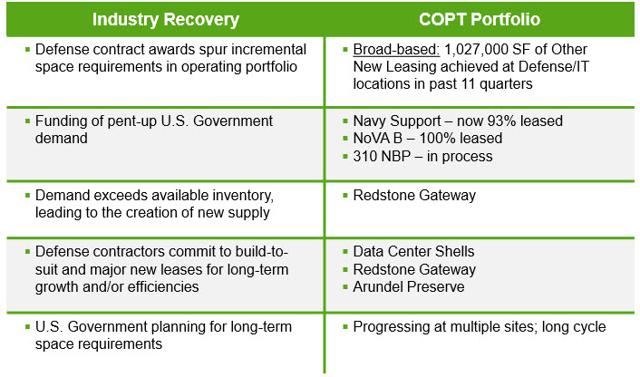

Accordingly, the REIT has a regional give attention to proudly owning properties in focused markets or submarkets within the Greater Washington, DC/Baltimore area with robust progress attributes. COPT is a market chief in these markets, and the corporate has recognized 5 impacts of trade restoration which are or shall be driving demand at these mission-important, Defense/IT areas.

Source: COPT Investor Presentation

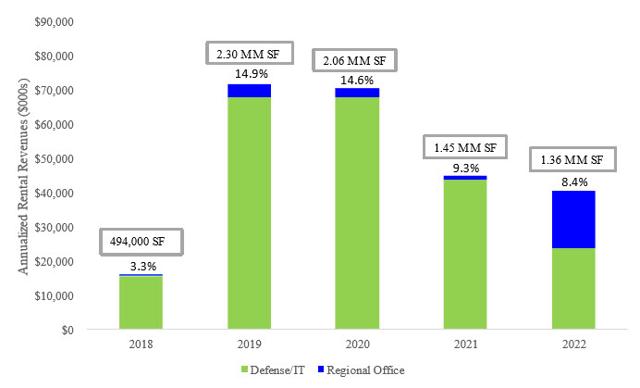

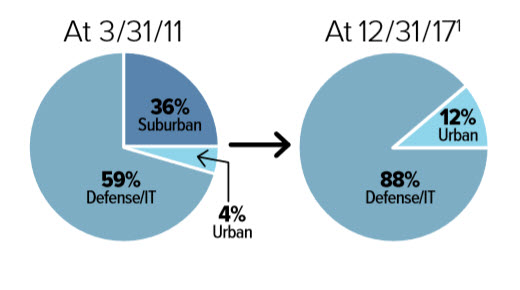

As of Q3-18, COPT owned 159 workplace and information middle shell properties, encompassing 17.7 million sq. toes and was 94% leased. Of these, COPT owns 152 buildings in Defense/IT (15.7 million sf) and 7 regional workplace buildings (2.0 million sf). As of September 30, 2018, COPT derived 88% of its core portfolio annualized income from Defense/IT Locations and 12% from Regional Office Properties.

Source: COPT Investor Presentation

From 2011–2017, COPT has remodeled its portfolio to give attention to its distinctive Defense/IT franchise by promoting $1.6 billion of commodity suburban workplace belongings (10.9 mm SF), growing $1.2 billion (6.0 mm SF) and buying $345 million (1.5 mm SF) of strategic properties. The firm has a major focus of belongings in or across the Greater DC space, the place there are a variety of Federal Agencies and cybersecurity-centered operations.

COPT’s area of interest-based mostly mannequin supplies competitive benefits that embody:

Unique Land Positions – COPT has properties and entitled land adjoining to key information-based mostly protection installations. The firm earns 59% of its core portfolio’s annualized rental income from 82 properties which are adjoining to Strategic Demand Drivers.

Development Expertise – COPT is a most well-liked and trusted developer with appreciable expertise in offering house for secured authorities operations.

Operating Platform – The firm has unparalleled groups of managers with the specialised abilities required to deal with complicated safety-oriented wants. COPT’s credentialed personnel collaborate with the US authorities and protection clients on a frequent foundation.

Customer Relationships – Its extremely specialised enterprise mannequin supplies a definite competitive benefit, and one by which COPT’s clients reward the corporate with repeat enterprise and sustainable progress alternatives.

Track Record – COPT was based in 1988 as Royale Investments, and traded on the Nasdaq. The firm modified its title to Corporate Office Properties Trust, and went on the NYSE in 1998. COPT has over twenty years of working expertise, with progress in belongings from $300 million (in 1998) to over $5 billion in the present day.

Source: COPT Investor Presentation

The Balance Sheet

During Q3-18, COPT executed a number of capital market transactions:

In late July the corporate closed on a $116 million development mortgage for 2100 L. Street in Washington, D.C. The proceeds from this mortgage will fully fund the venture’s remaining growth price and COPT continues to match fund growth investments with fairness.

The firm drew down $80 million of its ahead fairness settlement and issued $30 million at $30.46 a share below the ATM program. The firm stated it was utilizing the proceeds from the ATM to fund venture capex which is incremental to the 2018 growth plan.

Shortly after Q3-18, COPT entered into a brand new $800 million credit score facility to switch its present line. The new credit score facility has improved pricing and covenants, matures in March 2023 and has two six-month extension choices. Also, Fitch scores upwardly revised its outlook on COPT’s credit standing from steady to optimistic.

Source: COPT Investor Presentation

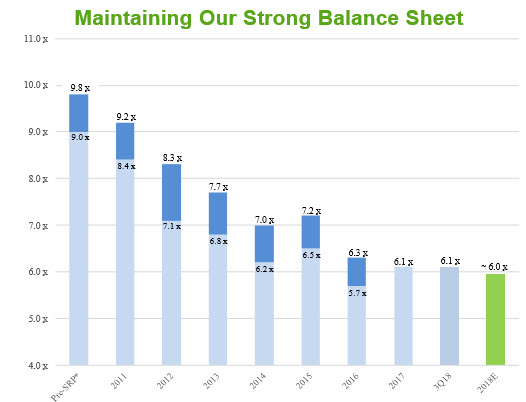

The stability sheet metrics stay robust, and the corporate expects yr-finish debt plus most well-liked to EBITDA ratio to be constant at ~6.0x and Debt/Adjusted Book ≤40%.

Source: COPT Investor Presentation

A Very Clear Path To Development Profits

One key differentiator for COPT is its give attention to growth. Demand for brand spanking new development within the firm’s core markets stays robust, even throughout a number of consecutive years throughout which the DoD had no funds. As COPT’s CEO Steve Budorick, explains on the Q3-18 earnings call,

An elevated and predictable protection spending surroundings and constant bipartisan assist in Congress to fund protection are driving demand for growth house all through our working portfolio and for brand spanking new developments.”

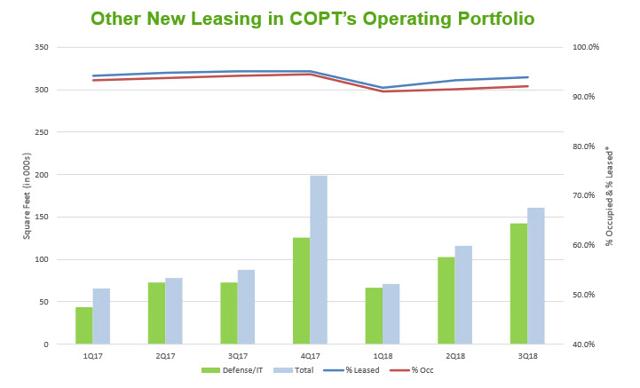

Highlights from Q3-18 embody 161,000 sq. toes of emptiness leasing within the firm’s working portfolio that together with developments positioned in service drove core portfolio again as much as 94% leased. Notable massive leasing positive factors through the quarter included the Fort Meade BW hall sub-section, which is up 50 bps to 92.4% leased. The NoVA protection/IT sub-section is up 80 bps to 92.1% leased, and the Navy Support Group which gained 160 bps is now 93.2% leased.

Source: COPT Investor Presentation

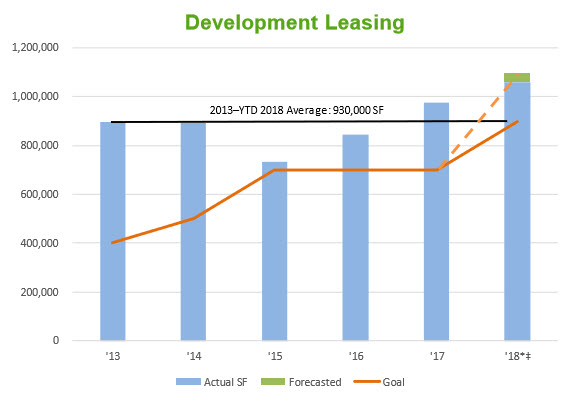

COPT introduced (submit Q3-18) two full constructing pre-leases for information middle shells, representing the sixth and seventh leases of the 11 constructing pipeline. These leases convey COPT’s annual growth leasing above 1 million sq. toes, and the corporate expects to fulfill our upwardly revise its growth leasing objective for the yr. COPT’s focus of expirations at mission important Defense/IT Locations mitigates rollover threat, as illustrated beneath:

Source: COPT Investor Presentation

On the Q3-18 earnings name, the corporate stated that “the sheer volume of data center development activities has stressed the capacity of accounting zoning and power distribution resources extending the completion times for land development”. This signifies that the delayed commencements will defer a few of the anticipated 2019 income into 2020, however “the magnitude of the revenue and the value creation of this program has not changed.”

Each quarter of delay in leasing the remaining 120,000 sq. toes equates to $0.01 of FFO alternative price to subsequent yr’s outcomes, and the corporate stated that “although the timing associated with leasing has been frustrating”, it “continues to have confidence the property will fully lease.”

COPT’s CEO added,

The DoD’s fiscal 2017 funds is driving the yr-over-yr will increase we’ve got achieved in emptiness leasing this yr. Throughout 2019, incremental demand from the DoD’s substantial 2018 funds, which handed in regulation solely seven months in the past ought to amplify present demand as protection outlays filter all the way down to the true property stage. We will probably see incremental demand from the 2019 protection funds emerge towards the tip of subsequent yr, additional increasing leasing alternatives.”

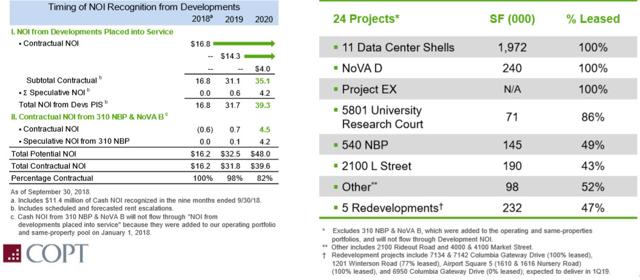

Through 2020, 24 just lately accomplished and below development initiatives that aren’t in similar-property characterize as much as $39.3 million of future annual Cash NOI, $35.1 million of which is contractual. Additionally, the 2 U.S. Government buildings characterize potential Cash NOI of $8.5−9 million in 2020, $4.5 million of which is contractual.

Source: COPT Investor Presentation

As seen beneath, COPT’s strong shadow growth pipeline bodes properly for future growth leasing & NOI progress. The 2–2.5 million SF shadow growth pipeline helps the corporate’s upwardly revised 2018 objective of leasing 1.1 million SF in growth initiatives. To date, 1.06 million SF have been accomplished:

Source: COPT Investor Presentation

The ‘Black Knight’ Wins

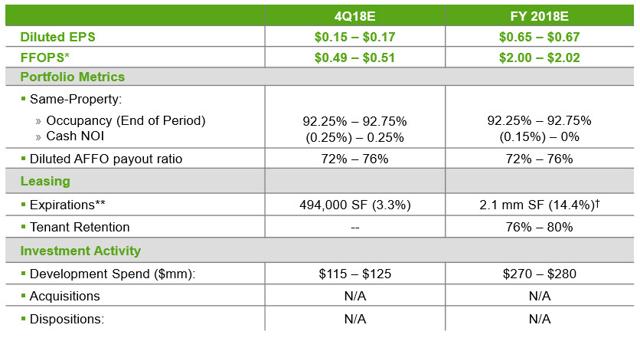

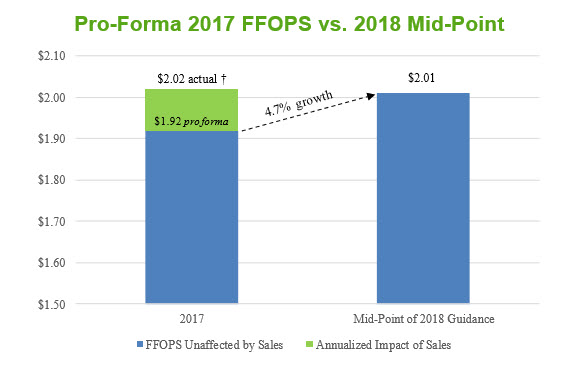

On the Q3-18 earnings name, administration stated it was sustaining the $2.01 mid-level of its annual steering and tightening its vary, from $1.98−2.04 to a brand new vary of $2.00−2.02:

Source: COPT Investor Presentation

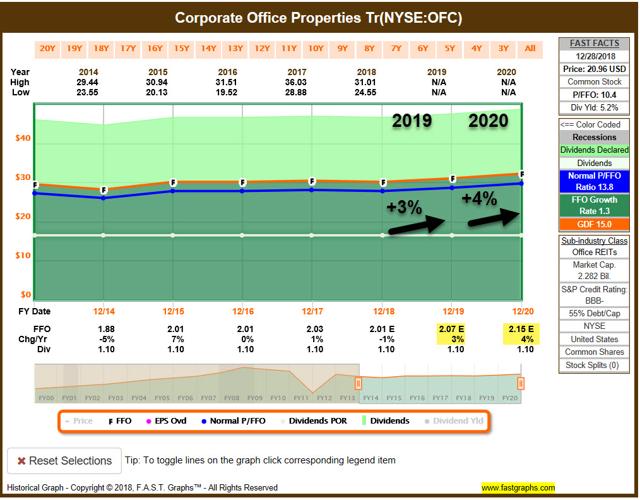

The firm stated it was additionally tightening This fall-18 FFO per share steering from the prior vary of $0.48 to $0.52 to a brand new vary of $0.49 to $0.51. The $0.50 cent midpoint of the This fall vary is flat with Q3 outcomes as a result of the corporate is finishing a number of climate-associated R&M initiatives that had been budgeted for earlier within the yr. As illustrated beneath, the $2.01 mid-level of 2018 steering represents 4.7% progress over professional forma 2017 outcomes.

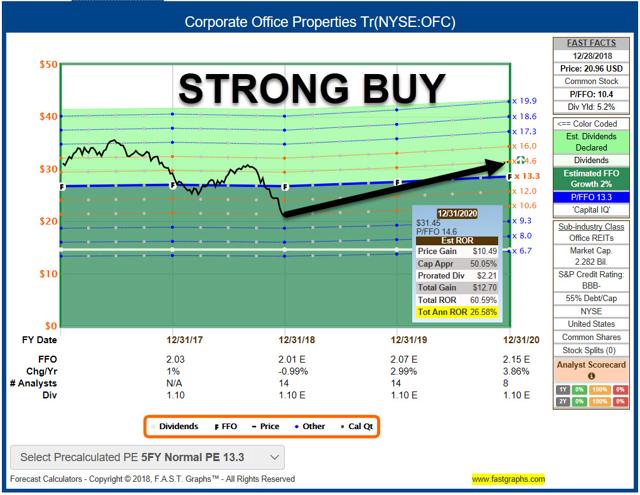

Although the above-referenced delays in finishing the information facilities and leasing will cut back COPT’s 2019 outcomes, the strength and quantity of leasing within the working portfolio, and the good thing about executing further growth initiatives will partially offset the influence of those delays. Here’s how analysts forecast COPT’s FFO/share progress in 2019 and 2020:

Source: F.A.S.T. Graphs

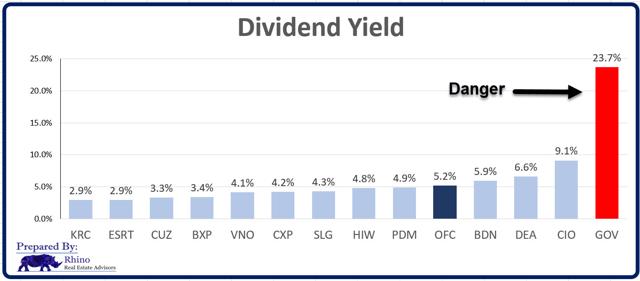

Now, as I stated, COPT has no direct peer, so we’ll evaluate to the broader peer group, beginning with the dividend yield:

Source: Rhino Real Estate Advisors

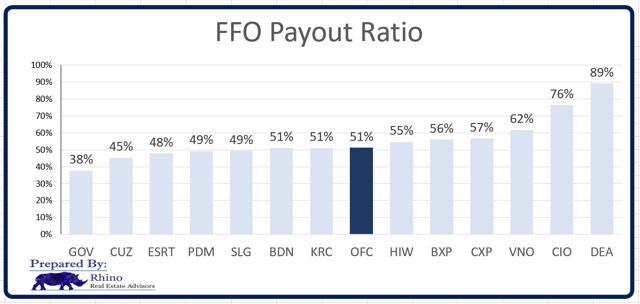

As you’ll be able to see, COPT is yielding 5.2%, and the though the corporate has not raised its dividend (it lower in 2011 and has not elevated since 2012), the payout ratio seems comparatively protected, as illustrated beneath:

Source: Rhino Real Estate Advisors

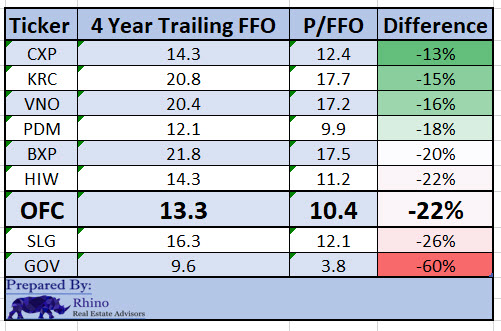

Now as seen beneath, OFC trades at a large low cost, based mostly on P/FFO metrics:

Source: Rhino Real Estate Advisors

Keep in thoughts that 88% of COPT’s core portfolio annualized rental income comes from rising Defense/IT areas (core portfolio 94% leased). Also, the pipeline of future construct-to-go well with transactions and growth exercise amongst present working properties stay strong.

The firm has a number of avenues of progress in Defense/IT generate sturdy, much less correlated demand for brand spanking new services: (1) U.S. Government, (2) Contractors serving on the mission, and (3) Contractors offering cloud computing.

And bear in mind, the momentary authorities shutdown has ZERO influence to COPT’s hire checks and, in consequence, we’re upgrading the corporate from a Buy to a Strong Buy. While the checkmate over the funds continues, we’re assured that the “black knight” will prevail, and we can have no drawback “sleeping well at night” proudly owning shares in Corporate Office Properties Trust.

Disclosure: Stephanie Krewson-Kelly, my co-creator of The Intelligent REIT Investor (obtainable on Amazon (AMZN)), can also be director of Investor Relations at COPT.

Author’s word: Brad Thomas is a Wall Street author and which means he isn’t all the time proper together with his predictions or suggestions. That additionally applies to his grammar. Please excuse any typos and be assured that he’ll do his finest to appropriate any errors if they’re ignored.

Finally, this text is free, and the only real function for writing it’s to help with analysis, whereas additionally offering a discussion board for second-stage considering.

Disclosure: I’m/we’re lengthy OFC. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]