Trending News

-

Company

1847 Holdings Recent Updates Show a Course for Growth: A Promising Future in the Lower-Middle Market

Since we last covered 1847 Holdings LLC (NYSE American: EFSH), the company has been making…

Read More » -

-

-

-

-

-

-

-

Since we last covered 1847 Holdings LLC (NYSE American: EFSH), the company has been making…

Read More »

Artificial Intelligence (AI) has had a meteoric rise in the past two years and it's no secret that the future…

Read More »

Today, Wall Street witnessed a tech-fueled frenzy as Nvidia's record-shattering earnings report sparked an enthusiastic rally in the sector. But…

Read More »

Nvidia's stock price soared to new heights, hitting its all-time high, and spurring on the AI revolution. But this recent…

Read More »

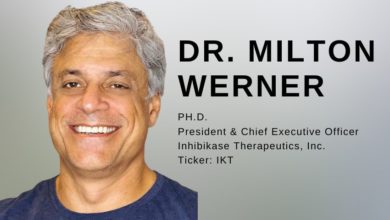

CEO and President, Milton Werner shares Inhibikase's vision, achievements, and future endeavors in neurological diseases while highlighting the significant progress…

Read More »

Travere Therapeutics' completion of a successful pre-NDA meeting with the U.S. FDA for Filspari in IgA nephropathy has sent its…

Read More »

OKYO Pharma's main drug has already surpassed Phase 1 and reached Phase 2. OK-101 is catering to niches within the…

Read More »

Despite economic concerns, the sell-off in big tech, rising interest rates and a looming recession, healthcare stocks are still going…

Read More »

Skylight executes a definitive agreement for the largest acquisition to date and secured a US $20 million credit line facility…

Read More »

HITRUST Risk-based, 2-year Certification validates Healthcare Triangle is committed to meeting key regulations and protecting sensitive information PLEASANTON, Calif., April…

Read More »

Cannabidiol, commonly known as CBD, is a naturally occurring chemical compound found in cannabis plants…

Read More »